GST mechanism in M'sia is progressive: PM

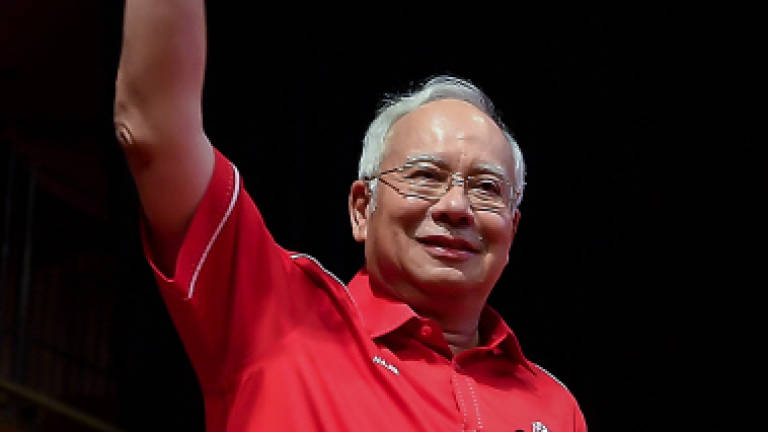

KUALA LUMPUR: Datuk Seri Najib Abdul Razak has described the mechanism for the Goods and Services Tax (GST) in Malaysia as progressive with the lower-income group receiving more government assistance from GST revenue compared to the high-income group.

The Prime Minister said this was because GST exemption on basic items ensured those in the lower income bracket would not be adversely affected.

" ... while those with higher income, will spend more, thus their tax is higher.

"There is still a misunderstanding on the implementation of the GST in Malaysia, and some consider it as a regressive tax like the GST or VAT (value-added tax) implemented in other countries," said Najib in a post on his blog, najibrazak.com, today.

The Prime Minister said the government's revenue was now channeled directly to the bottom 40% (B40) household income group which needed more programmes like the 1Malaysia People's Aid Program (BR1M) to reduce cost of living; school aid; assistance to paddy farmers, fishermen as well as special aid to low-income civil servants.

Najib said the targeted aid programmes would not be possible if the higher income earners did not contribute a larger amount of tax.

"This means that even though the low-income group also pays the six% GST, the benefits that they receive from the implementation (of the tax) are actually many times higher than the high-income group," he said.

He also stressed that GST in Malaysia had already taken into account the economic situation of the people and the current government would continue to ensure the best quality of life for all Malaysians. — Bernama