PETALING JAYA: Digital solutions and application development specialist Agmo Holdings Bhd this morning debuted on the ACE Market of Bursa Malaysia at 80 sen for a 54 sen premium, tripling its IPO price of 26 sen.

The IPO registered a positive start, with the 16.25 million new shares made available for the Malaysian public being oversubscribed by 120.15 times. The 6.50 million shares made available to eligible directors, key senior management, employees, and business associates were fully subscribed, while the 62.25 million shares made available by private placement had been fully placed out.

Agmo CEO Tan Aik Keong said the IPO has given it financial flexibility to pursue objectives of expanding operations in Malaysia and enlarge footprint in South East Asia via its Singapore expansion.

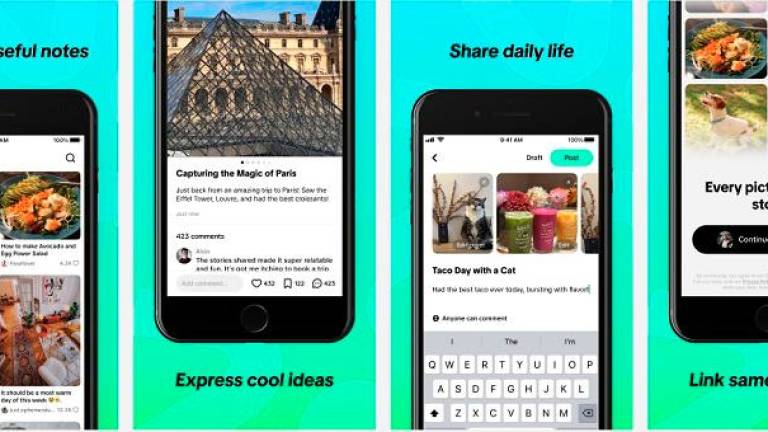

“With demand for digital solutions, including mobile and web applications, among businesses of all sizes growing at an accelerated pace, a lot of new opportunities have emerged for our group,” he added.

Of the RM22.10 million in proceeds raised, Agmo has allocated RM9.47 million for investments in research & development (R&D) and sales, marketing, and business development teams; as well as a technical support and maintenance services division.

It will invest RM6.22 million as working capital and related capital expenditure to cater for the expansion of its mobile and web application development and digital platform-based services as well as the setting up of a new office.

About RM2.54 million of the proceeds will be utilised for establishing a training and development centre, to be known as Agmo Academy, while RM690,000 has been allocated for the group’s regional expansion to Singapore, and the remaining RM3.18 million for listing expenses.

“We believe that the listing will give the group more recognition locally and regionally, and enhance our reputation among customers and potential leads while boosting our appeal as an employer so that we can continue to attract and retain talented and productive employees.”

Kenanga Investment Bank Bhd is the principal adviser, sponsor, underwriter and placement agent of Agmo’s IPO.