Amendment to MMIP policy to allow insurance coverage for those aged 65 and above, welcomed

SERI KEMBANGAN: Transport industry and elderly drivers of commercial vehicle can now breathe sigh of relief in view of the amended condition by Malaysian Motor Insurance Pool (MMIP) to allow coverage for drivers above 65 years.

Following a complaint lodged in January by industry players, MMIP has been instructed by Bank Negara Malaysia via the Financial Mediation Bureau (FMB) to amend a condition which had denied insurance coverage for drivers aged above 65 years.

Effective March 1, the new condition provides coverage for veteran drivers to operate a commercial vehicle with an excess of over RM5,000.

Under the latest clause of Warranty W.4CV, it outlined that: "Warranted that if at a time of accident the driver of the vehicle is below 21 or over 65 years of age on the last birthday an excess of RM 5000 over and above any excess already attaching to the policy shall be borne by the insured for Own Damage/Third Party Property Damage/Third Party Bodily Injury claim."

"However in the event that the Pool is required in law to pay to third parties by virtue of the Legislation or the agreement executed between the Minister of Transport of the Government of Malaysia and the Motor Insurer's Bureau of West Malaysia on 30th March 1992 or the Agreement executed between for the Minister of Finance of the Republic of Singapore and Motor Insurers' Bureau of Singapore on 22nd February 1975, you shall repay us the excess of RM5000," the clause stated.

In January, Transport Ministry was mulling to set an age limit for a driver to operate a commercial vehicle in the wake of MMIP's refusal to allow coverage for drivers above 65 years.

Previously, the MMIP's policy schedule specified that, "only drivers whose age is between 21 and 65 years on the driver's last birthday shall be permitted to drive the insured vehicle."

MMIP is one of the biggest motor insurance underwriters in the country representing 33 insurance companies with its main aim, "to provide motor insurance coverage to vehicles which may be considered 'high risk' or risks which will not be underwritten by any single insurance company."

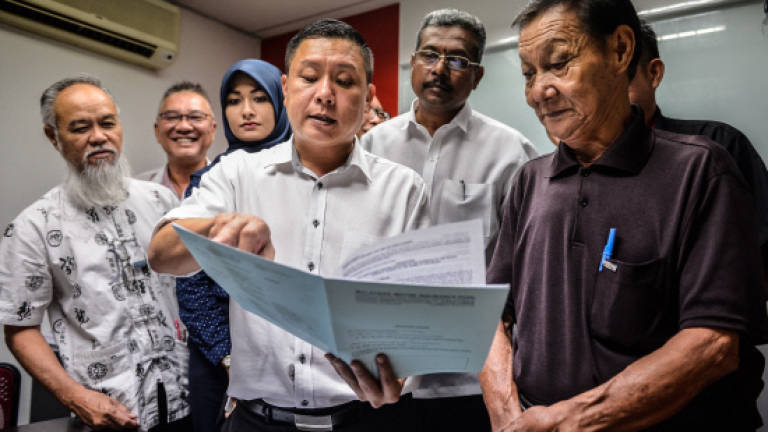

The matter came to light when a 73-year-old lorry driver Liew Kon Yew was involved in a crash with an MPV two years ago and sued by the other party for repair cost of RM15,034.

Upon checks by Liew's employer, it was found that he was not covered under MMIP policy due to age condition factor.

With the liability denied by the insurance companies for drivers above 65, it had sent shock waves across the transport industry that veteran drivers were considered as unsafe hands to man bus, lorry, school bus, taxi and other transport modes.

Malaysia Heavy Construction Equipment Owners Association commercial affairs officer Lam Kok Wai said the industry can now move forward without having the anxiety about the insurance coverage for elderly drivers.

"We were caught by surprise with the policy. In the past, we admit that we didn't read all the clauses in the insurance policy and we were not aware about no insurance coverage for drivers aged 65 and above," he said.

"The previous policy was very unfair to elderly drivers as currently almost 30%, out of 70,000 taxi drive are aged above 65 years old and this will put the public at risk," said Balakong Assemblyman Eddie Ng Tien Chee.

"Mr Liew's case is a very good example. He is sued and he is unable to pay the amount demanded. What will happen if there is death or serious injury during the accident?" he added.

In addition, Ng said, FMB has instructed MMIP to resolve Liew's predicament even though he was not covered under the previous policy.