PETALING JAYA: Malayan Banking Bhd (Maybank) has introduced the first-ever contactless cash withdrawal service via automated teller machines (ATM) in Malaysia.

In a statement, Maybank said the new service is available via the MAE app at selected ATM nationwide and aims to enhance convenience for more than 12 million Maybank ATM cardholders. Customers can use this service at some 1,000 ATM, which will indicate the availability of the contactless cash withdrawal service. Eventually, this service will be made available at all Maybank-owned ATM.

Maybank group president & CEO Datuk Khairussaleh Ramli (pix) said the bank has been bringing to the market numerous solutions for customers’ convenience. This was initially driven by its Maybank2020 Plan which included the group’s aspiration to become a digital bank of choice in the region.

“We have now progressed into our next phase of digital development guided by our latest five-year M25 Plan, and anchored by our mission to humanise financial services. Under this plan, we have a dedicated priority, Pervasively Digital, to ensure we continue to leverage technology to bring meaningful digital solutions to serve our stakeholders from all our business segments and communities across the region. The new contactless cash withdrawal service is another step in our holistic offering of digital banking services which we have been pioneering over the years.”

Group CEO of community financial services Datuk John Chong said its focus in building its digital capabilities has enabled the bank to stay ahead of the curve, and continue serving customers and the underserved segments of the community, especially during the outbreak of the Covid-19 pandemic.

“The new service reaffirms our strength as a digital bank, in addition to our role as a traditional bank. We have been able to design our own lifestyle applications, introduce digital financing solutions in Malaysia cutting across retail and non-retail segments for products such as mortgage, personal and SME financing, and allowed for KYC processes to be undertaken digitally in Singapore, Indonesia and the Philippines, amongst others.”

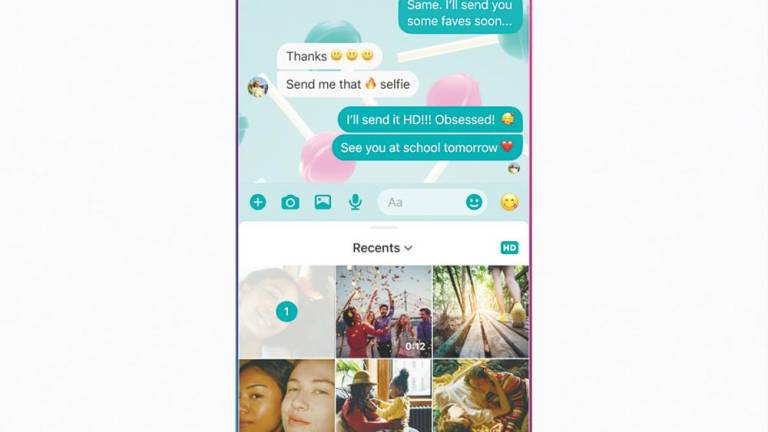

He said the contactless ATM withdrawal will not only enhance convenience for customers but also ensure that they are able to enjoy a comprehensive range of digital solutions via a single app, MAE.

“To undertake a cash withdrawal, all a user needs to do is scan the quick response code (QR) on selected Maybank ATM screens using the MAE app, enter the amount, provide a PIN or biometric authentication in the app, and receive the cash from the ATM.”

He added that the introduction of the contactless withdrawal service is also driven by the bank’s efforts to keep its customers safe, seeing as customers are not required to touch any external surfaces physically, with the exception of receiving cash dispensed from the ATM.