PETALING JAYA: Some RM10 million was credited into applicants accounts on the first day of the E-tunai rakyat initiative which started on Wednesday (Jan 15).

Finance Minister Lim Guan Eng said the overwhelming response in people using e-wallet will provide a boost to local consumption.

“As of 10pm Wednesday (Jan 15), there were 380,000 applications for the e-Tunai Rakyat on the selected e-wallet service providers, and 320,000 have been approved.

“We expect more to come on board and adopt e-wallet and apply for the initiative before it ends later,“ he said after a walkabout at the SS2 morning market here following the launch of the initiative.

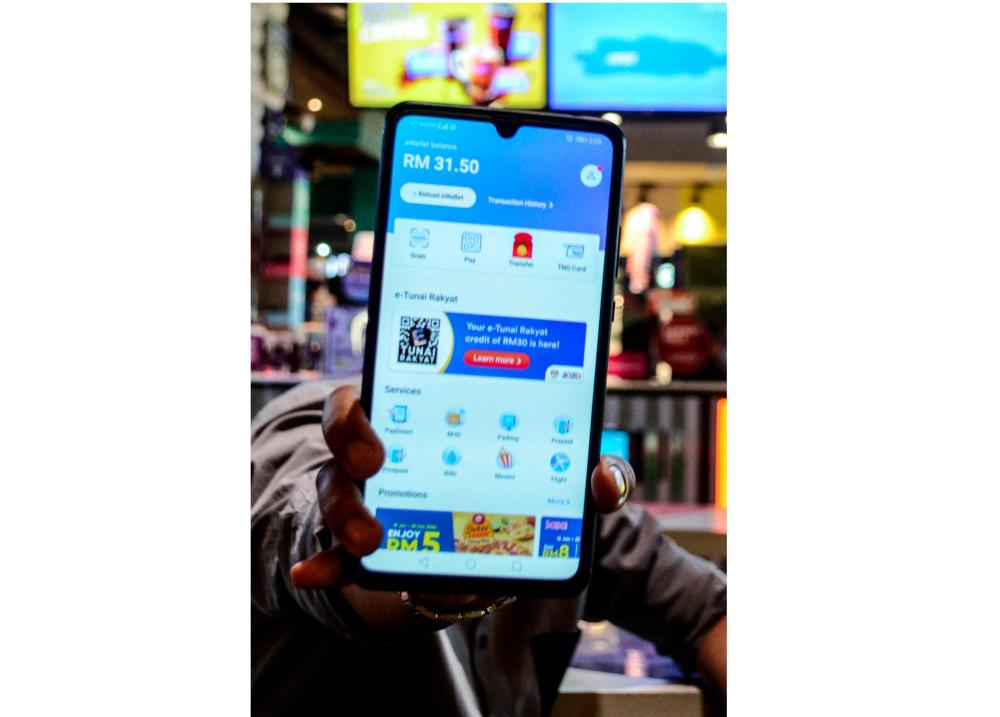

The claims for the e-Tunai Rakyat initiative kicked off with Touch ‘n Go eWallet, Boost and GrabPay selected to be the service providers for the project.

Malaysians aged 18 and above and who earn less than RM100,000 annually will be eligible to receive RM30 each through any of the participating e-wallets.

They are required to submit their personal details through smartphones before they become eligible to receive the e-tunai initiative.

The RM30 can be used to purchase goods and services available through the respective e-wallets.

He also said the adoption of cashless payment will be gradual, as there are still those in society who are not used to it, especially people living in rural areas and those in Sabah and Sarawak.

On the government’s support for the cashless agenda, Lim noted that it will consider increasing the initial RM450mil allocation should the number of applicants increase.

“Malaysians who have registered need not worry they may lose out, should the initial allocation be met.

“We have room to accommodate the increase.

“All Malaysians aged 18 and above and earning below RM100,000 per annum are eligible. No one will be left out,” he said.

To a question on whether the data collected will be sold to third party companies, Lim said they are strict and tight about this matter.

“We have already imposed safeguards and there is also the Personal Data Protection Act. Khazanah Nasional Berhad is a sovereign fund, not a commercial enterprise, therefore it is not in their interest to sell data,“ he said.

He added that the government is not running a business and will not be interested to sell off personal data of the e-wallet users to other companies.