Opposition should stop deceiving people by replacing GST with SST: Najib

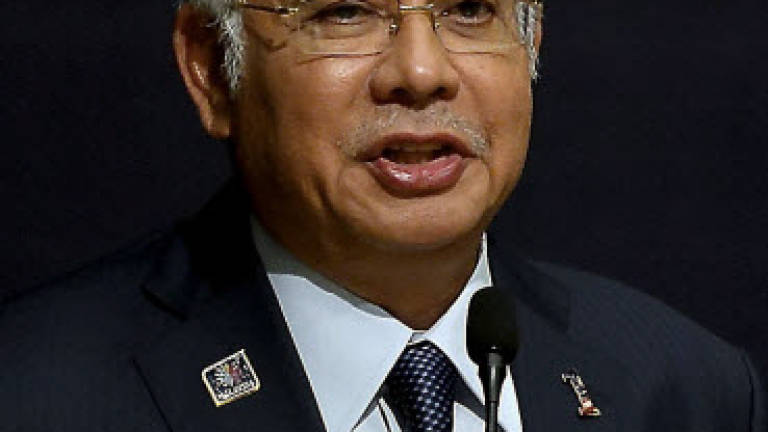

KUALA LUMPUR: Datuk Seri Najib Abdul Razak (pix) has called on the opposition not to deceive the people by saying that it would replace Goods and Services Tax (GST) with Sales and Service Tax (SST).

"Abolish the GST and they (the opposition) can state where they will get RM40 billion a year to cover the shortage of oil revenue. Do not deceive the people," said the prime minister in his latest post on his official blog (www.najibrazak.com), today.

Najib explained that the SST, that was proposed by the former prime minister Tun Dr Mahathir Mohamad, has overlapping taxation issues as well as multiple counting in product value calculations and leakages due to manipulation of wholesalers and sellers.

He said the introduction of the SST system was not just backward but it also had hidden costs that would burden the people.

Najib said Dr Mahathir was aware of the matter and had already acknowledged GST was better than SST as his own administration had recommended to upgrade the system to GST then.

“Ultimately, Tun Mahathir agreed with the government that the GST did cover the shortfall in oil revenue amounting to RM40 billion.

“But as he already made a promise to abolish GST, he now wants to replace GST with SST, an obsolete system that has been repealed by 160 countries in the world. Again, Tun did a u-turn,” he said.

He said Dr Mahathir wanted to make it appear that the opposition would abolish the GST and would replace it with SST instead, in which the rate was not informed to the buyers to garner votes.

“Is this not a lie? Under the SST system, it is not necessary for sellers to declare the amount of tax in the receipt.

“So they can charge tax on different rates without being detected by the enforcement agency, and the people will not realise they are still being taxed even if GST is abolished. But with GST the sellers must be transparent in stating the total amount is at six per cent,” he explained.

Najib said, in terms of system comparison, GST was a modern and more systematic system than SST.

He said GST was introduced as it is more modern, transparent and has complete legislation to prevent fraud and is being adopted by 160 countries worldwide, as well as having internationally recognised means of computation and standards. — Bernama