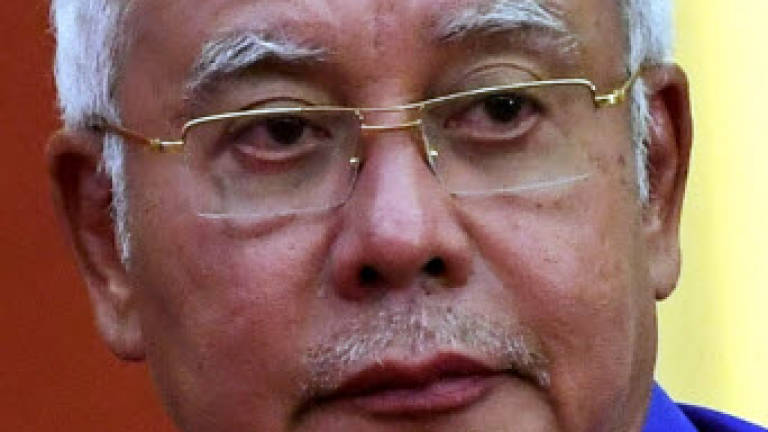

Najib questions sale of PNB's, Khazanah's assets

KUALA LUMPUR: Former prime minister Datuk Seri Najib Abdul Razak has questioned the government's move to settle the country's debts through the sale of Khazanah Nasional Bhd's and Permodalan Nasional Bhd's (PNB) assets and shares.

He queried whether the move, despite being the easy way out, would be the wisest and had been properly studied.

"We should look at the costs versus benefits before making any decision," he said in a posting on his Facebook account today.

Najib said the government's debt was mostly in the form of bonds or sukuk, with interest rates of around 3.6% a year.

"Meanwhile, the growth of Khazanah's assets was 9.6% a year and PNB's was 9.2%, far higher than the debt's interest cost," he said.

To illustrate his point, the former prime minister said in 2008, Khazanah's assets totalled RM33.7 billion and if everything was sold, the country's debt would be reduced by RM33.7 billion.

"This means that we will reduce the interest cost by RM1.2 billion a year at an interest rate of 3.6% or savings of RM10.1 billion for nine years up to end-2017.

"Because we did not sell those assets, they grew from RM33.7 billion to RM115.7 billion by end-2017 for a gain of RM82 billion. Therefore, which is the wiser choice? A profit of RM82 billion or savings of RM10.1 billion?" Najib asked.

He said during the same period, PNB's assets increased from RM120 billion to RM279.2 billion.

Additionally, PNB managed its own funds called propriety funds, which are national assets, and they grew from RM12 billion at the end of 2008 to RM43.9 billion at end-2017, Najib said.

In his posting, Najib also insisted that the national debt was not RM1 trillion, as that was not the figure given by international credit rating agencies, the World Bank or Bank Negara Malaysia.

He also said the government lost RM40 billion in revenue following populist policies such as the three-month tax holiday, the switch from the Goods and Services Tax regime to the Sales and Services Tax, and leakages from the reintroduction of bulk subsidies.

"What I am worried about is the purpose of the national assets and land sales is not to reduce debt but to cover this revenue loss of RM40 billion.

"Let us all see if the upcoming budget is a surplus or deficit budget. A deficit budget would mean that the sale of assets and land is to cover the loss of revenue instead of to reduce debt," he added. — Bernama