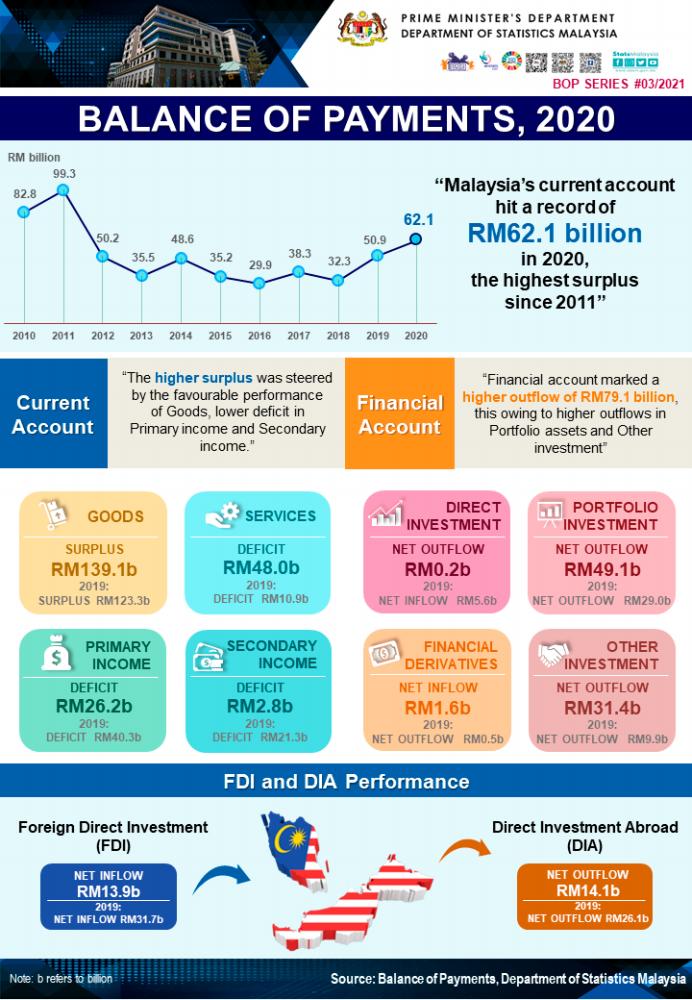

PETALING JAYA: The current account balance for all four quarters for 2020 stood at RM62.1 billion, the highest surplus since 2011, steered by the favourable performance of goods, lower deficit in primary income and secondary

income.

Chief statistician Malaysia Datuk Sri Mohd Uzir Mahidin said for 2020, net exports of goods was at RM139.1 billion, while the export of goods was RM778.2 billion driven mainly by electrical & electronic, rubber and palm oil-based products.

“Meanwhile, imports of goods posted RM639.1 billion were primarily in electrical & electronic products. The main destinations for both exports and imports were China, Singapore and USA,” he added.

Sectorally, services registered a deficit of RM48 billion in 2020, the highest ever recorded. This is a repercussion of border closures and travel restrictions in response to contain the Covid-19 virus, and as such, travel (the key component of services) logged a deficit of RM7.8 billion for the first time in 30 years.

Transport, the second largest contributor in the services sector, recorded a higher deficit of RM27.5 billion compared to RM25.9 billion in 2019.

Exports of transports accounted for RM13.4 billion, a decrease of RM8.2 billion from the previous year due to the decline in air passengers.

Nevertheless, during this pandemic, the rising demand for online shopping and businesses have led to the increase in exports of courier services under transport. Apart from that, the new norm of working from home and higher subscriptions of online movies via streaming has increased the imports of telecommunication, computer and information services.

In terms of income, primary income recorded a lower deficit of RM26.2 billion as compared to RM40.3 billion in 2019. Simultaneously, secondary income account also recorded a lower deficit of RM2.8 billion as against RM21.3 billion in the previous year due to lower outward remittances.

“On the financial front, this account marked a higher outflow of RM79.1 billion in 2020 as against RM33.8 billion a year ago. This is owing to higher outflows in portfolio assets and other investment,” said Mohd Uzir.

For 2020, foreign direct investment (FDI) showed a net inflow of RM13.9 billion as against RM31.7 billion a year before. Despite the decline, the FDI position surged by RM14.4 billion to record RM703.5 billion in 2020.

At of end-2020, Malaysia’s international investment position (IIP) recorded net assets position of RM79.6 billion. The international reserves stood at RM432.2 billion as compared to RM424 billion in the preceding year.