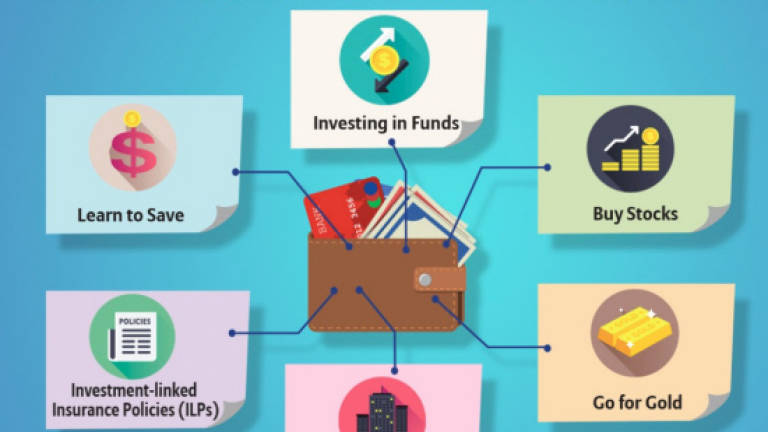

Investing your money: Advice for a novice

KUALA LUMPUR: Knowing how to correctly invest your money can give you great financial dividend. So, just where and how should you park or part with your money?

Here, Allianz Malaysia Berhad's Chief Investment Officer, Esther Ong, offers her knowledge on how to make sound investment decisions to grow your hard earned cash. These tips will help to set you on the right path towards making better financial decisions.

Learn to Save

Before you can learn to invest, you must learn to save. Limit your binge spending on items that give you instant gratification (clothes, watches, luxury cars) and swiping plastic. Investment can only take place when you actually have enough money to set aside for growth.

Money tip: Aim to live debt-free. Maintain a maximum of one and two credit cards for security in times of emergencies, medical or big purchases.

Funds

Take keen interest in your investments. Placing your hard earned cash into Mutual Funds or Sahams will not guarantee you a pot of gold. Play an active role to keep track and review the performance of your funds.

Money tip: The Employee Provident Fund (EPF) is a good alternative vehicle for you to grow your retirement money. It has offered a dividend rate of between 6.15% and 5.70% for the last five years.

Buy stocks

Before you dip your toes into in equities, read up and learn about the market. Ong says: "Be more involved in your investments. You cannot buy equities without reading and understanding what you are buying. Pick up financial dailies or magazines to acquire knowledge about the market and the economy."

Money tip: Make your life easier; go for the blue chip stocks and dividend yielding shares. That means stick to the regular stuff – big banks, consumers, telecommunications, and plantations.

Investment-linked insurance policies (ILPs)

With ILPs, your premiums pay for your life insurance and units in investment–linked sub-fund(s) of your choice. A single premium ILP is payable in one lump sum while regular premium is payable annually over a certain period.

Money tip: Look for insurers that apply prudent investment strategies and deliver consistent investment performance to help you generate stable income.

Invest in property

Property is a great investment. It is one of the biggest investments you will ever make, so when you do it, take into careful consideration about the location, location, location. Also think about where you will be in your life (career and personal life) five years from the time of purchase.

Money tip: If you have the means, invest in landed properties in good townships.

Go for gold

If you are serious about investing in gold bars, bullion or coins; watch the gold price before making your purchase. You can start with small amounts periodically, but ensure that you buy them from reputable banks.

Money tip: If you are thinking about accessories, those that are pretty to the eyes will not do much for your wallet.

To find out more on how you can grow and invest your money, Ong recommends that you do your due diligence and read up on the particular investment you are interested in before committing to it. Assess your risk appetite and if you are just starting out, go small and think long-term. Always remember that investment risk will be borne entirely by you, so invest wisely.