PETALING JAYA: The latest Purchasing Managers’ Index (PMI) data indicated that Malaysian manufacturers continued to face a challenging business environment at the end of the first quarter, with key survey gauges such as output and new orders falling.

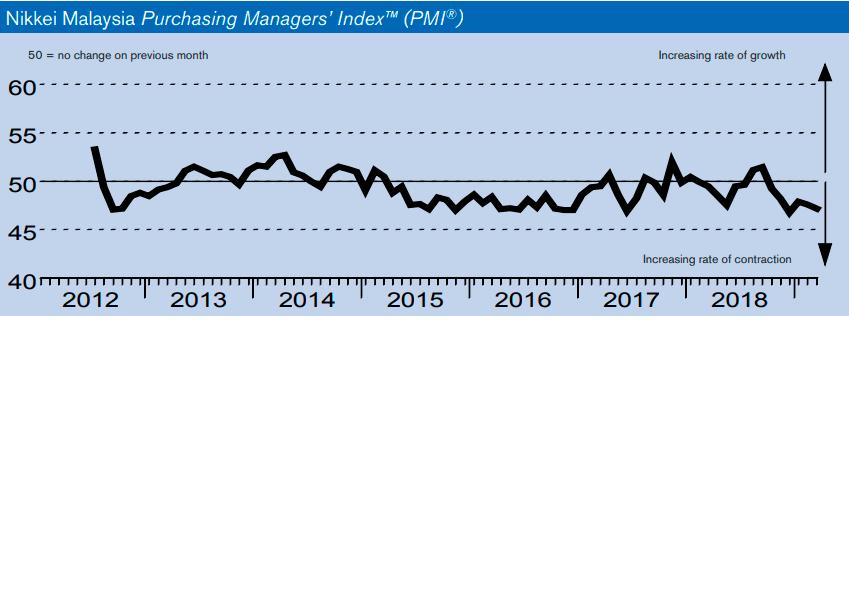

The headline Nikkei Malaysia Manufacturing PMI – a composite single-figure indicator of manufacturing performance – registered 47.2 in March, down slightly from February’s reading of 47.6, and below the long-run survey average.

IHS Markit, which compiles the survey; however, said the firms also grew more optimistic about the outlook, citing input cost and output price levels were broadly stable in March, while manufacturers held employment steady.

Analysis of comparable historical official data on Malaysian manufacturing output suggests that, at current levels, the survey data are indicative of annual output growth close to 4%.

A deterioration in the production trend commonly reflected tougher demand conditions, according to the anecdotal evidence from the survey provided by PMI panel member companies, particularly in overseas markets.

Meanwhile, Malaysian goods producers focused additional resources to clearing outstanding business in March. Efficiency gains reportedly helped ease pressures on capacity. Some panel members attributed backlog depletion to higher staffing levels.

However, manufacturing employment was broadly stable overall in March, as hiring in some instances was offset by other firms reducing workforce numbers due to softer demand.

Malaysian manufacturers were cautious towards inventory levels in March, with both pre- and post-production stocks falling. Holdings of finished items were depleted as firms stepped up efforts to ship orders in a timely fashion, while input stocks were cut for efficiency purposes.

Subsequently, purchasing activity was lowered. Elsewhere, survey data signalled stable price levels, with input prices and output charges both broadly unchanged since February.

Against the challenges signalled by latest data, Malaysian manufacturers reported their strongest degree of optimism towards future output in almost one year, supported by forecasts of improved sales, new projects and products and successful new contract tenders.

Commenting on the survey data, IHS Markit chief business economist Chris Williamson, said: “Malaysia’s manufacturing companies reported increasing headwinds on current business activity in March, though also reported a brightening outlook which adds to hopes that the recent slowdown will start to ease in coming months.

“While several key survey gauges fell in March, it’s important to bear in mind that, when compared against official measures, the survey is still broadly indicative of the economy growing at an annual rate of 4%–4.5%, with manufacturing output increasing at an annual pace of just under 4%.

“As with many other fast-growing economies, in Malaysia the PMI gauges have to drop much further below 50 to indicate either a contracting manufacturing sector or a decline in GDP.

“Encouragingly, the survey found companies to have become more optimistic about the year ahead, with expectations of future output growth rising to the highest for nearly a year. Indices of purchasing and inventories consequently came off recent lows as companies started to plan for demand in coming months.

“However, major headwinds persisted, including a fourth successive monthly deterioration in export business, plus growing concerns over the impact of trade wars and slower global economic growth,” he added.