Half billion ringgit losses due to surge in cyber crime

KUALA LUMPUR: The surge in cyber crimes, making up to between 40% and 50% of cases reported to the police commercial crimes investigations department (CCID), has incurred losses of over half a billion ringgit in two years.

In just three months into 2018, RM60 million was reported lost to scammers.

In countering the menace, police launched a nationwide operation last week to cut off the flow of funds by scam rackets by apprehending mule account holders who aided cyberspace criminals in amassing hundreds of millions of ringgit over the years.

In just four days following the launch of "Ops Mule Account" on Thursday, 44 suspects comprising 27 women and 17 men aged between 21 and 57 were arrested.

They were nabbed in several states after being traced by investigators.

The suspects were involved in 319 cases such as the Macau, African and e-financial scams where victims suffered losses of about RM17.3 million.

Bank account mules are those who "lease" or unwittingly allow their bank accounts to be used by cyberspace criminals for the transfer of funds from victims.

The real scammers, most of whom are foreigners, who hatch the swindling often get off the hook as they remain "invisible" in cyberspace, leaving the mules to face the music with the authorities.

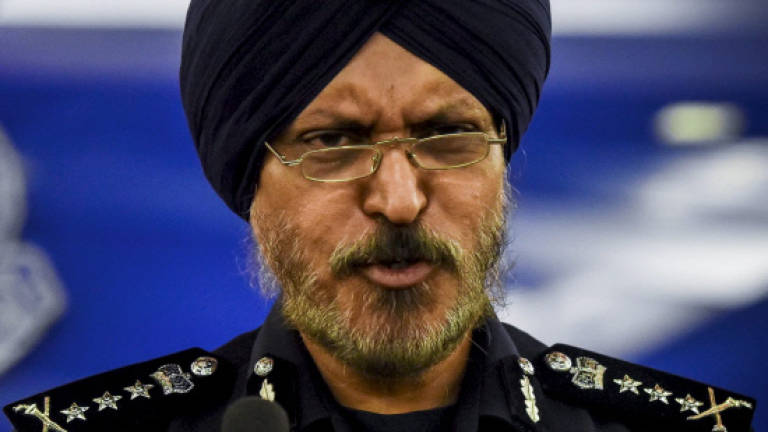

Federal police commercial crimes investigations department (CCID) director Commissioner Datuk Amar Singh (pix) said yesterday that housewives made up a large number of those held while the rest were students, drug addicts and the unemployed.

"While there are those who had unwittingly allowed their bank accounts to be abused by scammers whom they befriended, most of them were well aware of what they were doing and were paid commissions for every transaction. Those we arrested were behind at least five transactions of fund transfers from victims. We are going after these mules and the operation is ongoing. Between 40% and 50% of the cases we handle involve cyber crimes," he told a press conference at the federal CCID headquarters here yesterday.

He said in 2016, 39% or 12,766 out of the total of 32,871 cases were cybercrimes with losses of RM236 million, while last year it was almost 45% or 13,714 out of 30,612 cases where RM266 million was lost to cyber scammers.

Amar Singh said in the first three months this year, almost 43% of cases with losses of RM60 million investigated by the CCID are cybercrimes.

"The number of mule account holders is growing rapidly by the day. We identified 973 mule account holders in 2016 and 1072 last year. Women appear to be most prone to becoming mule account holders where these foreign scammer persuade or coax them to open these accounts. We advise the public to be cautious and to not be fleeced by the fraudsters," Amar Singh said.

He also advised the public to use the CCID's "mule account checker" — a webpage in the department's portal to verify the status of bank accounts.

Amar Singh said the webpage - (http://ccid.rmp.gov.my/semakmule/ ) lists blacklisted bank account numbers suspected of being involved in online scams.

He said the public can also check if their personal bank accounts are subjected to abuse by scammers.

"The blacklisted account numbers are entered into the system soon after we receive a police report from victims who allege they were cheated by those behind it," he said.