To protect and provide

ACCORDING to information from the Life Insurance and Market Research Association (LIMRA), insurance can be a complicated subject, sometimes very paradoxical. Although many people agree that it is highly important, as it provides protection for individuals or loved ones, those same people are also those who do not have a life insurance policy or they have insufficient coverage.

INSURANCE PENETRATION DROP

This is nothing out of the ordinary, in fact, it is a worldwide phenomenon. LIMRA estimates that some 65%of the population in the USA will not purchase any additional life insurance, or do not have a life insurance policy at all.

Closer to home, according to a 2015 report by the Life Insurance Association of Malaysia (LIAM), over 44% of Malaysians do not own a life insurance policy. This accords well with Bank Negara Malaysia’s Financial Stability and Payment Systems Report 2015, which states that the insurance penetration rate in Malaysia has actually dropped from 55.5% in 2014 to 54.9%.

MISCONCEPTIONS AND REALITIES

U for Life, Malaysia’s first instant online life insurance company, recently conducted a series of interviews with the people asking what they understood or knew about the phrase “life insurance”. While many of them recognised there is a need for life insurance, they also gave reasons why they did not purchase any.

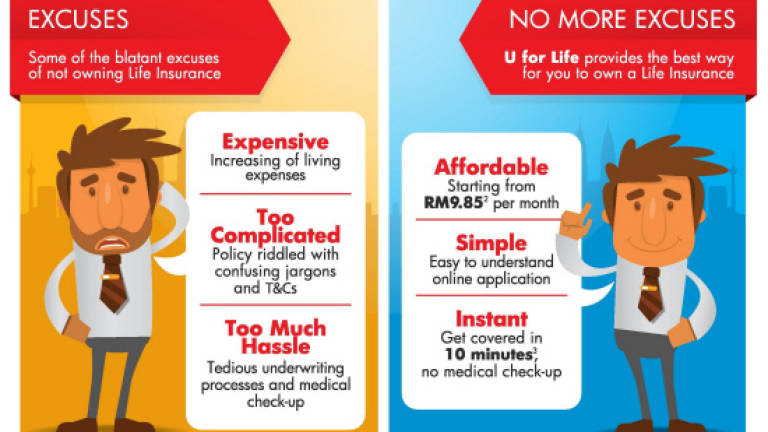

The two biggest and most frequent factors for the decline were due to price and complexity. Apparently, many people think that life insurance is simply too expensive. And with so many responsibilities and restraints like bills to pay and other financial commitments, many said they simply could not afford a policy. A huge percentage also believed that buying life insurance was too much of a hassle. They claimed that the products were too convoluted and complicated other than the process of getting one which many said was leceh (troublesome). Other factors that accounted for non-purchase of a policywas the thought that it was unnecessary and that life insurance is just not worth it.

ON THE OTHER HAND

In reality, life insurance among the various other insurances and insurance “products” in the market are beneficial, especially to the beneficiaries, which in most cases are one’s family members and loved ones.

For insurance company U for Life, it states that all its products are underwritten by Tokio Marine Life Insurance Malaysia Bhd and backed by Hannover Re, both reliable and established firms. U for Life’s instant online life insurance menu offers products designed for simplicity and affordability. By stripping away the complex financial components of life insurance, such as investments and savings, and by selling online to eliminate commission payments and reduce overheads, these are just some of the reasons why U for Life is able to offer life insurance coverage for a premium from as little as RM9.85 per month.

AFFORDABLE, CONVENIENT AND EASY

Without other features to increase the complexity of its policies, understanding its ins and outs is made easier, as is the process of online application, which can be done in a matter of minutes. Simply visit the U for Life website at www.uforlife.com.my to understand how simple, affordable and convenient the company has made it.

As a heads up, check out U for Life’s term life insurance policy, which is designed for basic coverage. It meets the needs of people who require life insurance but do not have one or do not have sufficient coverage. For example, young people at the start of their careers or those just starting their families; they are among the larger groups of people who have the most to lose should they suffer death or total/ permanent disability, depriving either themselves or their families of income and sustenance.

Life insurance offers protection and peace of mind. It enables the insured party some amount of assurance that their loss will not become a financial burden to their next-of-kin. For households with only one parent bringing in the bread and butter, it is even more necessary. Log on to U for Life website for more information on their range of affordable, convenient and easy to attain insurance policies.

INFOGRAPHIC

1. According to a 2015 report by Life Insurance Association of Malaysia (LIAM).

2. Calculated based on a female non-smoker aged up to 26-years old form RM100,000 Life Insurance Coverage from U for Life.

3. Approval of U for Life policy can be done within 10 minutes. Duration may vary depending on the internet bandwidth speed.