NEW YORK: Oil prices strengthened yesterday as storms threatening the Gulf of Mexico shut more than half of the region's oil production and on expectations of progress in the development of a Covid-19 treatment.

Brent crude was up 53 cents, or 1.2%, at US$44.88 (RM187.39) a barrel by 1522 GMT. US West Texas Intermediate crude rose 28 cents, or 0.7%, to US$42.62 (RM177.96).

"Prices are taking their cues from Mother Nature this morning as two storms bear down on the Gulf of Mexico. Half of the region's production has been shut down, though gains will be limited by the threat of a second prolonged Covid wave," said Stephen Brennock of oil broker PVM.

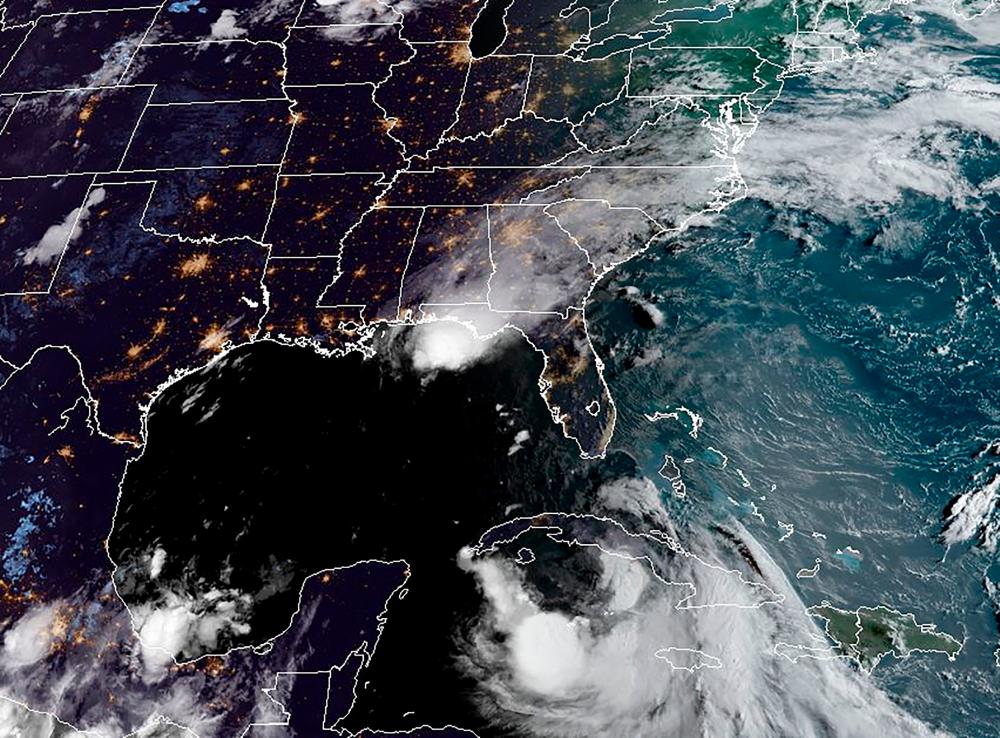

Energy companies shut more than 1 million barrels per day (bpd) of offshore crude oil production in the US Gulf of Mexico because of the twin threat from Hurricane Marco and Tropical Storm Laura. Workers have been evacuated from more than 100 production platforms.

"The much larger pricing impact off of the storm factor is falling on the product markets since refinery activity in the Texas and Louisiana region could be significantly reduced due to flooding," Jim Ritterbusch, of Ritterbusch and Associates, said in a note.

Motiva Enterprises may shut the largest crude oil refinery in the United States for the bad weather later this week, according to sources.

US petrol futures were up more than 5%.

Also supporting oil prices was a report by the Financial Times that US President Donald Trump is considering fast-tracking an experimental Covid-19 vaccine being developed by AstraZeneca and Oxford University.

On Sunday Trump hailed FDA authorisation of a coronavirus treatment that uses blood plasma from recovered patients, a day after he accused the agency of impeding the rollout of vaccines and therapeutics for political reasons.

The World Health Organization, however, was cautious about endorsing the treatment, citing "low quality" evidence that it works.