KUALA LUMPUR: RHB Bank Bhd, which posted record net profit of RM2.31 billion for the financial year ended Dec 31, 2018 (FY18), is cautiously optimistic that the bank will surpass last year’s earnings in FY19.

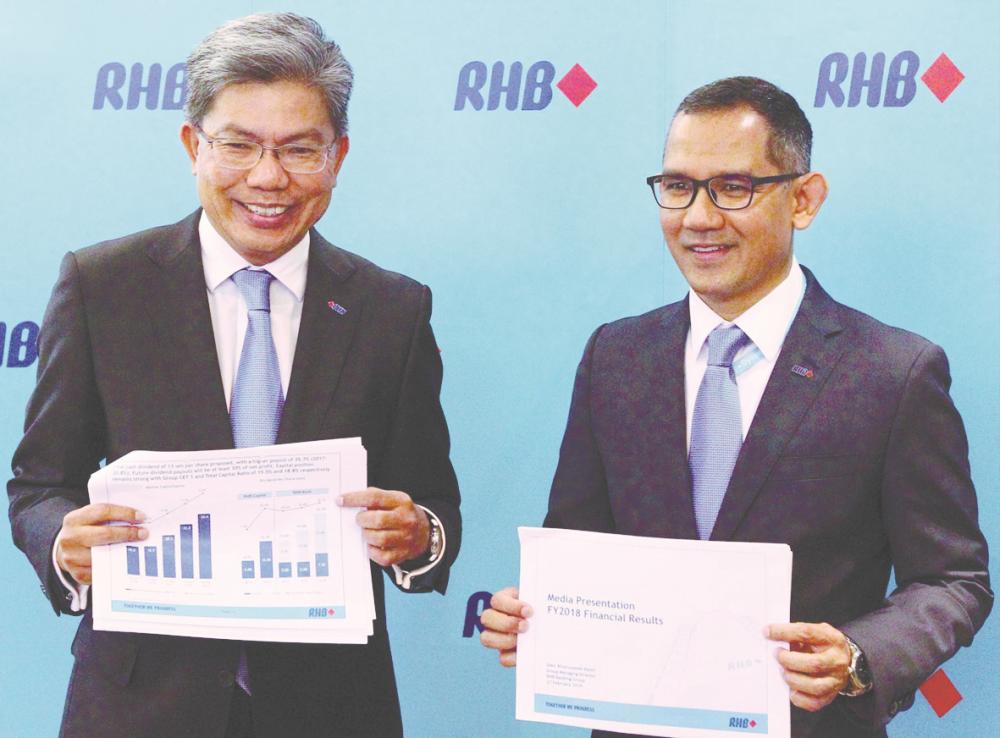

“We are working very hard to surpass what we did last year and we are cautiously optimistic that we can improve our profit this year,” its group managing director Datuk Khairussaleh Ramli told reporters at a press conference here today.

On loan growth, Khairussaleh said the bank is targeting a 5% increase this year, to be supported by resilient growth in mortgages as well as small and medium enterprises.

“We think the industry will grow around 5%-5.5% this year. We are also trying to be conservative and target 5% growth given the current challenging global economic environment,” he said.

Nevertheless, he said due to heightened deposit competition, especially in the retail segment, the bank could see net interest margin (NIM) compression of up to three basis points (bps), down to 2.17% in FY19, compared with 2.20% in the fourth quarter of 2018.

The group registered a higher NIM of 2.24% for FY18, compared to 2.18% in FY17 supported by growth in loans and continued prudence in the management of funding cost.

Moving forward, Khairussaleh said with the RM200 million investment allocation in digitalisation for the next five years, the bank will continue to invest in technology infrastructure and digital capabilities to improve operational efficiency.

Commenting on its performance in FY18, Khairussaleh said the results demonstrate the group’s strengths and resilience operating in a challenging environment and its good progress in FIT22 implementation.

The bank’s net profit soared 22.9% to RM565.43 million for the fourth quarter ended Dec 31, 2018 fromt RM460.08 million in the previous corresponding period, thanks to higher net fund-based income and lower allowances for credit losses on loans and other assets.

Its revenue increased 7.7% to RM3.31 billion from RM3.07 billion.

The bank declared a final dividend of 13 sen per share for the quarter under review.

For the whole of 2018, RHB Bank posted record net profit of RM2.31 billion, up 18.2% from RM1.95 billion on the back of a 6.9% expansion in revenue to RM12.69 billion from RM11.87 billion. This was mainly contributed by an 8.5% increase in net fund-based income to RM4.94 billion, with a higher net interest margin of 2.24%, supported by growth in loans and continued prudence in the management of funding cost.

The group’s gross loans and financing grew 5.5% to RM168.9 billion while gross impaired loans ratio improved to 2.06% from 2.23% a year ago with gross impaired loans at RM3.48 billion as at end-December 2018.

Allowances for credit losses on loans were 22.8% lower at RM322.4 million, primarily due to certain recoveries recorded in the current period, coupled with substantial impairment provided for oil and gas-related companies in the corresponding period.

Allowances for credit losses on other financial assets were also significantly lower by RM241.8 million, mainly due to improved ratings of investment portfolio and the absence of impairment provided on an oil and gas-related bond in Singapore last year.

The bank’s common equity tier-1 and total capital ratio after the FY18 final dividend are among the highest in the industry, at 15.49% and 18.78% respectively.