KUALA LUMPUR: Semiconductor tester and burn-in service provider KESM Industries Bhd, which saw a 10-15% decline in chip testing volume in the last six months due to the trade war, said the situation is temporary and not expected to prolong.

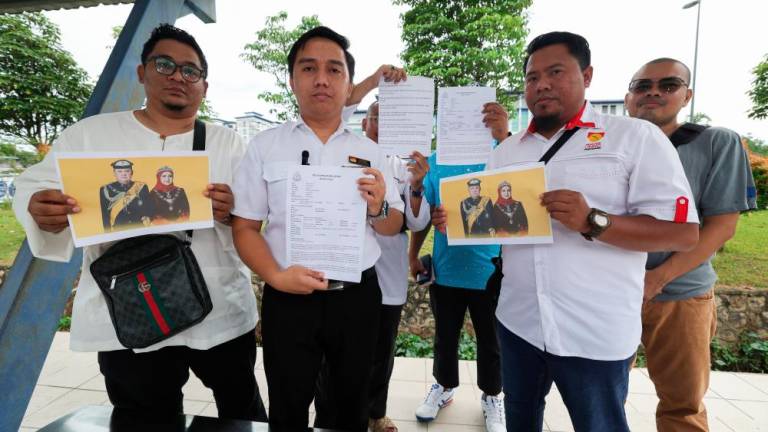

“The continuing trade war between US and China has somewhat impacted our volumes in testing and burn-in. Secondly, the end customers have tightened up their purchases, as a result our customers are controlling their inventory more cautiously. The end result is affecting our performance,” executive chairman and CEO Sam Lim Syn Soo (pix) told reporters after the group’s AGM and EGM today.

However, he noted that while the trade war has impacted chip processing volumes, the bright prospects of the automotive sector goes beyond that.

He noted that the tariffs imposed by US on China, has an indirect impact on KESM as semiconductor producers, which are its clients, have become more cautious and are less bullish about their inventory.

KESM has also seen the plant utilisation rate being reduced to a mere 50-70% from a high of 90%.

Nonetheless, Lim opined that the dip is a temporary nature and is not expected to prolong as the company is not heavily relying on the personal computers and phone markets, which have seen a slowing growth. Instead, he said it is banking on the fast-growing automotive market.

As for earnings performance, Lim said while he expects improvements, the rate of growth will depend on developments and technology changes on the customers end.

When asked if KESM will be holding back on investments in times to come, Lim said the company has taken on a selective approach with its investments.

“We are not spending as much simply because we are very selective with our investments. We have to look at the profile of our customers, type of devices they are doing because we want to make sure we get the best economies of scale to give our customers the price they deserve. From what I see the changes in technology, we have to be always be ready to make an investment,” he added.

KESM had held back on investments after a fall in its fourth-quarter earnings and instead chose to reward its shareholders with a proposed dividend payout of 18.5 sen for FY18.

The company is also investing in transforming its plants in Malaysia and China into smart factories over the course of five years. These investments are funded via internally generated funds.

For the first quarter ended Oct 31, 2018, KESM recorded a net profit of RM2.64 million, representing a decline of 76.78% from the RM11.4 million recorded in the same quarter a year ago. Revenue for the period also fell to RM81.56 million from RM90.71 million.

For the financial year ended July 31, 2018, KESM recorded a lower net profit of RM39.34 million against RM43.99 million in the previous financial year, while revenue grew to RM349.78 million from RM337.99 million.

Lim said the earnings could have been better if not for the supply issues and higher taxes that dragged its net profit down.