AIA eyeing lion’s share of affluent segment Part 2

THE concluding portion of the exclusive interview following on from page 21 in the Sun on Friday, Dec 16:

the Sun: Two factors are altering the insurance scenario:

a) that people are living longer,

b) that the traditional (Asian) support mechanism is being disrupted with children living abroad, and/or pursuing independent lives and careers.

These have made insurance increasingly important – to get coverage for a “longer run”, say 15 to 25 years or more after retirement, besides factoring inflation-impact on medical and healthcare costs. Could you expand on this and the “Maturity Booster” by-product. How do you explain this to a prospective customer or layman?

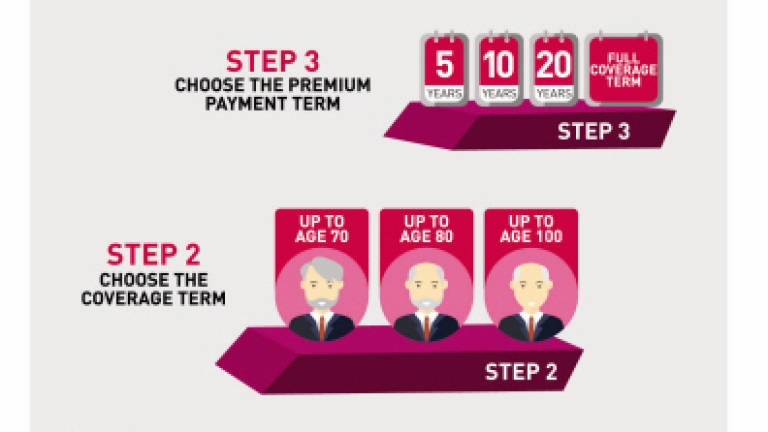

CFW: Maturity booster is paid at the end of the insurance maturity. This product intends to cover death and total disability. However, if you live beyond the “expiry age” (eg. You choose a plan providing coverage until age 70) – the expiry age remains the maturity point.

• At this maturity point (in this case, age 70), you will receive whatever is in your fund account, which is called the fund value. Your fund value belongs to you and you can claim it. However, through the maturity booster, AIA has the option to give you an additional 20%, on top of your fund value.

• We will pay the coverage if there is an event of death and total disability. But if you are still alive and well at the Maturity Point (the expiry age of the coverage/ contract), you will get the maturity value together with the additional 20% of the maturity value.

• As an example, if one buys RM500,000 coverage and becomes totally disabled, the insured client will get the half a million coverage.

• If the insured client lives beyond the maturity age (maturity point) of the coverage plan, this option becomes available. For instance, if the cash value is RM600,000, AIA will provide another 20% of RM600,000 to the insured client, besides the cash value.

TW: The cash value is the result of the investment, part of the premium which the company has invested for you.

CFW: The maturity is not guaranteed but the coverage is. However, the maturity value will depend on the market movement.

the Sun: The AIA website states that you will (a) double the coverage when one suffers an accident and (b) triple the coverage when one encounters unforeseen cases overseas. Why would you double or triple the amount on such cases?

CFW: This was developed from the needs which we observed. Things like accidents are unforeseen. So by doubling or tripling the coverage amount (as in cases like MH 370/MH17), it would help our customers take care of such unforeseen events.

the Sun: If say the customer, at the age of 57, gets the RM500,000. Then around the age of 60, some major medical incident occurs. Will the coverage be on the spot?

TW: This plan covers the incident of death or total permanent disability. For that scenario, you need to get another insurance plan such as medical insurance.

• As for doubling and tripling the amount of the coverage, for accidental death or accidental death on public conveyance, we looked at the unfortunate incidents affecting the two MAS flights. People never think about dying in the airplane, yet we have had two recent incidents.When that happened, it was so unfortunate and sudden.

• Hence, AIA wanted to provide that added assurance during these unforeseen circumstances, without added costs.

the Sun: Could you explain why AIA has specified the need for medical check-ups only if the coverage is RM1.5 million and above? Most insurance companies require their customers to go through medical check-ups to ensure that all clients meet the health requirements.Would you not want to be sure that the people applying for coverage meet the requirements?

CFW: Let me clarify.We do not mean that there is no declaration and underwriting. The prospective customer applying for this plan must answer a list of questions regarding their health and well-being.

• So, while it states that you do not need to go for a medical check-up for coverage below RM1.5 million, you still need to execute the self-declaration.

• For anything beyond RM1.5 million, we require you to go for a medical check-up on top of the self declaration, to be sure that you are as healthy as you declare.

the Sun: Would you not be risking some instances of alteration or misrepresentation just to qualify for the plan?

CFW: This again goes back to the fundamentals of insurance.

TW: Disclosure is always the responsibility of the insured. The prospective customer has the responsibility to disclose honestly. Elsewhen the insurance company discovers that a customer has not been honest, he will lose the plan. This is a standard practice across the insurance industry.

the Sun: Why is RM1.5 million the cut-off point instead of any other amount?

TW: We worked with our re-insurers and as part of our risk benefit assessment, AIA wanted to raise the non-medical check-up limit beyond the traditional RM500,000.We have managed to raise the limit to RM1.5 million till now, but we are going to continue to work with the re-insurer to explore further raising of the non medical check-up limit.

• The intention is to get a bigger group of people to come in. But the fundamental factor is still the honest self disclosure. Even when you are investing RM1.5 million, the minute anybody states yes in any of the particulars in the self declaration, we will ask the prospect to go for a medical check-up.

• Even when applying for RM500,000 coverage, one will need to disclose the information honestly, as part of the risk assessment.

the Sun: Legacy planning has become increasingly prominent among this segment.What are the pitfalls that people should avoid?

CFW: A misconception about legacy planning is that people think they must be very rich in order to execute legacy planning. The term often conveys an image of being rich and being an expansive process, which is incorrect.

• Thinking about your children is also part of legacy planning ... what would happen when you are not around? You would still want to leave something behind.

• Another important fact which people may not realise is that insurance is a CREDITOR PROOF.

the Sun: Could you elaborate on this creditor proof facet?

CFW: People feel they can buy a house/property for legacy purposes, but these items are NOT creditor proof – insurance is creditor proof.

TW: Even if you owe the bank money, the bank cannot use your insurance money to cover the debt.

•When one borrows money from the bank to buy property, the bank will liquidate the mortgaged or leveraged asset in the event that you are not around and have not paid up the loan.

• However, nobody can touch the insurance policy, not even the bank.

the Sun: So insurance is creditor proof? The amount one has invested in insurance remains safe?

TW: Absolutely.

the Sun: What happens when someone cannot continue paying the insurance premium?

TW: If one does not pay the insurance premium after a period of time, the policy will lapse. Maybe the insurance company will wait for a month or so, giving the customer a reasonable time to pay. Otherwise it will be unfair to the pool.

the Sun: What happens if the person loses his job and cannot pay the insurance premium after six months?

TW: The policy lapses but whatever he has contributed will remain valid.When he is able to pay, we will consider reinstating, provided that there are no other health issues other than those he has declared before.

the Sun: But if he cannot pay the further premiums, what happens to the amount which he had paid before he “left”?

TW: This depends on the policy. If there is a cash value and he surrenders the policy when he is unable to pay further premiums, then he is entitled to the cash value.

However, if one buys a term policy with no cash value, then everything will stop when the customer stops paying further premiums.

the Sun: When it comes to legacy planning, there are several options including investing in property. Besides property, what other types of investment can become a liability?

TW: A lot of people consider investing in luxuries like expensive cars. Even so, you won’t be gaining/ leaving cash, as that is a depreciating asset.

the Sun: When it comes to legacy planning, there are several options including investing in property. Besides property, what other types of investment can become a liability?

TW: A lot of people consider investing in luxuries like expensive cars. Even so, you won’t be gaining/ leaving cash, as that is a depreciating asset.

• However, the insights gleaned from our research indicate that Malaysians tend to prioritise property as the primary form of investment from our insights.

• AIA is NOT discouraging people from investing in property. Instead, we are just clarifying that property investments are NOT creditor proof.

• So, it would be prudent to diversify one’s investment portfolio ... and insurance is indeed a very good (and creditor proof) option.

• A-Life Signature can help in leaving something for one’s dependents/loved ones if anything should happen to the insured customer. This would prove better than dipping into EPF reserves.

the Sun: You have said that the take off (of A-Life Signature) is very encouraging. How are you communicating and promoting this plan to potential audiences?

TW: Yes, it is very good and encouraging. We are communicating primarily through social media and word of mouth.

AIA has an enviable base of around two million individual customers. From these customer records, we were able to detect/ identify those who can be bracketed as the mass affluent segment. Through our life planner force, we approached this group of people and were able to sell this product successfully.

Our next phase is to move aggressively into the outer market, targeting those who have yet to become an AIA customer.We particularly intend to maximise thrust through social media and word of mouth channels.

the Sun: One can perceive two basic sub-segments on AIA’s radar with different priorities, needs and mindsets. They may also necessitate a differential approach and customer acquisition cost as in:

• Those who are “arriving”, roughly in the late 20s to 40 age-group; i.e. those who need to be enticed and convinced regarding early investment in insurance; and

• Those who are between 40 to 60 years, who have already achieved and these thoughts are now top of-mind.

the Sun: So, you segmented the mass affluents into two parts. Is AIA also varying the communication mode and acquisition process when talking to these two sub segments?

TW: Yes, we have very clear segmentation strategies leveraging insights derived out of very extensive quantitative and qualitative market research.

the Sun: Is it possible to share some of these research insights with our readers?

TW: We regret that it is highly classified information. We strongly protect our knowledge and data base – it represents our key competitive advantage. By mining that information, we derived our portfolio strategy–offering a relevant group of products for each customer or segment.

• You have rightly pointed out that customers go through a life cycle journey, having different needs for different stages. We follow our customers from the day they step in to AIA to the end, for a very long time.

• As part of the “real life company” proposition, we journey with our customers through the ups and downs in their life journey by offering more than just a range of protection, investment and insurance products.

• We also “provide” through AIA’s brand positioning as a real life company and reiterate that we are here to help Malaysians live/enjoy longer life and healthier lifestyle, besides protecting people and their financial future.We have colated real evidence that if one persists with a healthier lifestyle, you fall sick less and increase your lifespan.

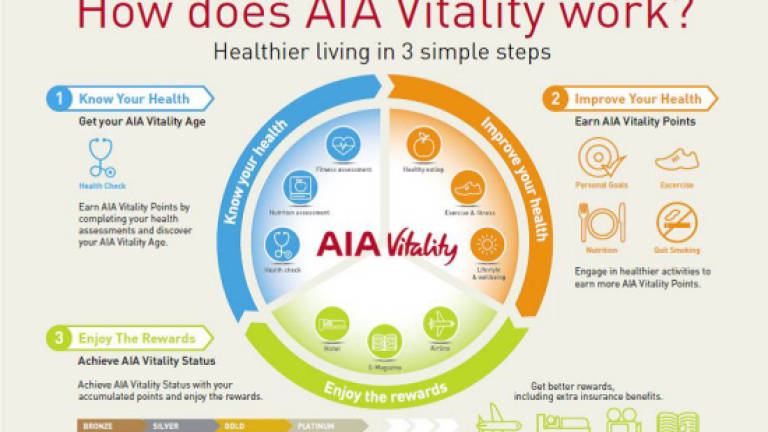

We accrued this data through a programme called AIA Vitality, which was recently launched. AIA Vitality is our real initiative to deliver this brand promise “Helping Malaysians to live a healthier and longer lifestyle”.

• This caring value addition possibly distinguishes AIA from other insurance companies.

PRASHUN DUTT, Chief Marketing Officer of the Sun, is a former Regional Media Director. After 14 years with advertising agencies JWT, McCann Erickson, O&M and Bozell, he has since leveraged this strong foundation in the global media industry with Times Publishing, Forbes, CNBC, MTV and The Economist. Besides socio-economic features and country reports he writes analytical articles on business, marketing, advertising and communications.

• Research and editing support provided by the Sun Corporate Cell: Brian Chung and Michele Theseira.

• Creative visualisation, art and design: Ashley Seow

Feedback/Comment: pdutt@thesundaily.com