KUALA LUMPUR, Feb 27: Perikatan Nasional (PN) which is set to complete one year as the government this March 1 had taken a daring and historic move to put more money back into the pockets of the rakyat.

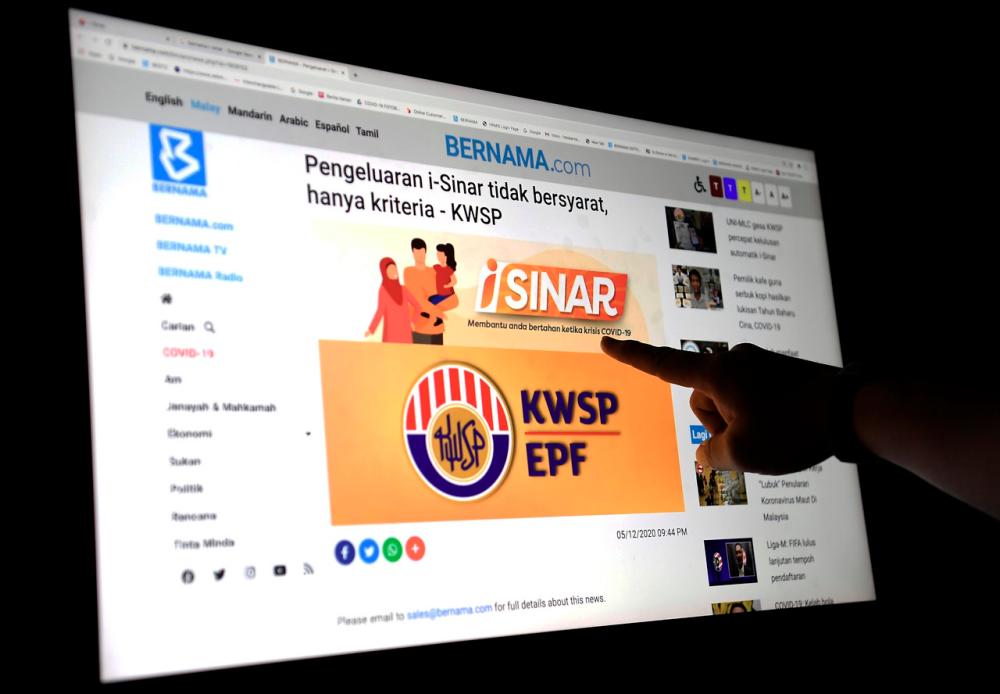

Couldn’t be happier, affected Malaysians breathed a sigh of relief when the Employees Provident Fund’s (EPF) i-Sinar and i-Lestari facilities were introduced to ease their burden.

To the people, it was a bold measure demonstrated by the government, as well as an achievement.

The i-Lestari withdrawal facility was unveiled on March 3, just a few days after the establishment of the Perikatan Nasional administration. The RM500 withdrawal initiative kicked off on April 1, 2020 for a period of 12 months, involving a total amount of RM30 billion.

The i-Sinar is an extension of the i-Lestari withdrawal facility, with all approval conditions removed recently in consideration of public sentiment.

It was reported that about RM18.5 billion has been released under the i-Sinar facility since applications opened last December, benefiting 3.3 million members.

To many, the money obtained from the facilities opened up an opportunity for them to start a small business amidst the COVID-19 pandemic.

“We may just earn a small profit, but enough to ensure there is food on the table for the family, said Azuar Fahmi Mohd Ali, 30.

The Utusan Malaysia ex-journalist said getting a job during the pandemic was difficult, forcing him to look for other alternatives, including selling gadgets to support his family.

“Before the pandemic, I was supposed to go for a number of job interviews but when the Movement Control Order 1.0 was imposed, the opportunities disappeared just like that.

“So I went into small-time business selling gadgets and thankfully, it gave me some income before I managed to obtain a permanent job,” he told Bernama.

He also believes settling his debts will help him to reduce his burden in future should the pandemic continue to rage.

“The PN government’s move to implement the i-Sinar and i-Lestari initiatives was timely and appropriate as we do not know for long will this pandemic prevail.

“Daily COVID-19 cases are also still high. Hence I will also maintain some savings from the withdrawal of this facility,” added Azuar Fahmi, who is now a journalist at a financial portal.

Basir Zahrom, 37, similarly started a small business after losing his job in August last year.

“I’m relieved and happy as this initiative greatly helped in sustaining my livelihood particularly during this economic uncertainty. I do understand that our EPF is meant to sustain us in old age but we desperately need the funds right now.

“After being laid off, I started my small business selling black earth, fertilisers and vegetable seedlings,” he said.

Basir, who has found a new job as an executive officer at a public university, however said his business is facing supply problems due to the movement restrictions.

“Fortunately, I have already settled or reduced the payments on my personal loan, credit card and car, and I also set aside some as savings so that my monthly salary can be used for our daily essentials,” he said.

Housewife Norizan Khalid, 39, said her family’s livelihood was tremendously affected by the temporary closure of the night markets to contain the pandemic.

She said the family depended highly on the income from her husband’s business at the night market.

“At least we can use the withdrawal to pay bills and other necessities such as the children’s needs when the schools reopen.

“Presently, my husband is peddling his wares at the roadside to earn some income. With i-Sinar, we are also able to settle our outstanding debts, and the rest will be for savings for daily expenses,” added Norizan.- Bernama