PETALING JAYA: The Inland Revenue Board (IRB) has started giving out refunds for the RM16.04 billion unreturned tax refunds in a small scale although it has yet to receive the amount meant for the repayment from the government.

During the tabling of Budget 2019, the government had announced a RM30 billion special dividend payment from Petronas to fully settle the outstanding tax refunds estimated at RM35.4 billion comprising RM16 billion of income taxes and RM19.4 billion of goods and services tax.

The Ministry of Finance is slated to channel the amount from the special dividend to IRB’s tax refund fund before it is refunded.

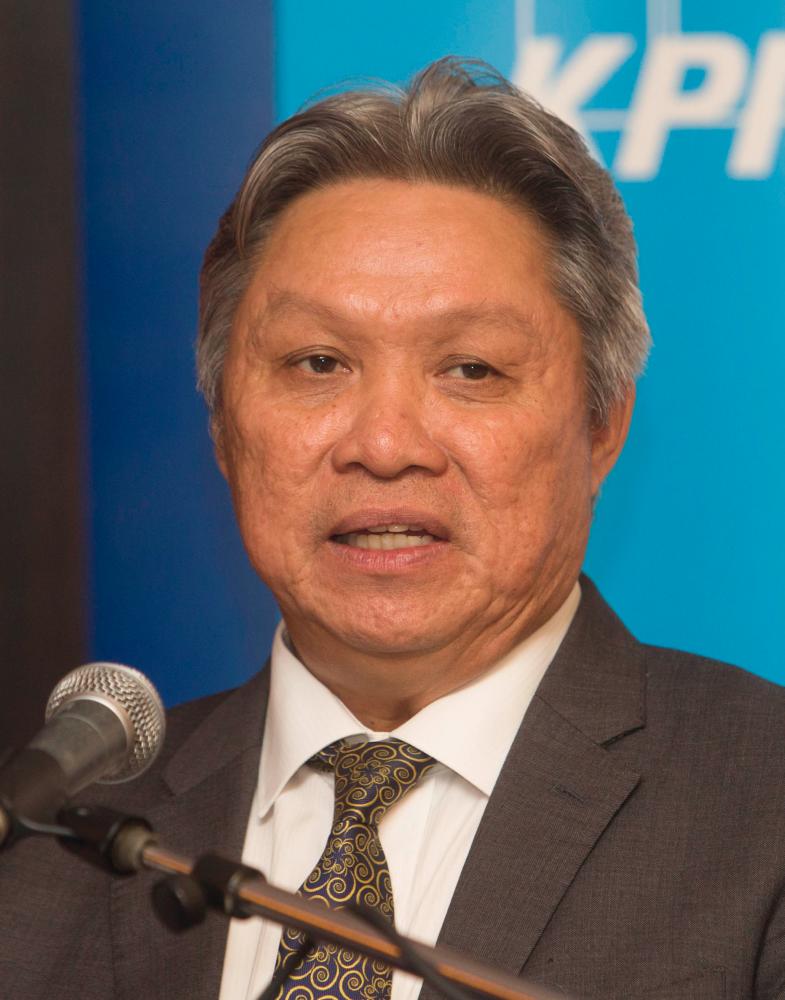

“We have not received the money yet. We have started giving refunds but the big amount as mentioned by the Finance Minister will come through the special dividend by Petronas. I’m not sure whether the dividend has already been given (to the government) or not,” IRB CEO Datuk Seri Sabin Samitah (pix) said a media briefing today.

At this juncture, refunds are being provided for smaller amounts.

On another issue, Sabin said the response for the special voluntary disclosure programme (SVDP) has been progressing within expect-ations, after about two months into its implementation.

“So far the outcome is very encouraging ... it is up to our expectations (but) it is not beyond our expectations because maybe some taxpayers would want to wait and see whether they can trust the IRB or not.”

“I am aware that there are uncertainties surrounding the implementation of the SVDP, which includes trust issues on the part of the taxpayers. Please be rest assured, any voluntary declaration made by taxpayers during this eight-month period will be accepted by IRB in good faith,“ he said.

He also noted that the tax authority will not question those who come forward on the nitty-gritty and will assess their tax matters as declared with no questions asked and no reasoning required.

“I also assure you, your declaration and any information provided will be duly treated as confidential, as stipulated under the Income Tax Act 1967. It will not be shared or made known to a third party,” he added.

Under the SVDP, IRB has identified some 80,000 tax dodgers comprising 76,000 individuals and 4,000 companies, who were yet to pay or declare their taxes.

The IRB has sent out special forms to identified individuals, requesting them to furnish the tax authority on the source of the funds used to finance the accumulation of their assets.

A task force has been set up to look at the group of taxpayers who have accumulated assets that do not match their declaration.

The IRB has previously said it is looking to collect some RM10 billion from the SVDP.

On another note, Sabin said there is a unit within the IRB established in September to monitor e-commerce businesses via social media. The IRB, he added, will not go after those who spend within their means.