PETALING JAYA: The Body Shop’s retailer InNature Bhd is planning an initial public offering (IPO) on the Main Market of Bursa Malaysia.

In a draft prospectus with the Securities Commission Malaysia, the company said the IPO will entail the issuance of 177.27 million new shares comprising a public issue of 74.07 million new shares and an offer for sale of 103.20 million existing shares.

This includes the institutional offering of 161.14 million shares to Malaysian and foreign institutional and selected investors; and the retail offering of 16.13 million shares to the Malaysian public, the directors and eligible employees of InNature and its subsidiaries.

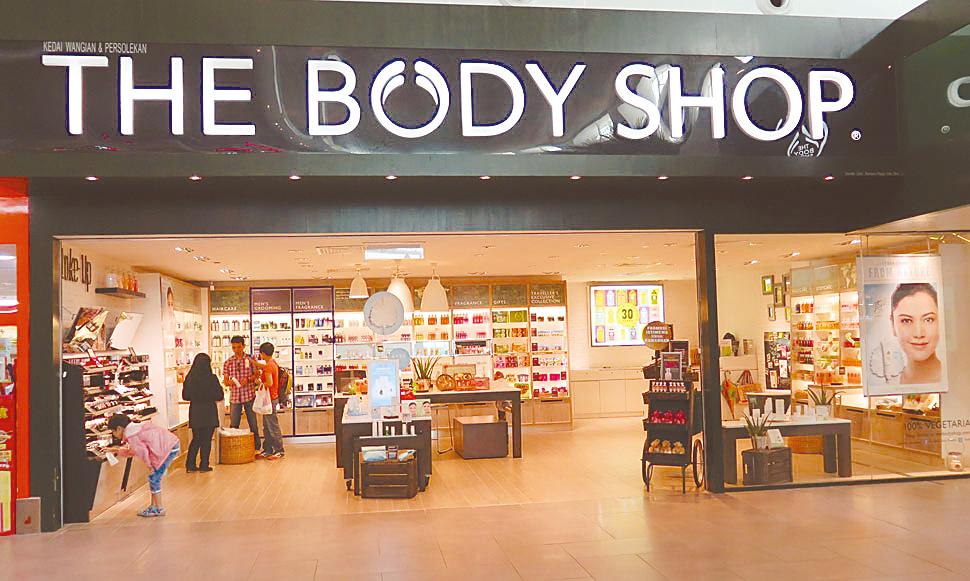

InNature is principally involved in the retailing and distribution of The Body Shop (TBS) products through its subsidiaries Rampai-Niaga, TBS Vietnam and Green Cosmetics who hold the TBS franchises in West Malaysia, Sabah and Labuan; Vietnam; and Cambodia respectively. It has 89 points-of-sale in West Malaysia, Sabah and Labuan; 26 points-of sale in Vietnam as well as online platforms.

Proceeds from its public issue will be utilised for capital expenditure, working capital and new business development.

The group’s net profit jumped 87.1% to RM45.03 million for the financial year ended December 2018 (FY18) against RM24.07 million a year ago. Meanwhile, its revenue came in at RM184.47 million for FY18, 7.3% higher than the RM171.92 million previously.

“Moving forward, we will continue to grow our revenue and strengthen our leadership in the mono-brand beauty specialty store segment as well as the “naturals” beauty market,“ InNature said.

InNature added that it is the board’s intention to recommend and distribute dividend of at least 30% of its annual audited profit after tax attributable to the shareholders.