Signs of bear market in Asia: Fund manager

PETALING JAYA: Asian equities are seeing signs of a bear market or a correction judging from the current macroeconomic environment, according to Aggregate Asset Management (AAM).

"Intensifying trade rhetoric and policies from the US against the EU and China and vice versa have sent shockwaves throughout the markets. This has caused treasury curves to flatten over the last few months prompting some analysts to raise the alarm," the Singapore-based fund management company's co-founder and executive director Wong Seak Eng told SunBiz via an email interview recently.

Asian stocks have nosedived in recent weeks, on heightened tensions between the US and China over tariff issues.

Wong pointed out that the probability of an economic contraction increases as the market is approaching the end of an economic cycle.

"However, how the future plays out still remains a big question mark. We can only say that given uncertainty in the market right now, there are a lot of opportunities and bargains stocks to capitalise on."

Despite the continued fund outflows from the emerging markets, he said, the rate of outflows from its portfolio is not a major concern as it only equals to 0.56 times of the net tangible asset value. Dividend yield for its portfolio currently stands at 3.6%.

"When there is an inflow of cash, we go on a hunt for bargains. This only works for investors with a long-term investment horizon. We do not think it is easy to make big money if one just focuses on the short-term movements."

Wong said the company sees opportunities in almost all market conditions, unless the valuations turn extremely high.

"We buy stocks that give a decent dividend yield and are selling at below their net asset value. We invest in companies with strong balance sheets. We are willing to buy and hold.

"We consider ourselves to be very patient. We think big money is made by investors who are willing to be contrarian, and willing to wait. Investors who act irrationally will usually end up with poor results."

For Wong, Asia remains a good investment destination as it trades less than 15 times in terms of price-to-earnings ratio.

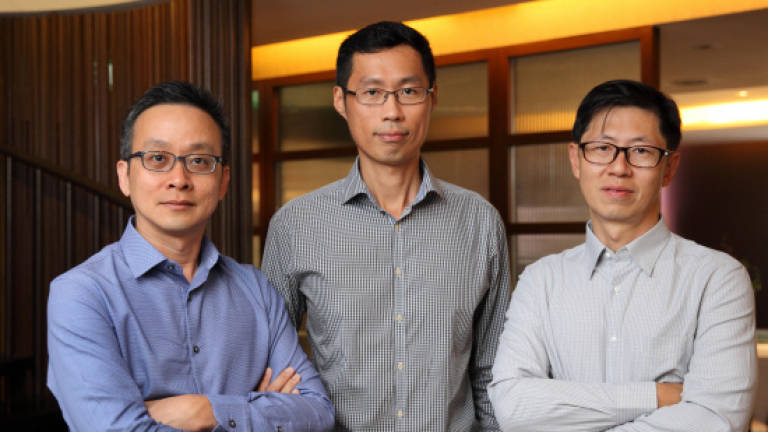

AAM, which has S$500 million (RM1.5 billion) assets under management, was founded by two Malaysians, Wong and Eric Kong, as well as Singaporean Kevin Tok five years ago. Its single flagship fund – Aggregate Value Fund – offers the zero management fee model, which means the company makes money from performance fees and the clients only pay when the fund is profitable.

"On the off chance that there is no performance, we pay our managers and staff through cash reserves that we have saved up over time. We believe that this compensation system puts the clients' interests first, as managers have to deliver performance to earn their keep."

Based on its track record, the fund generates an average net return of 10.59% per year. It has about 600 stocks in its portfolio with presence in Asian markets such as Hong Kong, Malaysia and Singapore.