DAP lawmakers want Bank Negara to investigate CID chief

KUALA LUMPUR: A group of DAP leaders have urged Bank Negara Malaysia (BNM) to conduct a full-scale investigation into Criminal Investigation Department (CID) director Datuk Seri Wan Ahmad Najmuddin Mohd over the RM1 million he had accrued in his Australian bank accounts, which was subsequently seized by the Australian authorities.

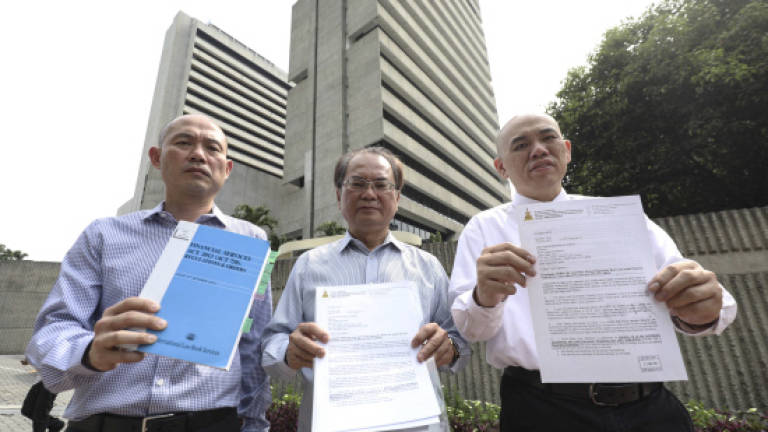

DAP Kampung Tunku assemblyman Lau Weng San, Selangor DAP leader Ronnie Liu and Segambut MP Lim Lip Eng were at the BNM headquarters today to hand over a letter to its officers urging for an investigation on how the money was transferred out of the country.

"We want them to investigate this matter as a case of public interest, the Australian authorities believe that there were irregular activities in terms of money transactions. BNM as the regulator of financial institutions and enforcement should initiate an investigation into this matter," said Lau outside the BNM headquarters here today.

Liu raised the question that if the money was for his children's education in Australia, why was the bank account under the CID director's name.

"Before the Australian authorities seized his money, they asked him for an explanation as to the origins of this money, because he failed to answer, the authorities seized it," said Liu.

Liu also said that Najmuddin had given a "lame excuse" as to why he would not want to retrieve his money back.

"He (Najmuddin) said that it's a long process and that lawyer's fees are expensive. They have lawyers in Australia that will do these things pro bono. I believe that because he could not explain the source of his money to the Australian authorities, that's why he doesn't want the money back," he said.

Segambut MP Lim Lip Eng also said that BNM should have a record of the money leaving the country if they do not then it amounts to money laundering.

"If I have a Maybank account and want to transfer RM50,000 to another bank account, I will have to declare it and state my reasons for making the transaction. For such a big amount of money to leave the country, the CID director would have had to declare it, or not it will be classified as money laundering under the Anti-Money laundering act," he said.