On DEC 10, minister in the Prime Minister’s Office, Mujahid Yusof Rawa dropped a bombshell. The pilgrims fund Lembaga Tabung Haji (LTH) had violated Section 22(3)(a) of the Tabung Haji Act 1995 as it was paying dividends (or hibah) to its depositors despite having a deficit of RM4.1 billion. Its 2017 accounts had already red flagged that its liabilities were at RM74.4 billion as opposed to its assets of RM70.3 billion. The minister’s announcement prompted Marang MP Datuk Seri Abdul Hadi Awang and some Umno members to quickly come to the defence of LTH by calling for a Royal Commission of Inquiry and appealing to depositors not to withdraw their savings.

Their call underlines a larger concern. According to the Report on the Rehabilitation and Restructuring Plan for Lembaga Tabung Haji, 2018, “13% of the depositors hold almost 50% of the total deposits with the highest depositor having a balance exceeding RM190 mil.” Any sudden and large withdrawals will have an adverse effect on LTH’s survival and impact on smaller depositors who have put their life savings for their pilgrimage or as investment.

To most Muslims, LTH, established as a statutory body in 1963, offers the financial means and opportunities for them to fulfil their religious obligation to perform the Haj. Over the years, LTH’s role as a savings financial institution expanded to a savings-investment conglomerate, investing in syariah-compliant vehicles while keeping to its social obligation.

Not surprisingly, LTH depositors have great confidence in the fund as it was ranked one of the top seven government-linked investment companies (GLICs), standing together with the Employees Provident Fund, Retirement Fund (Inc), Lembaga Tabung Angkatan Tentera, Permodalan Nasional Bhd, sovereign wealth fund Khazanah Nasional Bhd, and the government’s primary holding company, Minister of Finance Inc. As of 2017, these seven GLICs hold majority ownership of 35 public-listed companies and control about 42% market capitalisation in Bursa Malaysia.

If LTH is doing so well, how did it incur such a large deficit?

This is not the first time LTH faced such financial controversies. In 2001, just after the Asian financial crisis, auditor PricewaterhouseCoopers reported that LTH had made risky investments and fraudulent withdrawals amounting to RM9 million. Datuk Mohamad Bakke Salleh as the then chief executive officer (CEO) was roped in to save LTH. LTH recovered and became more professionally managed, allowing it to continue serving pilgrims for the Haj.

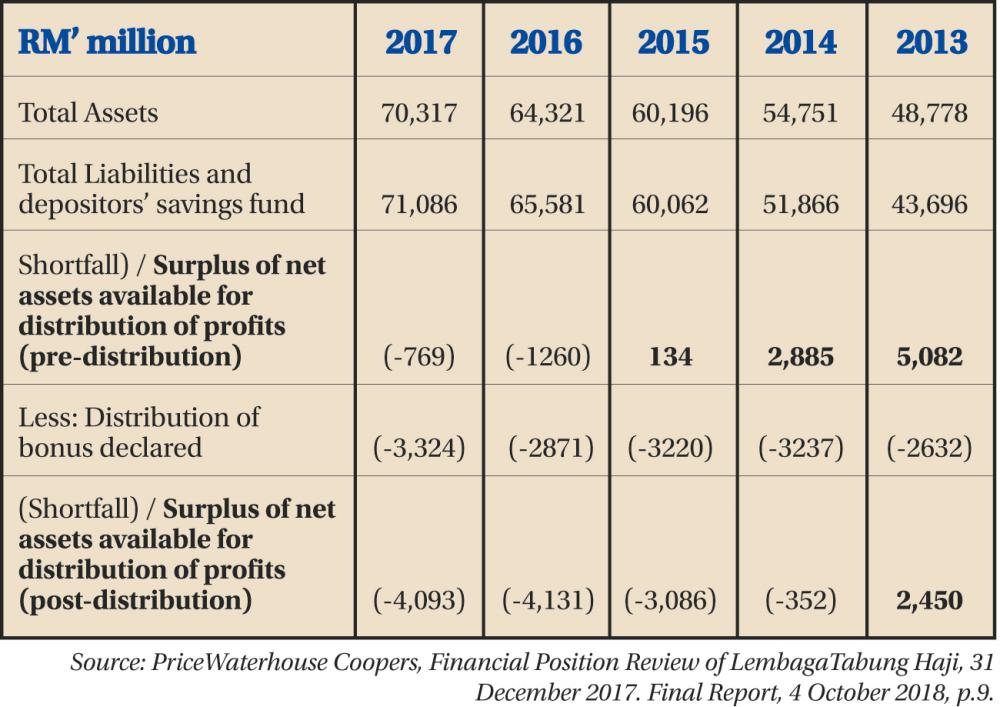

History repeats itself. The same auditor is again stating that LTH net assets have declined consistently since 2013 (see table). Dividends were distributed through unrealistic policy adjustment to “defer impairment losses” and hence the RM4.3 billion deficit was not recognised in 2017. Basically the management of LTH delayed reporting the diminishing value of its assets in order to continue paying hibah.

Before this crisis, LTH’s corporate governance broke down in 2015 and undermined its aim to function as a financial institution to facilitate pilgrims. LTH had bought an overpriced piece of land from 1Malaysia Development Board to build the Tun Razak Exchange (TRX). LTH paid a whooping RM2,773 per sq ft when the land was initially bought by 1MDB at RM64 per sq ft. According to LTH’s group managing director and CEO Datuk Seri Zukri Samat, the 1.6-acre (0.65ha) land is not providing any yield to Tabung Haji and had to be disposed.

In September 2018, former LTH chairperson Datuk Seri Abdul Azeez Abdul Rahim, who is also Baling MP, was investigated by the Malaysian Anti-Corruption Commission (MACC) over allegations of corruption and money laundering, which allegedly had run into millions of ringgit.

The LTH saga is a shout out for more resilient institutional reform for all GLICs and GLCs. It is not just about incompetency in management, or tampering with its accounts, but repeated offences of unfettered fraudulent practices and risky investments. Corruption and patronage for political and personal gains are normalised and institutionalised. Trust is betrayed as losses are paid on the backs of the poor, low and middle-income depositors who have placed every single sen in hope of performing their pilgrimage.

LTH is here to stay as it has an important social role to fulfil for the pilgrims. It is, therefore, pertinent that any reforms made to GLICs and GLCs have to be resilient and long lasting. The concentration of powers in the hands of a few must be clipped so as to rid patronage, misuse of power and corruption. Placing LTH under Bank Negara Malaysia, is a welcome move and will give confidence that LTH fund will be better managed. While the government has passed laws to monitor procurement, excessive national debts, and accumulation of excessive wealth, these laws must be implemented without prejudice. Institutions such as MACC must be independent and report directly to the parliamentary select committees, which will have to act as oversight bodies to end the repeated abuse of power and corruption.

Comments: letters@thesundaily.com