Police to launch crackdown on 39,743 account holders that support various fraud rings

KUALA LUMPUR: Holders of close to 40,000 bank accounts, who allowed online scammers to use them for cheating, will be brought to book in a nationwide operation by police soon.

The Commercial Crimes Investigation Department will soon launch large scale operations against 39,743 bank account holders for allegedly providing 'mule accounts' to fraud rings operating the Macau scam, African scam, and other e-financial frauds.

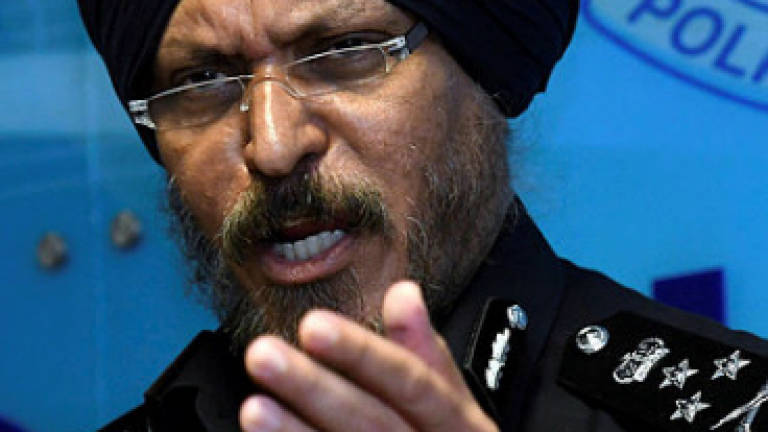

"The operation which will be targeted at holders of accounts identified in more than five police reports as being involved in various online scams, will be conducted nationwide simultaneously," said CCID director Commissioner Datuk Seri Amar Singh.

He told a press conference today that based on police investigations, at least RM800 million has flowed through such mule accounts, which have increased dramatically from 5,411 in 2015 to about 40,000 accounts in the past three years.

"We are rather anxious about these cybercrime numbers. The problem is in our daily banking process, it is easier to open bank accounts," said Amar Singh, who expressed the hope that bank authorities will be more cautious.

"The account holders could be anyone. They could be poor people in dire need of money, drug addicts or the real scammers," he said.

These account holders or the fraudsters can face criminal action under Sections 411 and Section 414 of the Penal Code for dishonestly receiving stolen property and assisting in the concealment of stolen property.

The offence of dishonestly receiving stolen property carries a penalty of jail of up to three years and a fine, while those who voluntarily assist in the concealing or disposing of stolen property may be liable to imprisonment for up to seven years, with a fine or both.

Meanwhile, Amar said the CCID together with their counterparts from Hong Kong and Singapore, have busted a love scam syndicate, following several raids.

Amar said police launched a series of raids simultaneously between Oct 19 and 21 after the three police forces exchanged intelligence, which led to the arrest of the suspects.

"This is the first ever operation where we exchanged vital information about these scams and we launched the raids simultaneously in Malaysia, Singapore and Hong Kong."

Besides two Nigerians believed to be the masterminds of the syndicate, police also arrested 16 locals and a Chinese woman, aged between 29 and 60.

He said the masterminds needed locals to act as intermediaries to transfer the scammed money to the operators' accounts in foreign countries.

Amar said the syndicate has been linked to 38 love scam cases involving losses of RM28 million here, while the Hong Kong based syndicate has been linked to 100 cases involving RM54 million in losses.

"The Singapore syndicate has been linked to eight cases involving losses of RM1.35mil," he added, stressing that love scams are on the rise.

The modus operandi of such scammers is to first gain the trust of their victims, who are mostly women.

They would then claim a gift meant for the victim was stuck at the customs or post office and that a payment is needed for its release. A bank account number, usually provided by an account mule, would be given to the victim to deposit the money.

The suspects would cut contact with the victims and disappear once the money had been deposited.