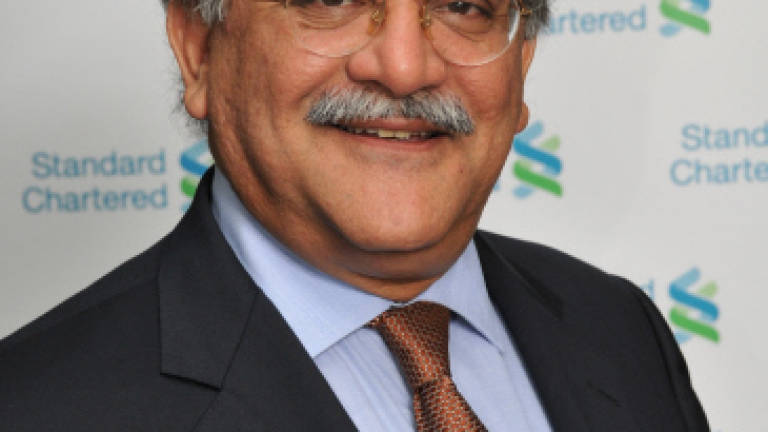

Post Budget Comments Standard Chartered Bank Malaysia Bhd

CEO and Managing Director

Osman Morad

We believe that the subsidy rationalisation plan will bolster the government’s fiscal consolidation message and we expect the government to limit the impact of subsidies on its balance sheet and drive more efficient allocation of resources. This will help meet its target of narrowing the fiscal deficit for 2015 to 3% of gross domestic product (GDP). We await the announcement on the new mechanism for the new subsidy which will eventually replace these with a social safety net. We view the extension of GST zero-rated list of items and the increase in BR1M to be a positive move for the rakyat as this will alleviate the burden of the lower income group and cushion the temporary inflationary effect of GST implementation. This reaffirms the government’s fiscal consolidation stance.

Efforts to assist first home buyers through extension of the 50% stamp duty exemption on instruments of transfer and loan agreements until Dec 31 2016, and increase in the purchase limit from RM400,000 to RM500,000 will hopefully encourage more developers to build affordable housing and give buyers more options.

As a leading Islamic banking provider, we look forward to the Investment Account Platform (IAP), the new shariah-compliant investment product to be introduced in 2015. We believe that participation of high net worth individuals in the Islamic financial market is conducive to growth and the proposal to give individual investors income tax exemption on profits earned from qualifying investment for three consecutive years is a meaningful incentive.

The proposal for the Malaysian Government Securities and Government Investment Issues to be listed and traded in the Exchange Traded Bond and Sukuk (ETBS) is welcomed by the banking industry including Standard Chartered, as it will enable us to offer a wider range of Islamic finance investment opportunities through our various distribution channels including our 43 branches nationwide to the retail investment community.

In addition, we are encouraged by the deduction for expenses incurred in the issuance of sukuk based on Ijarah and Wakalah principles which is proposed to be extended for another three years until year of assessment 2018. This will assist Malaysia to maintain its lead in global sukuk issuance.