AIF hopes financing green tech would boom

PETALING JAYA (Jan 16, 2014): The Asian Institute of Finance (AIF) is hopefull that the loan approval rate under the Green Technology Finance Scheme (GTFS), which offers financing for producer of green technology, will increase by 50% this year, said Strategy and Policy Development Head Dr Sofiza Azmi.

To date, GTFS has approved 109 projects which have received worth RM1.5 billion by 22 banks.

Following the success of the fund, the government has allocated an additional RM2 billion for the scheme and extended its operations to 2015.

According to her, the approval rate for the financing has also increased from 54% in December 2012 to 59% in September 2013, demonstrating enhanced understanding within the local financial institutions towards green financing.

"We believe the increase in loan approvals under the scheme will be driven by enhanced understanding within the domestic financial institutions towards green financing."

"Furthermore, Malaysian Green Technology Corporation is also hiring more employees with financial background to help look into the feasibility and commercial viability of the projects," she told reporters on the sidelines of the AIF's distinguished speakers series titled "Renewable Energy Development through Project Finance".

The government established the GTFS with support from Bank Negara Malaysia in 2010 with an initial fund of RM1.5 billion as part of its commitment to green industries.

Sofia said the fund enables companies to obtain soft loans with the government subsidising 2% of the interest rate or profit rate and providing a guarantee of 60% on the amount of financing via Credit Guarantee Corp Malaysia.

"We are in the midst of talking with relevant agencies including major banks and GreenTech Malaysia to enhance financial support. I hope that the approval rate for GFTS to increase more than 50% this year," she added.

Earlier, AIF CEO Dr Raymond Madden in his lecture identified four main challenges facing the Malaysian financial institutions to finance green technology projects

He said among the challenges includes information mismatch, lack of technical knowledge to evaluate the feasibility of green technology project due to limited proven track record, requires huge capital investment as well as uncertainties and risks associated with renewable technology investments fall outside the scope of plain vanilla finance.

Hence, he said AIF will assist in bridging the knowledge gap on a range of aspects of green financing, whilst growing the awareness levels of the domestic financial services industry.

Madden said participation of the financial sector is crucial as it is the fulcrum of the economy facilitating technological development and spreading innovation.

"Although there is a growing trend in the amount of loans and number of project financing approved by financial institutions in Malaysia under the Green Technology Financing Scheme (GTFS), continuous active participation of financial institutions is fundamental to the growth of the renewable energy development," he said.

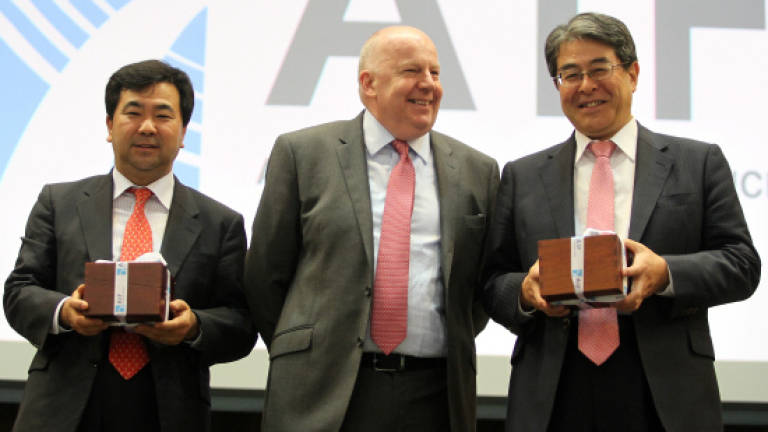

The lecture was presented by Mizuho Bank Ltd's managing executive officer and head for Asia and Oceania (excluding East Asia) Hiroshi Suehiro and senior vice president and head of renewable energy and carbon business, global structured finance division Keiichi Niinuma.

Madden pointed that the county has the potential to become a key player in green technology globally with unwavering backing from the government coupled with keen participation by the private sector.