KUALA LUMPUR: More than a year after Malaysia shifted its consumption tax system back to the Sales and Services Tax (SST), a lot more needs to be done in order to boost government revenue by other means and further reduce its dependence on petroleum resources.

For 2019, the government is estimated to collect RM189.9 billion in taxes, with direct income tax at RM123.8 billion (69%), SST at RM26.8 billion (15%), other direct tax at RM11.7 billion (6%) and other indirect tax at RM17.5billion (10%).

Due to the lower tax collection, the government had to rely on revenue collected from its petroleum resources to make up for the shortfall, but as the oil price has stabilised below US$70 (RM289.80) per barrel, the government has to find other resources to ensure enough revenue is generated.

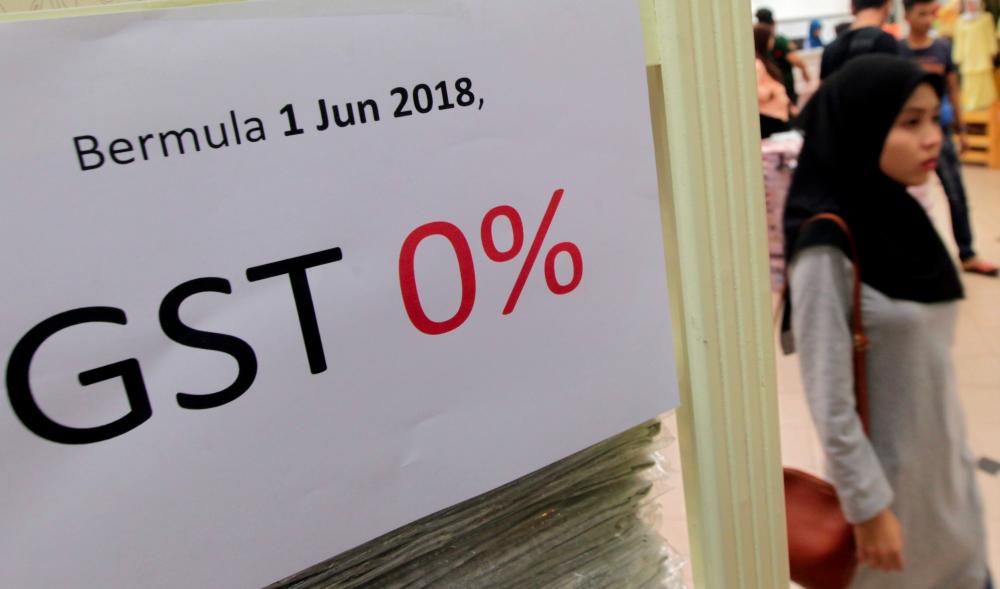

Despite calls to revert to the Goods and Services Tax (GST), the government has reinforced its stand by sticking to the SST system, which was part of the ruling government’s manifesto during the 14th General Election.

Finance Minister Lim Guan Eng was quoted as saying that the government will not be bringing back the GST despite calls from economists to revive the tax due to the shortfall in tax collection as well as lack of efficiency.

In 2017, the Barisan Nasional government collected RM44 billion in GST.

One of the main reasons held against the GST was that the consumer price index (CPI) basket for goods under the SST is much lower at 37% compared to the 60% during the GST era.

During the tax rollback, the government had promised to expedite GST and income tax refunds, and as of April 30, the government had paid out a total of RM17.1 billion.

According to the Finance Ministry, the payment was part of the one-off special dividend payment received from Petronas worth RM30 billion.

To boost the revenue collected from the SST, the government implemented a sugar tax on July 1 this year. The tax, an excise duty of 40 sen per litre, is imposed on sweetened beverages containing more than 5g of sugar or sugar-based sweetener per 100ml.

The sugar tax is also be imposed on carbonated, flavoured and other non-alcoholic beverages.

A similar tax is being imposed in other countries including the United Kingdom, France, Mexico, Norway, Portugal, the United Arab Emirates, Saudi Arabia and South Africa. In the Southeast Asian region, Thailand and Brunei both implemented the tax in 2017 while the Philippines followed suit in 2018.

However, the tax would not provide a significant boost to the country’s revenue as it is mainly imposed for health reasons.

For 2020, the government had estimated that the SST collection is expected to rise 15% to RM28.3 billion, while direct income tax is expected to be collected at RM130.3 billion, other direct tax (RM12.3 billion) and other indirect tax (RM19 billion).

In order to boost the collection, the government has proposed to introduce a new band for taxable income in excess of RM2 million and taxed at 30%, which is a two percentage point increase from the current 28% rate, during the 2020 Budget.

The government will also be implementing the service tax on digital services starting Jan 1, 2020 with a 6% rate.

From the listed services, the government is eyeing to increase tax revenue by RM2.4 billion a year, and the Royal Malaysian Customs Department (RMCD) has opened the registration of foreign service providers starting Oct 1, 2019.

The services that would fall under the basket would be software, applications and video games, music, e-books and films, advertisements and online platforms, search engines and social networks, databases and hosting, Internet-based telecommunication, online training as well as a subscriptions to online newspapers and journals and others.

“Service tax shall be charged and levied on any digital service provided by a foreign-registered person (FRP) to any consumer in Malaysia. Digital service has the meaning assigned to it under Section 2, Service Tax Act 2018 (STA),” said the department in its guideline.

KPMG executive director Ng Sue Lynn said that it is important to note that the 6% is on services and not on goods.

“Hence, the amount is not as significant as many thought it to be. However, the challenge is when the services element is embedded into the price of the goods,” she said.

She also highlighted that the RMCD would face a challenge in identifying foreign service providers, but is positive that it is doable based on the three criteria used.

“The implementation of the tax would not be burdensome to the consumers. From a positive view, the 6% tax for a foreign service provider will provide a level playing ground for both local as well as foreign providers,” she said.

In response to the digital tax implementation, Google Malaysia said in a recent statement that the 6% digital tax will be charged on user purchases and reflected under Billing & Payments.

“We always comply with the tax laws in every country we operate in, and we continue doing so as tax laws evolve. To be in compliance with Malaysia’s new SST we will charge a 6% services tax to our clients in the country, starting from Jan 1, 2020, once the law comes into effect,“ it said in a statement.

So far, Google has confirmed that the 6% will be charged on its G Suite services. As for its other services, Google said to wait for further announcements on platforms such as YouTube Premium, YouTube Music and online purchases for digital items such as e-books, mobile applications, and movies on Google Play.

“Users will be notified about any possible pricing changes via email,” it said.

As the digital tax kicks in, consumers are still waiting for further clarity on what other items would fall under the SST. There have been calls to widen the tax base to increase the country’s revenue in line with a global economic slowdown as well as lower oil revenue. — Bernama