PETALING JAYA: There is limited upside for equity markets in Asia Pacific ex-Japan, including Malaysia, in the near term, as US-China trade tensions are expected to remain elevated until at least the US presidential elections.

Nomura equity strategist Chetan Seth said although there is limited upside in the near term, it is constructive over the medium term, expecting a sharp earnings recovery in 2021.

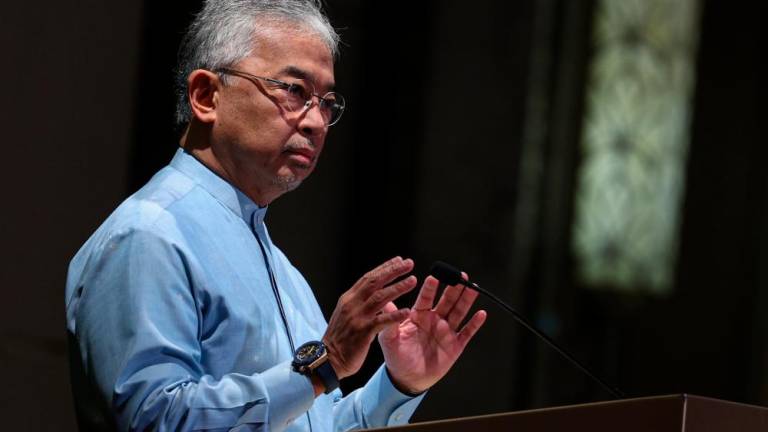

“It (US-China tensions) is incremental negative for the stock market generally at least until the US elections. After the US elections, it’s anyone’s guess. We’ve implicitly assumed a higher discount rate or a lower valuation multiple because of these ongoing tensions between US and China. Generally, you’d tend to be more exposed to domestically focused stocks if you’re worried about trade tensions or tariffs down the line,“ he said at the Nomura Investment Forum Asia 2020 today.

Chetan, who is based in Singapore, said Nomura’s top-down strategy is to stick with large/liquid countries which have done well so far with containment of Covid-19 (China, Korea); have strong corporate and government balance sheets and fiscal/monetary room to stimulate to sustain growth; less-than-average exposure to banks/financials but above-average exposure to stocks benefiting from long term structural themes; some valuation support but less earnings downside risks.

“When we combine these frameworks, our preferred tactical country allocation would be overweight on MSCI China, Korea and neutral on India, Thailand, Indonesia and Phillipines.”

It is underweight on Malaysia and has downgraded Malaysia by one notch, and its top picks are Public Bank Bhd and Globetronics Technology Bhd.

On its portfolio strategy, Chetan said the Covid-19 outlook and US-China trade relations should remain the dominant themes for markets and as market upside is limited in the near term, it is focusing on bottom-up opportunities.

This includes a barbell portfolio of stocks (mix of stocks benefiting from structural themes and some laggards), with its overall portfolio biased towards some quality/growth/strong balance sheets. Key risk to its barbell portfolio strategy is a V-shaped economic recovery and sustained reflation.

“In this low-probability scenario, we will look to accumulate quality/growth/ tech should they underperform value/cyclicals, as we do not see a sustained outperformance of the latter other than a tactical rally. We believe growth will remain subpar and become even scarcer with Covid-19 only accelerating some of the recent secular trends.”

He said as gradual economic recovery is expected from the second half of the year, equities have rallied in anticipation.

“While forward equity valuations appear toppy on low earnings base of 2020, we think investors should focus on 2021 EPS. Equities relative to bonds are still quite attractive and global equity valuations do not appear overly expensive. Equities under-allocated in global portfolios and should provide an inflation hedge for investors,“ said Chetan.

However, he cautioned that the shape/extend of earnings recovery is a key unknown.

“Consensus expects full normalisation of profits by end-2021. This is in sharp contrast to 2008/09 when it took several quarters. We see some risks.”