KUALA LUMPUR: E-wallet providers in Malaysia need to work together in order to educate customers on choosing the best e-wallet services.

Touch n Go Sdn Bhd and TNG Digital Sdn Bhd chief executive officer Syahrunizam Samsudin said Malaysians were spoilt for choice as currently Malaysia had more e-wallet providers compared with the world’s second largest economy, China.

“Hence, it is natural that customers end up bewildered with the myriad e-wallet offerings. At the end of the day, consumers will choose the one e-wallet provider who gives them more value and benefits,” he told Bernama at the sidelines of Wild Digital Asia 2019 conference.

However, Syahrunizam said the e-wallet market also depended on the demographics and age group with those between 18 and 25 having an average of five e-wallets to maximise the benefits while those above 35 tend to focus on only one or two e-wallets as it was more convenient.

He also said the service providers need to upgrade their products with the latest technology as local users become technologically savvy.

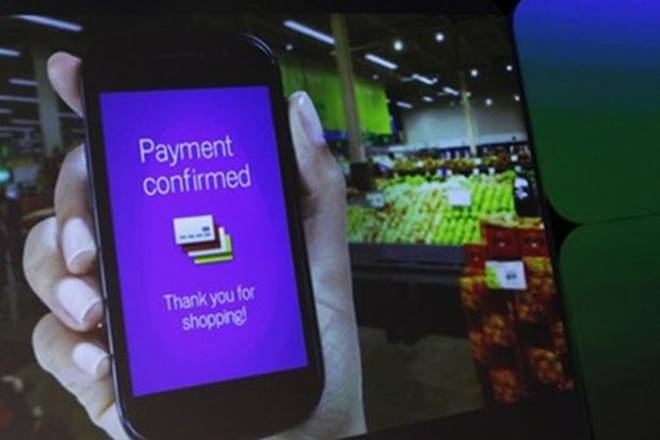

He added that TNG Digital’s Touch ‘n Go e-wallet would continue to innovate and create more opportunities for Malaysians to go cashless.

“Touch ‘n Go and Touch ‘n Go Digital will continue to innovate and create more use cases for Malaysians primarily in the area of transportation and also lifestyle.

“We are very much homegrown and we know Malaysians very well for the last 22 years and now we want to use our data-driven technologies to create more possibilities for Malaysians,” he said.

A homegrown company, Touch ‘n Go began its journey with Malaysians over two decades ago when the Touch ‘n Go card was first introduced to drivers, making it much easier and faster to pay tolls on the highways.

The process was simple and contactless – a simple tap on the reader with the card allowed customers to make payments for transportation. — Bernama