KUALA LUMPUR: A beverage supplier learned too late that when you apply for a loan, you do not pay processing fees or a deposit upfront.

That ignorance left him RM3,080 poorer.

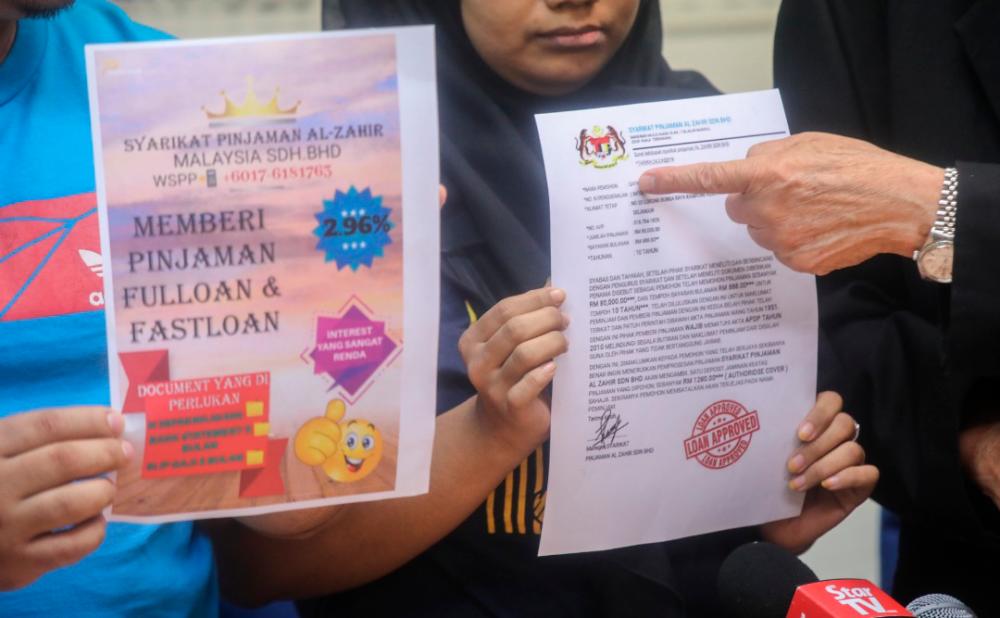

The man, who wished to be known as “Din”, said that on June 22 he saw a post on Facebook that said that a company was offering loans at an interest rate of 2.96%.

He sent in an application for an RM80,000 loan. A man who claimed to be an officer in the company called to ask him for copies of is myKad, bank statement and payslips for three months. He was asked to send the documents via Whatsapp.

Two days later, the same man called and asked Din to place a deposit of RM1,280 into a bank account as “deposit payment”. He was told that his application would be approved in an hour.

However another man, who also claimed to be an officer, called later and told him that he was listed under CTOS, a credit reporting agency. “He told me to bank in another RM1,800 as a fee for the loan application,”

Din told a press conference at MCA Public Services and Complaints Department head Datuk Seri Michael Chong today.

Din complied with both requests for payments but it finally raised a red flag when the company continued to ask for more money.

He then lodged a report with the police, but when he informed the company what he had done, the officer told him the matter “would be raised in court”.

Chong said 16 similar cases have been brought to his attention. He said loan applicants should be cautious. “Go only to legitimate entities,” he advised.