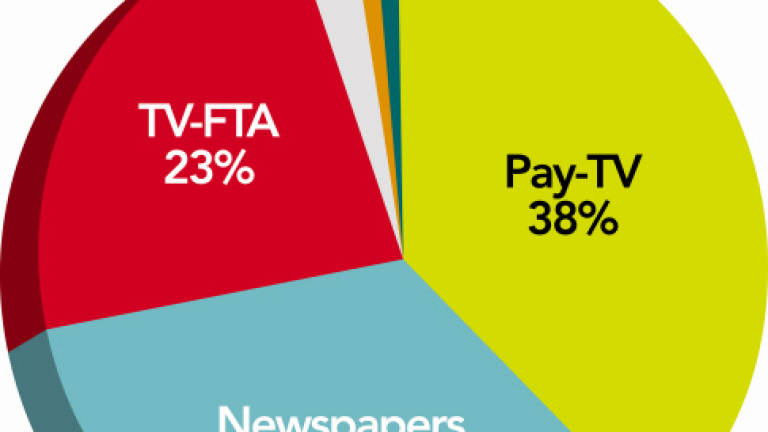

Malaysian advertising expenditure FH 2014

ADVERTISING expenditure in Malaysia during Jan-June (FH) 2014 has been estimated as RM6.8 billion, reflecting a 14% growth over the RM5.99 billion achieved during the comparable first half of 2013.

TV and press (newspapers) commandeered 95% of this advertising revenue, with PAY-TV reflecting the single highest market share 38%. Followed by press (newspapers) 34% and Free-to-AirTV with 23%.

These figures have been gleaned from the latest update from Carat, quoting advertising expenditure data provided by Nielsen (refer to pie-chart).

Radio obtained 3% share of this pie, with magazines and in-store media recording 1% apiece. Cinema recorded a negligible fraction, while the data-provider has temporarily stopped reporting out of home since January 2014 (according to Carat). Despite the hype and buzz, internet ad-expenditure still remains marginal.

Over the past four years, cable/satellite channels (pay-TV) have recorded the most significant growth, both in revenue $ volume and % market share. Growing from 20.3% (RM1.95 billion) in Jan-Dec 2010 to around 36% (RM 4.91 billion) in Jan-Dec 2013.

For the first time in recent memory, during Jan-Dec 2013, pay-TV (36%) replaced newspapers (34%) as the medium with the single highest revenue volume and market share of the Malaysian advertising expenditure pie. Besides quality programming which is increasingly enticing more appointment viewership, audio-visual spectacles like the FIFA 2014 World Cup is sure to have enhanced their coffers during

FH 2014.

Press has grown in $ volume, driven largely by English newspapers, while conceding market-share leadership to cable/satellite (pay-TV) channels. Growing from RM 3.89 billion in Jan-Dec 2010 to around RM 4.57 billion in Jan-Dec 2013. But market share has declined from 40.4% (in 2010) to 34% in 2013 and FH 2014.

This is a classic example of decline from Star to Cash-Cow. The rate-of-growth for newspapers has slowed down, influenced by some vital factors including evolving reading habits and media convergence.

Ambitious newspapers may have to review their product proposition, content mix and selling strategies to rejuvenate and accelerate revenue accruals. Recognising the revised priorities and challenges being faced by media specialists will also deliver dividends.