Govt to better manage risk from government guarantees

PETALING JAYA: The government said there is a need to further enhance the risk management of government guarantees to ensure its exposure remain minimal to the government fiscal position.

In the Economic Report 2017/18, the government said it is aware of the need for close monitoring of government guarantees as the main source of contingent liability.

Moving forward, the government said the risk assessment framework will be further enhanced by adopting vigorous evaluation process and best practices to minimise credit and default risks.

"In order to manage liquidity risk as well as smoothen issuance, there is a need to closely monitor government guarantee paper issuances as this may affect the pricing of the government guarantee papers," it noted.

Meanwhile, to further manage the moral hazard issues, the government said that government guarantee fees will be imposed based on its risk profile and exposure to the government.

In addition, the government said the scope and duration of the government guarantees will be restricted according to the intended investment and the life-cycle of the asset.

It said another important element that could be incorporated in the fiscal framework is the valuation and pricing of risk exposure, which should be constructed based on robust methodology.

The government said it has also explored the introduction of numerical rules for government guarantee issuances, which is currently being applied in the federal government debt management.

"This would significantly improve the management of government liabilities in its fiscal framework," it said.

The government's guaranteed debt stood at RM187.3 billion or 15.2% of gross domestic product (GDP) as at end of 2016.

It noted that the outstanding government guaranteed debt experienced a lower average annual growth rate of 4.3% in the past two years, compared with 14% in the year 2012 to 2014.

"This is attributed to a more selective and stringent evaluation process and more robust risk assessment," it said.

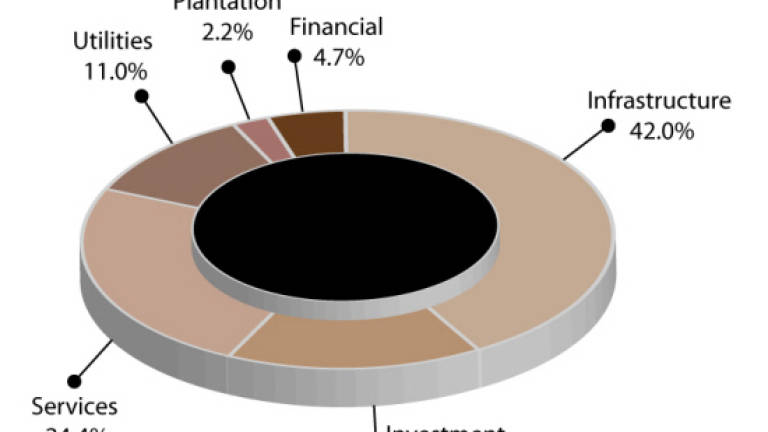

Currently, the main proportion of the government guarantees portfolio are extended for infrastructure sector (42%), which include the mass rapid transit (MRT) and light rail transit (LRT), highways, airports, container port and tolled bridge projects.

This followed by the services (24.4%), investment holding (15.7%), utilities (11%), financial (4.7%) and plantation (2.2%) sectors.