KUALA LUMPUR: It is time for Bank Negara Malaysia (BNM) to reimpose financing quota that the banks need to adhere to in order to assist first-time home buyers, said the National House Buyers Association (HBA).

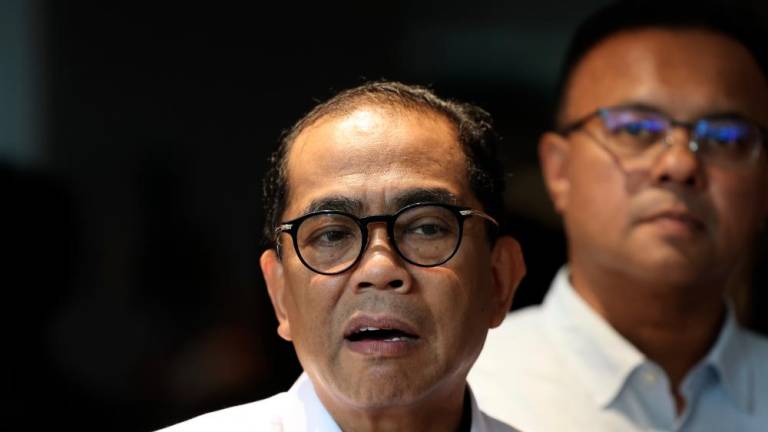

Its Honorary Secretary-General, Datuk Chang Kim Loong said the quota system was implemented in the 1980s by BNM where banks were needed to accomplish a certain amount of quota in small-sized financing.

He said the matter was proposed to the central bank to consider.

“In 1980s, banks must achieve a certain amount of quota of small financing, whether for low-cost or medium-cost houses (priced) below RM100,000.

“So, we want this to be reintroduced and banks must accomplish a certain amount of quota or percentage for affordable housing (funding). So, there are no more excuses of not enough loans or not meeting the criteria,“ he said at the Rahim & Co Seminar 2018 themed “The Malaysian Property Market: Where are We Heading Post-GE14?” here today.

Chang also proposed to government to allow the Employees Provident Fund (EPF) to become a financier.

“If we were able to lend our own money, we will have avenues to support first-time buyers.

“The scheme should be equipped with an insurance coverage in the case of death (of house buyers) or if the home buyers were to sell their units, the money should go back to EPF,“ he said. — Bernama