PETALING JAYA: The Employees Provident Fund (EPF) has signed up to the United Nations-supported Principles for Responsible Investment (PRI), underlining its commitment towards responsible investing and environment, social and governance (ESG) practices.

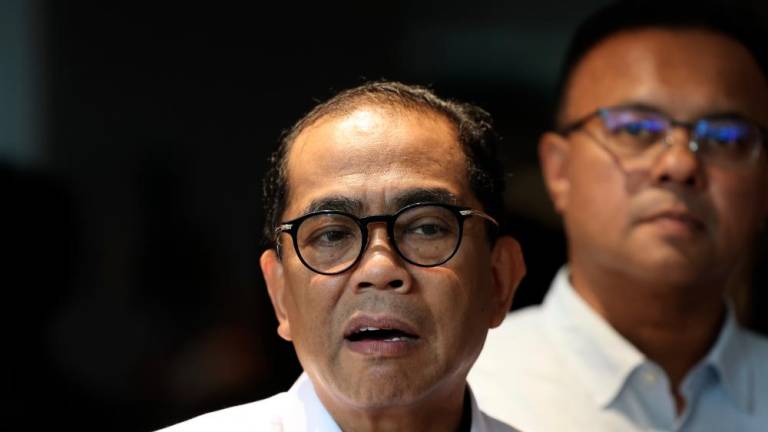

Its CEO Tunku Alizakri Alias said in a statement today that aligning its investment activities with the broader interests of society would bode well with its objectives as a retirement savings fund driven by long-term, sustainable value creation for its stakeholders.

“We believe that the upholding of ESG best practices can affect the performance of investment portfolios to varying degrees across companies, sectors and regions,” he said.

“By signing the UN-supported PRI, we formally underline our commitment to the six PRI, and we hope to meaningfully incorporate ESG factors into our investment due diligence and decision-making process, given its potential to enhance return while reinforcing our existing risk management framework.”

The EPF has traditionally been a socially-conscious investor in excluding companies that are seen as unethical such as alcohol, tobacco, gambling, weaponry and nuclear power.

Tunku Alizakri said this would improve EPF’s ability to balance financial returns with measurable impact towards society and the environment for the benefit of future generations.

The UN-supported PRI is acknowledged as the world’s leading proponent of responsible investment with more than 2,000 signatories representing more than US$70 trillion (RM288 trillion).

The initiative aims to understand the investment implications of ESG factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.

Signatories are required to implement the six PRI, which include embedding ESG considerations into investment analysis and decision-making processes, as well as seeking appropriate ESG disclosures from investee companies.