KUALA LUMPUR: The business outlook among Malaysian com-panies slid further for the second consecutive quarter for Q1 2019, but firms are more upbeat about investments for business expan-sion this year.

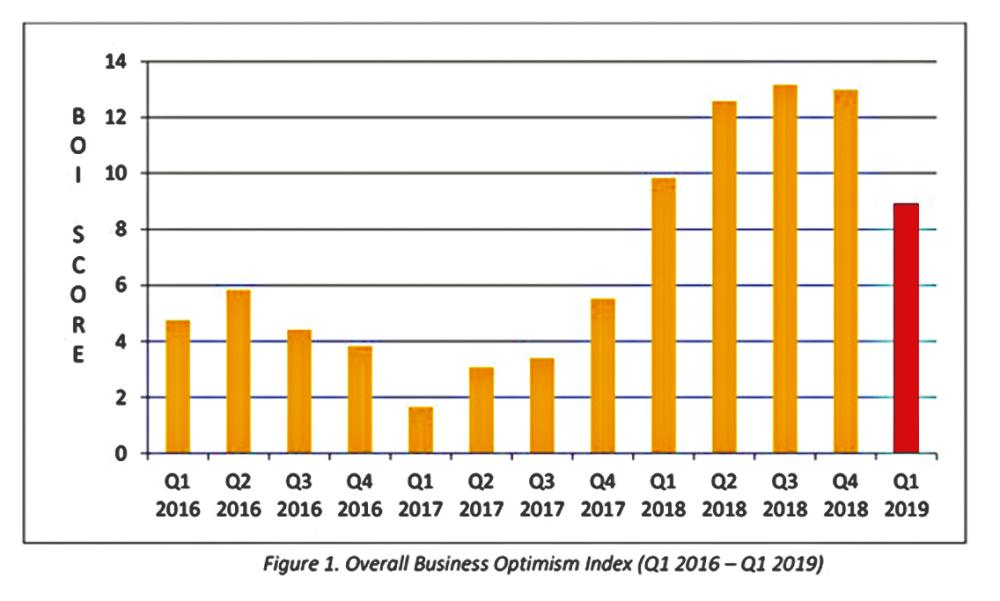

According to Dun & Bradstreet (D&B) Malaysia’s Business Opti-mism Index (BOI) study, the overall BOI moderated down-wards from +12.99 percentage points in Q4 2018 to +8.92 percentage points in Q1 2019.

On a year-on-year (y-o-y) basis, the BOI rose slightly from +7.25 percentage points in Q1 2018 to +8.92 percentage points in Q1 2019.

The six business indicators under the quarterly BOI study are: volume of sales, net profits, selling price, inventory level, employees and new orders.

For Q1 2019, only two of six indicators have climbed up on a quarter-on-quarter basis. On an annual basis, four of six indicators have risen for Q1 2019.

The transport, services and wholesale sectors have emerged as the most upbeat sectors while construction and mining are the least optimistic.

Compared with 2018, there is a visible jump in firms expecting investments to rise from 18% in 2018 to 26% in 2019.

The proportion of firms expect-ing investments to decrease fell further from 15% for 2018 to 7% in 2019. Majority of local firms had anticipated investments to remain unchanged at 67%.

Dun & Bradstreet (Malaysia) Sdn Bhd CEO Audrey Chia said moving into Q1 2019, it expects sentiments among local firms to moderate due to weaker growth within external-oriented industries such as wholesale trade as well as the muted outlook among cons-truction and mining firms.

“For 2019, however, firms have anticipated higher investments for business expansion compared to the previous year. This is particularly in the area of tech-nological investments in soft-ware, infrastructure and machi-nery and capital equipment.”

The BOI is a measure of business confidence in the econ-omy. Released quarterly, it is based on a business sentiment survey that is designed to capture business expectations and is one of the most effective ways to track how the business community perceives the business environ-ment, and where they think it is moving.

This is the 24th D&B BOI study being released in Malaysia.