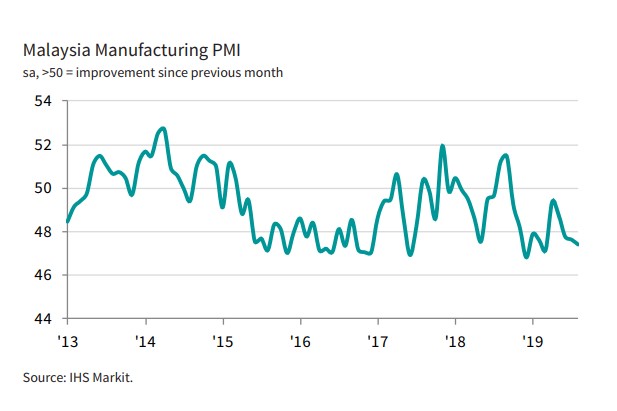

PETALING JAYA: The headline IHS Markit Malaysia Manufacturing Purchasing Managers’ Index (PMI) recorded 47.4 in August, a fractional decline from July’s 47.6, signalling tough demand conditions and rising cost pressures.

Nevertheless, the outlook improved to the most optimistic for nearly six years, encouraging firms to expand their workforces for the first time in three months.

At current levels, the PMI is broadly indicative of annual gross domestic product (GDP) growth of 4.5%, according to historical comparisons.

Although the seasonally adjusted Output Index dipped in August, the fall was only fractional. Analysis of comparable historical official data on Malaysian manufacturing suggests that, at current levels, the survey’s output index is consistent with annual production growth of just below 4%. According to anecdotal evidence, new product launches had supported output during August.

The level of new work received from external markets stalled in the latest survey period, contributing to sustained weakness in the New Orders Index. Challenging demand conditions persisted in August, with intense competitive pressures, reduced workloads from clients in other key export markets and global trade war worries reported as drags on sales.

Nevertheless, panellists showed optimism towards the outlook over the next 12 months in August, as business confidence strengthened to its highest level since October 2013. Planned promotional activity, new products, work in the pipeline and forecasts of improved domestic and external demand all lifted sentiment, according to anecdotal evidence.

In line with expectations of greater sales, firms enhanced operating capacities by expanding employment, reporting the first rise in staffing levels for three months. Furthermore, the rate of job creation was on a par with its historical average. Higher workforce numbers led to efficiency gains in August, as backlogs of work declined for a 12th month in succession. Panellists also reportedly upped their efforts to complete work in a timely fashion.

Increased shipments of finished goods were meanwhile signalled by a reduction in post-production inventories during August. Panel comments indicated that firms were striving to manage stocks more efficiently. Similarly, pre-production inventories also declined during August, which in turn facilitated an improvement in supplier delivery times, the first since May.

The latest survey data also pointed to higher operating costs amid reports of currency fluctuations, rising commodity prices and shortages of certain raw materials. Firms responded to margin pressures by raising output charges in August at the quickest pace in nine months.

Commenting on the latest survey results, IHS Markit chief business economist Chris Williamson said having correctly indicated a strengthening rate of expansion in the second quarter, the survey’s latest data suggest some mild loss of momentum in the third quarter as current manufacturing conditions clearly remained challenging in August. The PMI nevertheless remains consistent with steady annual GDP growth of 4-5% in the third quarter so far.

“The recent subdued Malaysian PMI readings in part reflect ongoing global trade tensions, which have led to a weakening in the pace of economic expansion globally. The worldwide PMI surveys have indicated the slowest worldwide GDP growth for three years in recent months, led by falling manufacturing output.

“Encouragingly, Malaysia’s manufacturers have become increasingly optimistic that the tide will soon turn and that demand will strengthen again in coming months. Optimism for the year ahead is now at its highest since late-2013, and it’s especially good to see firms taking on more staff to meet the improved outlook and reporting new product launches to help drive revenues,” said Williamson.