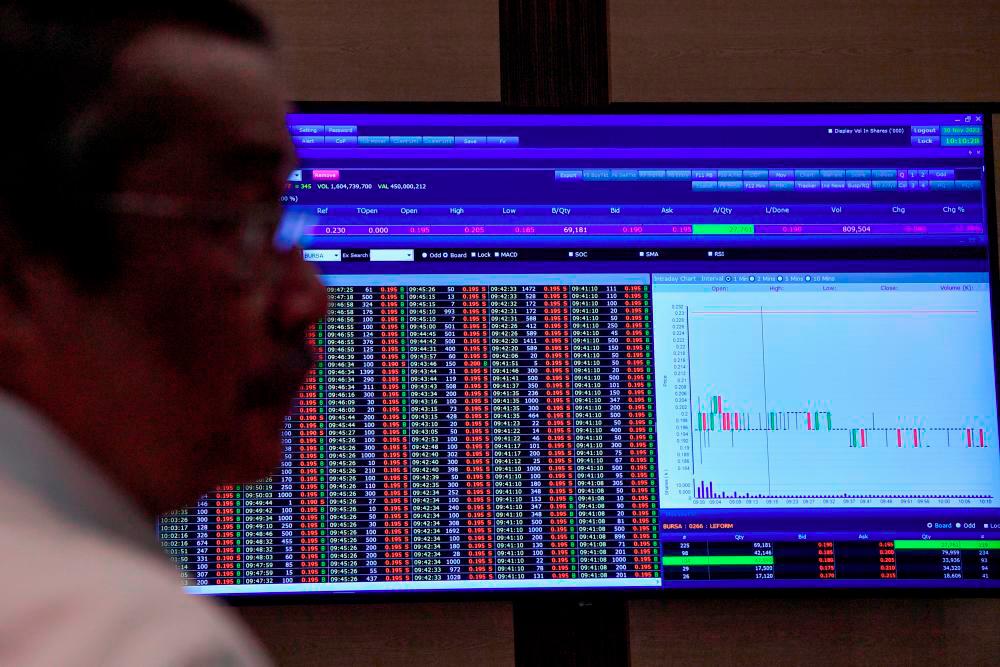

KUALA LUMPUR: Bursa Malaysia is expected to be muted in the upcoming holiday-shortened trading week as investor sentiment is likely to remain soft for the time being due to external factors, although bargain hunting may prevail given the attractive valuations.

Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said, on this backdrop, the benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) is likely to trend sideways, with a slight bias towards positive within the 1,485 to 1,500-level for next week.

“From a technical perspective, we spot the immediate resistance at 1,500 and support at 1,470,” he told Bernama.

Meanwhile, Hong Leong Investment Bank Bhd (HLIB) said that the FBM KLCI near-term outlook remains positive amid China’s reopening and near-peak interest rate upcycle, however, the benchmark index is expected to move range-bound, with resistance at 1,500, 1,512 and 1,528, and support at 1,451, 1,468, and 1,479 ahead of the long weekend holidays.

Bursa Malaysia and its subsidiaries will be closed on Monday for the Thaipusam replacement holiday and will resume trading on Tuesday.

“(Expect) the absence of fresh local catalysts and a technical support trendline breakdown, with a key focus on February results season and the re-tabling of Budget 2023,” it said in a research note.

On a week-to-week basis, the key index eased 7.08 points to 1,490.47 on Friday against 1,497.55 a week earlier.

On the index board, the FBM Emas Shariah Index gained 34.72 points to 11,212.27, the FBM ACE Index increased 112.0 points to 5,843.23 and the FBM 70 Index advanced 125.15 points to 13,884.99.

The FBM Emas Index fell 7.01 points to 10,886.35 and the FBMT 100 Index erased 16.02 points to 10,547.89.

Sector-wise, the Industrial Products and Services Index inched up 0.98 of-a-point to 191.75, the Energy Index bagged 25.35 points to 906.11 and the Technology Index improved 1.10 points to 69.39.

The Plantation Index rose 86.01 points to 6,927.24 while the Financial Services Index dropped 155.37 points to 16,314.82

Weekly turnover swelled to 18.10 billion units worth RM10.57 billion against 11.21 billion units worth RM6.12 billion last week.

The Main Market volume soared to 12.44 billion shares valued at RM8.78 billion from 7.23 billion shares valued at RM4.95 billion a week ago.

Warrants volume rose to 1.26 billion units worth RM217.46 million from 951.90 million units worth RM130.73 million previously.

The ACE Market volume shot up to 4.39 billion shares worth RM1.57 billion from 3.02 billion shares worth RM1.04 billion last week. - Bernama