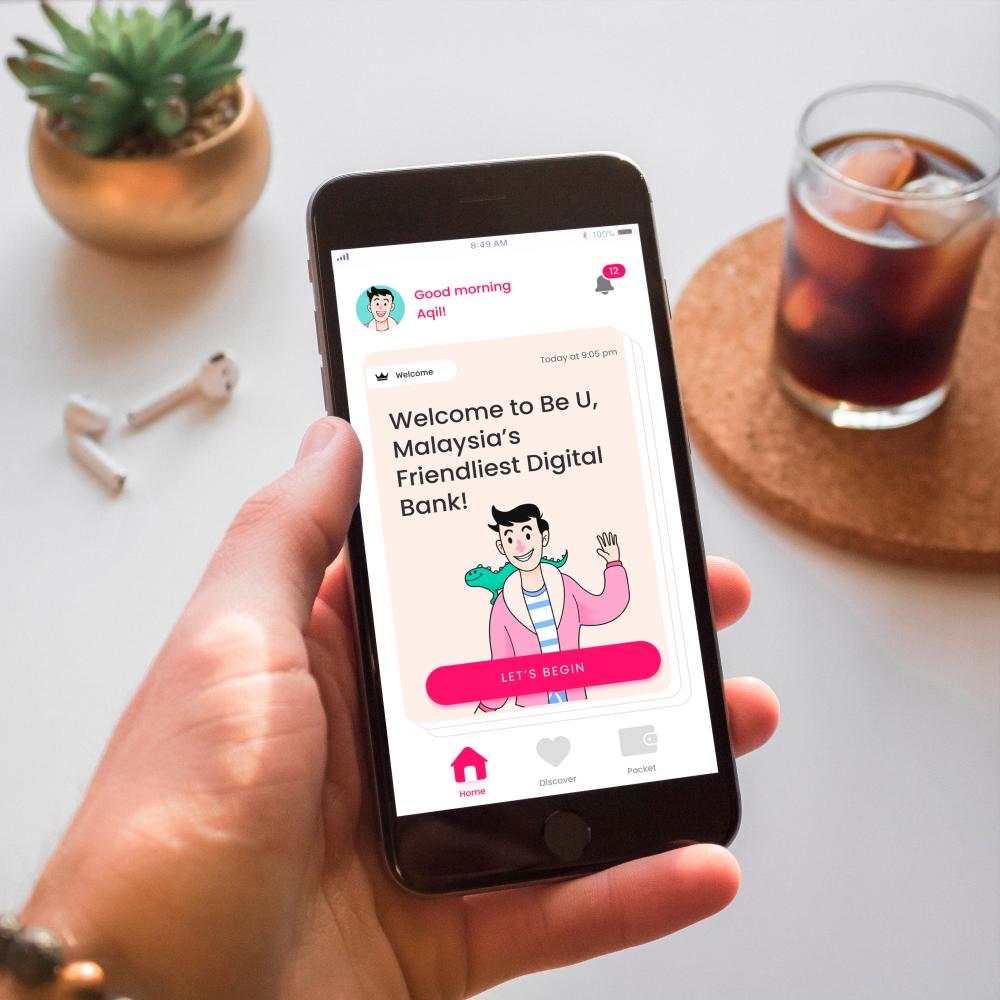

PETALING JAYA: Bank Islam Malaysia Bhd has launched its fully cloud-native digital banking proposition named Be U.

The all-new banking app allows users to do their banking transactions seamlessly, without the hassle of visiting a branch, thus broadening financial inclusivity by targeting the digital-native, younger generation. Its engaging and user-friendly interface is intended to help users quickly understand and manage their finances.

Group CEO Mohd Muazzam Mohamed said Be U is a gamechanger for Bank Islam and the Islamic banking industry. It is a product that intends to redesign and catalyse Bank Islam’s future growth by leveraging the rapidly changing fintech landscape and further allowing customers access to an affordable and easy-to-use financial solution.

“Through Be U, Bank Islam is shifting from being product-centric to customer-centric in building products that fulfill customer needs. This effort aligns with our five-year business plan (LEAP25), which aims to become the champion in syariah-ESG total financial solution with leadership in digital banking and social finance,” he said in a statement today.

He said that having taken a holistic approach to meet customers’ needs, the bank has designed the digital bank proposition to be different and complementary to what is presently available in the market. Be U is targeted at the younger generation, offering a savings account that allows zero balance, fund transfer capabilities, and a Nest feature that helps users save for specific goals.

“There will be frequent new functionalities or offerings on the Bank Islam Be U app over the next 12 months, including term deposit, gig marketplace, debit card, personal financial management, micro-financing, micro takaful and much more. We will replicate the learnings from Be U into the entire organisation, which is the bigger picture we’re looking at. We want to turn Bank Islam into an increasingly agile organisation by adopting new ways of working, attracting talents with new skillsets, using the latest technology, and leveraging data and automation. This will, in turn, enable Bank Islam to serve our customers better.”

Mohd Muazzam added that Be U focuses on customer segments that Bank Islam does not, capturing users still in the early stage of their working life.

“Once their financial footing is more stable, and they require more complex financial products and instruments, Be U will be there, offering Bank Islam’s various products and services.”

Made available to the public since mid-June this year, Bank Islam targets between 350,000 and 400,000 downloads and users of the Be U app within the first 12 months of its operations.

The cloud-native solution is anticipated to be the cornerstone of all upcoming digital banks to be introduced in Malaysia.