PETALING JAYA: Identity theft is a tangible threat for people in Malaysia – 7% said they know their identity has been stolen and used by a fraudster to open an account, while a further 12% believe it is likely to have happened, according to global analytics software firm Fico’s identity proofing and digital banking survey.

The acknowledged level of risk from identity theft means there is a good understanding of why identity proofing is an integral part of the banking experience in Malaysia.

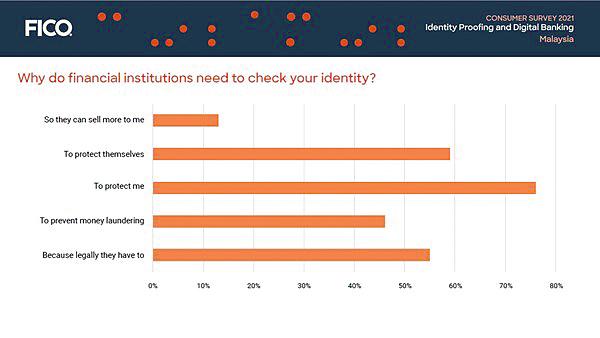

Just over three-quarters (76%) of respondents recognised that identity proofing happens for their protection. Most people are not cynical about the reasons their identity is confirmed. While a large number (55%) recognise there is an element of regulation driving providers to carry out more checks, only 13% think this is done to enable financial institutions to sell more.

A majority (59%) of Malaysian respondents did see identity proofing as a way for banks to protect themselves, while 46% regard it as a tool to prevent money laundering.

Most Malaysians are open to providing their bank with a biometric such as a facial scan, fingerprint, or voiceprint to secure their accounts. The survey revealed that once they understand why it’s necessary, 50% are happy to provide their biometrics. Only 7% say that banks should never capture biometrics, while 14% are willing but unhappy to provide them.

“In a lot of Asian countries, fingerprinting, identity cards and authentication apps have been commonplace for some time. There is less concern around privacy and the survey shows there is broad acceptance of the benefits that biometrics deliver when it comes to securing bank accounts and stopping money laundering,” said Subhashish Bose, lead for fraud, security and compliance in Asia Pacific.

In Malaysia, 42% of consumers prefer to open bank accounts digitally and 48% prefer branches. However, over the last year, thanks to the pandemic, 57% of Malaysians are more likely to open an account digitally than a year ago; while those who attend branches often do so for social and technical reasons.

“Digital account opening has been available in Malaysia for some time, it just remained unused by some segments of the market who either hadn’t discovered it yet or were not willing to trust it. This has created a belief that accessing a branch offers a more informed and secure account opening process,” said Bose.

As attitudes change and more people experience the benefits of digital banking there will be further opportunity for banks who adopt multichannel strategies and can engender trust in new channels.

Malaysians who open an account digitally, prefer to carry out the process entirely in their chosen channel whether it be smartphone or website. If customers are asked to move out of channel to prove their identities, many of them will abandon the application, either giving up on opening an account completely (5-7%) or by going to a competitor (11-12%). Of those who don’t immediately abandon, up to an additional 25% will delay the process.

The survey found that any disruption matters such as asking people to scan and email documents or use a separate identity portal causes almost as much application abandonment as asking them to visit branches or mail in documents.

The survey was conducted in January 2021 by an independent research company. 1,000 Malaysian adults were surveyed, along with 13,000 consumers in various countries.