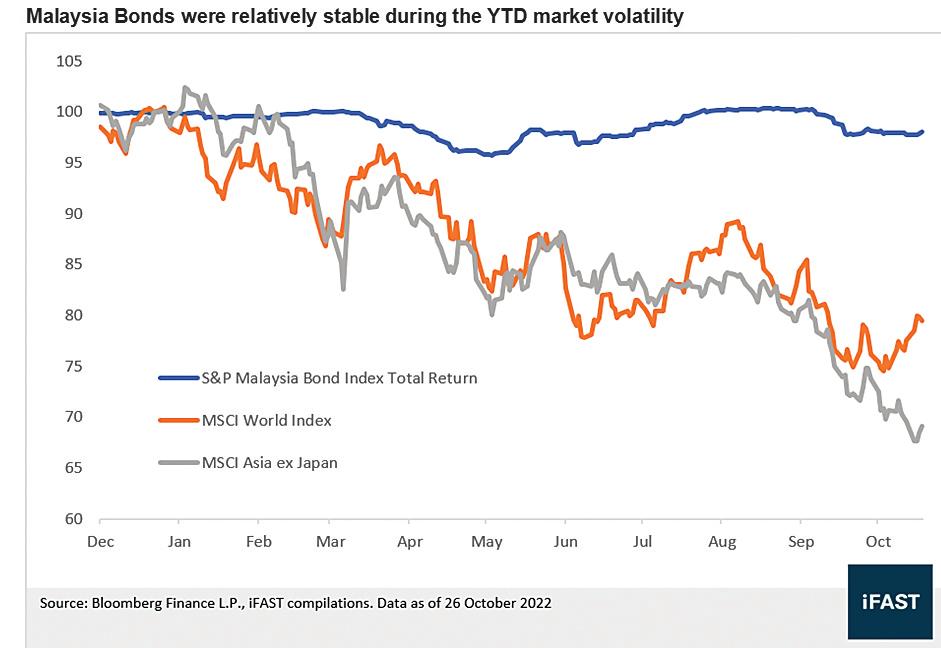

MALAYSIA-CENTRIC bonds have remained resilient year to date (YTD) as they outperformed global peers as well as when compared to global equities, ending up in positive territory while other indices tumbled on rising yields and global inflationary pressure.

The broad markets are struggling with a potent mix of elevated inflation and the prospect of faster-than-expected interest rate increases, and bonds were sold off sharply for yet another quarter. This can be seen from the 8.06% decline of Bloomberg Aggregate Bond Index.

Decent run for Malaysian fixed income amid abundant domestic liquidity

Being a victim of the US Federal Reserve’s aggressive rate hike cycle, the Malaysian bond market was not spared from the global rout, with yields spiking across the yield curve, almost erasing the positive gains in the last two months. However, the yields offered were able to cover the losses from the declining bond value; therefore Malaysia bonds were able to record positive total return in YTD and in the last quarter.

Nonetheless, it is worth noting that unlike global markets, Malaysia Government Securities (MGS) yields did not break the April/May high, thanks to dip-buying interest from local institutions. Meanwhile, the expected 25 basis point (bp) increase on Sept 8, 2022 was almost treated as a non-event as the market had priced in sufficient rate hike buffers. Back in third-quarter 2022 (Q3’22), as yields started to pick up and surpassed pre-pandemic levels, we recommended investors increase the duration of their Malaysian bond portfolios.

Despite outflow from global investors, domestic investors splash with liquidity especially those fixed depositors looking for higher yields than the current low deposit rates. The domestic bond market is flooded with inflow from local players.

Yields have priced most of the Overnight Policy Rate (OPR) hikes

Although Malaysia’s inflation has declined from a month ago, we do not expect Bank Negara Malaysia to suddenly make a 180% turnaround.

Meanwhile, In the absence of any catalyst pointing towards a change in the Fed’s hawkish tone, bond yields will remain elevated. As mentioned, current bond yields have already priced in sufficient rate hike buffers and now assume a normalised OPR of 3.25%.

Therefore, we expect less surprise on rate hikes to hit the Malaysian fixed income market.

Malaysia bond yields are at the most attractive levels since 2008/09

In addition, Malaysia bond yields are getting more and more attractive with current yields surpassing pre-pandemic levels and are back to 2008 Global Financial Crisis (GFC) levels.

We think that Malaysia bonds are oversold as the economy now is in much better shape than it was during the GFC. Current gross domestic product growth stood at 8.9% year-on-year compared with 6.6% in the same quarter of 2008 which showed that economic activity is robust with low risk of recession.

Thus, we think that the sell-off in Malaysia bonds is sentiment-driven, which shows attractive opportunity for investors to lock themselves into one of the highest yields in decades.

Fixed income investors should continue to stay invested in Malaysia bonds and seek opportunities in lower rated/unrated credit

At this juncture, we continue to advocate medium to long duration Malaysia bonds for investors with higher risk appetite that could stomach higher near-term volatility in order can enjoy pre-pandemic level yields and spreads which are pretty decent, while on the other hand, only taking slightly higher duration risk which, we also believe is rather limited as most of the hawkishness has been priced into the current yields already.

However, more conservative investors can consider short duration bonds to take advantage of the attractive yields that Malaysia bonds currently offer.

This article is contributed by iFast Research.