OAKLAND, California: US chip maker Advanced Micro Devices Inc on Tuesday (Jan 31) posted revenue that beat Wall Street targets, enthusing investors who saw the company gaining on rival Intel.

Shares rose 3.5%, even though AMD’s forecast was behind many analysts’.

“AMD remained resilient and even made gains in their datacenter chips ... against Intel,” said Wayne Lam analyst at CCS Insight.

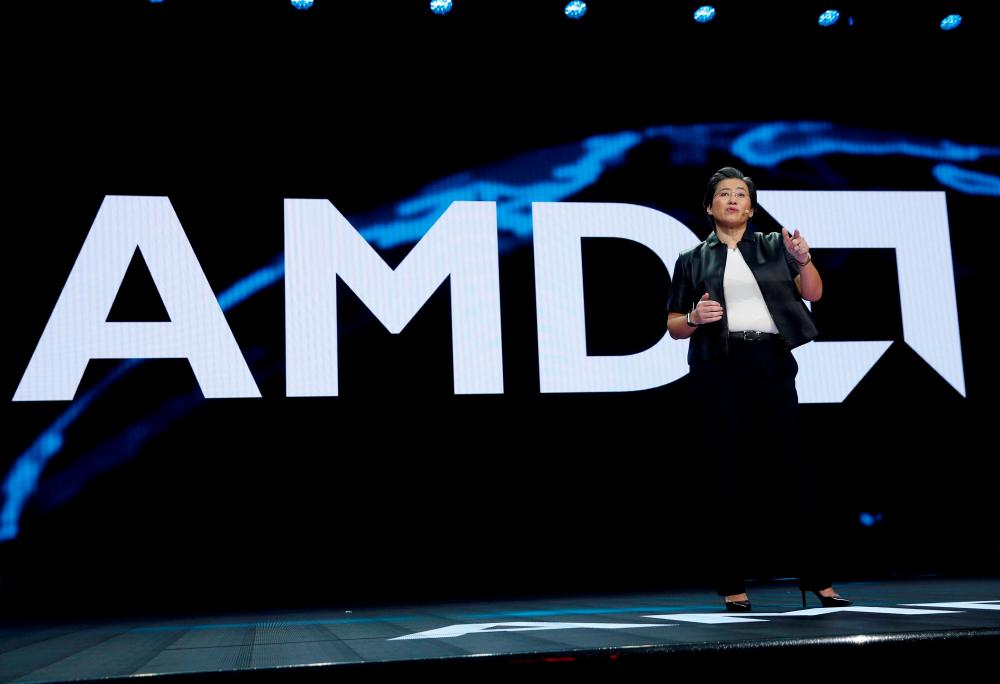

“Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio,” AMD chief executive Lisa Su said.

Data centre segment revenue grew 42% to US$1.7 billion (RM7.2 billion) during the fourth quarter.

AMD has been steadily chipping away at Intel’s share of that lucrative market. Intel had nearly the whole server chip market in 2017, but was less than 80% in the first three quarters last year while AMD exceeded 13%, according to research firm IDC’s count.

AMD’s forecast was stronger than expected considering Intel Corp’s gloomy outlook for the PC market, which, according to Intel chief executive Pat Gelsinger, is seeing “some of the largest inventory corrections literally that we’ve ever seen in the industry”.

Still, analysts said Intel's struggle and any price cuts could affect AMD as well.

PC shipments fell 16.5% to 292.3 million units in 2022, according to data from research firm IDC.

Revenue for AMD’s client segment including chips for the PC dropped slightly over 50% on year, but analysts said that was expected due to the sagging consumer electronics market.

AMD had already started under-shipping last year in response to plummeting processor demand as customers looked to clear their inventory stash before buying more chips.

This decline led chipmakers to slash revenue forecasts, triggering a sell-off in chip stocks. AMD's stock fell 55% last year, underperforming the Philadelphia SE Semiconductor index during an industry downturn.

Adjusted fourth-quarter revenue rose 16% to US$5.6 billion. Analysts on average were expecting revenue of US$5.5 billion, according to Refinitiv data.

The company forecast current-quarter revenue of US$5.3 billion, plus or minus US$300 million. Analysts on average expected revenue of US$5.48 billion, according to Refinitiv data. – Reuters