More measures possible to deepen financial markets, says BNM

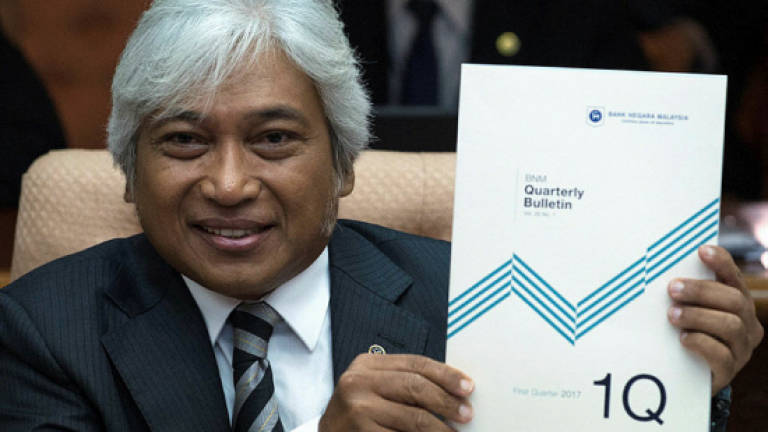

KUALA LUMPUR: Bank Negara Malaysia is not ruling out the possibility of introducing another round of measures, if needed, to deepen Malaysia's financial market, says Governor Datuk Seri Muhammad Ibrahim.

For now, he said the central bank was in the midst of analysing the outcome of two measures that had been introduced by the central bank on Dec 3, 2016 and March 13, 2017, respectively.

"We will look again. Let it (the measures) work first. We will look at the outcome of those measures and when the time comes, we will introduce new ones if there is a need.

"We will discuss with market players the things that we need to do as we move forward to deepen and make our financial market even more liquid," he said when announcing a robust economic growth of 5.6% for Malaysia in the the first quarter of this year, against 4.1% in the corresponding quarter, thanks to strong domestic demand and private expenditure.

The ringgit showed stability and performed better against the US dollar in the quarter just ended, owing to the measures to develop the domestic financial market.

The better performance was reflected in the improvements across all liquidity and volatility indicators of the foreign exchange market, amid weaker US dollar sentiment mainly driven by market uncertainties in the direction and implication of policies in the country, the governor said.

"We noticed that the trend now better reflected the strength of the ringgit vis-a-vis the strength of the economy.

"As we move forward, the ringgit will further reflect the strength of the Malaysian economy," he said.

Going forward, Muhammad said continued external uncertainties might result in higher volatility in the ringgit's movement.

This included the pace of US interest rate normalisation, volatility in global oil prices, external political and global financial market developments.