Tun M set to woo investors in Japan, reduce dependence on Chinese investments

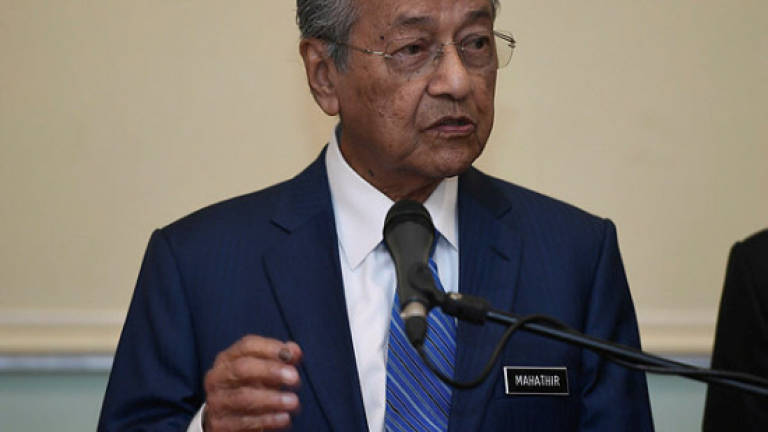

KUALA LUMPUR: Prime Minister Datuk Seri Dr Mahathir Mohamad is set to woo investors and offer business deals during a trip to Japan that starts on Sunday, as he looks to cover a gaping debt hole and shift the country away from dependence on Chinese investments.

The visit marks his first foreign trip after returning to power in a shock election result last month, and indicates a shift back to the 92-year-old's 'Look East' policy to strengthen ties with east Asia, especially Japan.

It is also seen as a sign of the country's move away from China, which contentiously pumped billions of dollars into the scandal-tainted previous administration of Datuk Seri Najib Abdul Razak. The new government has said some Chinese companies are now under suspicion of being used to cover up the graft scandal at state fund 1Malaysia Development Berhad (1MDB).

"The previous government may have engaged Japan, but certainly not with the enthusiasm it had for China," said Shahriman Lockman, a senior analyst with the Institute of Strategic and International Studies.

The cash-strapped government could look to tap Japan's vast pool of low-cost capital, while potential stake sales in Malaysian state-linked companies could be investment targets of Japanese companies, said bankers involved in cross-border deals.

Mahathir had already agreed to attend the annual Nikkei conference on Asia before winning the elections, but will now also meet Prime Minister Shinzo Abe and senior officials during his three-day visit.

"The fact that he chose to stick to his plans to attend the conference does say something: it will doubtless provide an opportunity to rejuvenate Malaysia-Japan ties," said Shahriman.

Mahathir has pulled out of a high-speed rail project with Singapore and is reviewing a US$14 billion (RM55 billion) local rail line to be built by Chinese companies.

The foreign ministry said in a statement that Mahathir's visit would enable Malaysia to highlight its current policies towards Japan and other countries in the region, especially related to foreign investments and trade.

"With the comeback of Tun Dr Mahathir, I'm sure our industries will be very delighted to think positively of their engagement with Malaysia and its industries," Makio Miyagawa, Japanese Ambassador to Malaysia told Bernama.

Japan is Malaysia's largest foreign direct investment contributor at US$13 billion last year, Bernama said.

On the hook

Mahathir has accused Chinese state-linked firms of inflating deal costs, engaging in corrupt practices, and even conspiring in the cover up of the 1MDB scandal.

He's sending the finance minister and anti-graft agents to China this week to investigate discrepancies in a bilateral gas pipeline deal. These billion-dollar deals, and a growing presence of Chinese construction workers and entrepreneurs, have spooked Malaysians.

"Mahathir probably wishes that he could run a scalpel through those incredibly costly projects that involve Chinese companies," said Shahriman.

But moving away won't be easy, given the decades of strong ties and about a hundred billion dollars in bilateral trade, Shahriman said.

Ties between Malaysia and China peaked in the last few years after Beijing stepped in with a US$2.3 billion deal to buy 1MDB assets. This was followed by several infrastructure projects which were won by Chinese state-linked firms.

Financial industry executives expect Japan to accelerate its pace of investment in Malaysia under the new government.

"Malaysia is a market the Japanese find easier to invest in. The way Malaysian firms operate their business, the legal set-up - all this is something the Japanese are comfortable with," said the regional head of investment banking at a Japanese bank, who was not authorised to be named.

He expects interest in the financials sector, namely banks and insurers. Mahathir is scheduled to meet top officials from Nomura Securities and Sumitomo Mitsui Banking Corporation, among others. — Reuters