SHAH ALAM: RMS Synergy Sdn Bhd aims to list on Bursa Malaysia’s Main Market or ACE Market as early as 2026, for vessel fleet expansion to cater to the growing demand for offshore support vessel (OSV) by oil and gas (O&G) operators in Malaysia.

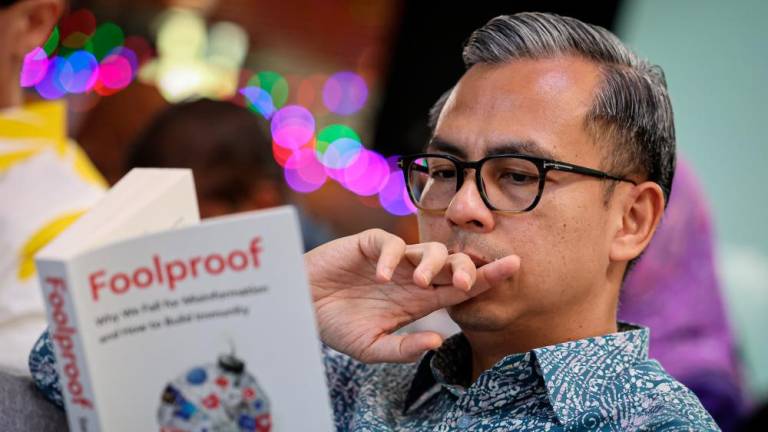

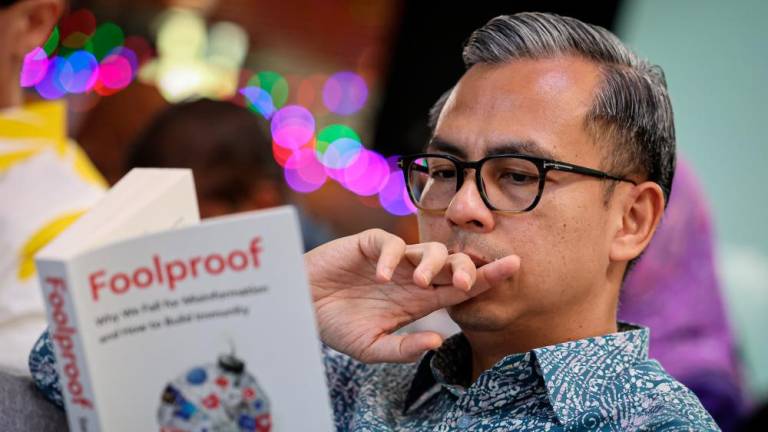

CEO Mohamad Asraf Abdul Ghafur said that since vessel chartering is the group’s core business, more funds are required to increase its vessel capacity to fulfil the OSV market demand.

He cited Petroliam Nasional Bhd (Petronas)’s Activity Outlook 2023-2025, which implied that it will require 204 vessels to support drilling and projects (wells) and 147 vessels to support its production operations this year.

Last year, it registered a revenue of RM70.2 million from 13 projects. This year, Mohamad Asraf hopes to increase its revenue as well as projects.

He is optimistic that RMS Synergy will achieve its target because it has been quite consistent in terms of profitability, performance and maintaining cash flow.

In order for the company to list on the main board, Mohamad Asraf said that it would need to generate more revenue to secure more assets for its business operations.

He remarked that it was difficult for private companies that are involved in the oil and gas (O&G) industry to get financing from local banks due to the high volatility of the market, which most banks may not have the risk appetite for.

His main goal for the company is to receive sufficient funds to purchase assets, either through listing or bank financing. He added that the company is open to talking with local banks or investors.

In addition, the company has recently acquired one vessel under a joint venture (JV) and plans to add five or six vessels to its fleet, which he reckoned would take three years. At the moment, the company is focused on purchasing anchor handling tug supply (AHTS) vessels because of its multifunctional capabilities.

Mohamad Asraf clarified that by acquiring assets and expanding its vessel fleet, it will be able to bid as a panel contractor for panel contractor contracts by Petronas, which it has previously been unable to directly participate in due to not owning its own assets.

On outlook, he said that although he believed that the O&G market will be “really good in the next one or two years”, he is cautiously optimistic due to the well-known price volatility of the market.

“(The O&G market) depends on the global market, that’s why on our side, we are cautiously optimistic. So part of it, we diversify our business, not to only focus on one industry. If the market is down, we can still sustain,” he told SunBiz.

Mohamad Asraf said that the company has a good track record in operations and project execution as well as maintains a good relationship with its clients and vendors. He shared that they are “quite famous in Singapore, Vietnam and Indonesia”.

At the moment, it is focused on the Malaysian market and has no immediate plans to expand outside the country.

Recently, the company entered into a JV with Vietnam-based OSV service provider Hai Duong Petroleum and Marine Corporation (Haduco) to form Haduco RMS Sdn Bhd, whereby the former will be the majority stakeholder with a 51% stake while the remainder will be held by the latter.