PETALING JAYA: Malaysia needs to have an independent fiscal institute to provide economic forecasts and analysis of the public finances, according to Malaysia University of Science and Technology (Institute of Postgraduate Studies) dean Professor Geoffrey Williams (pic).

He cited as an example the Office for Budget Responsibility in the United Kingdom, which is a non-departmental public body funded by the Treasury. It produces two five-year-ahead forecasts for the economy and the public finances each year, alongside its budget and spring statements.

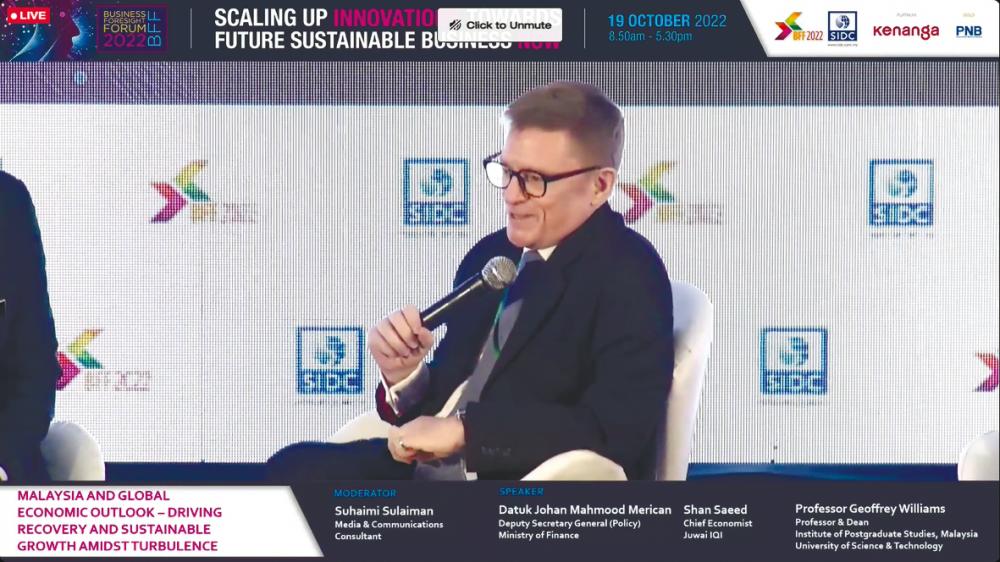

“Malaysia needs this because of the independence and (it) needs to build a better infrastructure for economic forecasting and economic impact assessment,” Williams said during a panel session “Malaysia and Global Economic Outlook – Driving Recovery and Sustainable Growth Amidst Turbulence” at the SIDC Business Foresight Forum 2022 today.

In terms of growth sectors, Williams said Malaysia should focus on those that resist technology because the technologies in the Fourth Industrial Revolution are different as they are specifically designed to replace people.

“We didn’t have this in the past, the technologies of the past were to help people to do their jobs, not to replace the people. (Malaysia) needs to focus on sectors that resist technology, that is social work and social care. These are high-skilled, very demanding jobs but they demand a different type of skill, soft skills. We need to ensure that we create value-adding opportunities, we don’t want these jobs to be low paid anymore because they are high value adding areas and they are exportable,” he emphasised.

Ministry of Finance deputy secretary general (policy) Datuk Johan Mahmood Merican said Malaysia is all pro-business across the political spectrum, particularly in its core electrical and electronics (E&E) industry.

“E&E is one of the mainstays of our Malaysian economy. Behind the scenes, the federal government and state government continue to work together to ensure investments still come in and (is) a key part of the E&E (companies) how to move up the value chain, building on the ecosystem that is there,” Johan said, adding that from E&E, one of the spinoffs that is becoming a new growth sector is medical devices.

“Aerospace is a new growth sector for Malaysia. We see now Boeing and Airbus components being manufactured in Malaysia, where they have clusters such as in Subang and the likes. That is also an area highlighted in the National Investment Aspirations, chemicals is also a big space as well. That’s building on Petronas is also going downstream and palm oil going downstream and oleochemicals that is also being built in clusters in the east coast or in Johor.”

Meanwhile, Securities Commission Malaysia (SC) chairman Datuk Seri Dr Awang Adek Hussin said the SC intends to work together with intermediaries and fintech providers to employ Regulatory Technology (RegTech), as well as Supervisory Technology (SupTech) tools, in order to enhance Malaysia’s market efficiencies.

Amid the challenging external environment, he said, the country must intensify efforts to uplift the economy in order to ensure sustainable growth moving forward, which calls for greater financing of technology and innovative solutions.

Awang Adek remarked that new innovations and technologies typically disrupt the status quo but pointed out that such tools are important for progress. Hence, he said, the entry of new players into the capital market and industry, digital adoption is a responsibility that the SC does not take lightly.

Digitisation of conventional market segments has also picked up due to operational disruptions during the pandemic. Existing intermediaries have stepped up their digital offerings, alongside new entrants, particularly in the provision of digital investment management services.

“However, this digital push cannot be at the expense of market integrity. It is paramount that continued investor confidence in online platforms and market access points, be preserved. Therefore, we expect intermediaries to practice high standards of accountability, as well as to take appropriate measures to ensure the resilience of their systems,” said Awang Adek in his opening address.

Simultaneously, the commission will continue to closely monitor market activities and transactions. From a reporting and supervisory standpoint, he said there exists opportunities for increased use of technology.

“Given growing demand for online products and services, progressive early steps have ensured relevant regulations and safeguards, including for trading of digital assets in Malaysia, were developed,” he said.