The previous articles in our series on Your Personal Journey to Financial Security have talked about why you should consider investing your money in order to ensure a more secure future for yourself and your loved ones, and how to find the right experts to help guide you along your journey.

For most people, the ultimate goal is to be able to retire comfortably, by ensuring that they have adequate savings or investments to sustain them in their old age. However, there can be no denying that the hardships brought about by the pandemic in the past two years have made achieving this goal a lot more challenging.

Various economists have warned that a retirement crisis is on the horizon. The most recent figures released by the Employees Provident Fund (EPF) show that almost half of its members (46%) have less than RM10,000 in their account, and that the percentage of its members who are on track to reach the basic savings threshold (RM240,000 by age 55) has dropped from 36% to 27%, exacerbated by the number of people withdrawing from their EPF accounts to offset their daily expenses during the pandemic.

However, it doesn’t have to be that way. The best time to act is now, and the earlier you can begin saving for your retirement, or even growing your wealth again after it has taken a hit, the better.

This time, we would like to touch upon a wealth-building option known as a Private Retirement Scheme (PRS). PRS are offered and managed by PRS Providers and are governed by the Securities Commission Malaysia.

As the name indicates, a PRS is voluntary long-term savings and investment scheme designed to help you save more for your retirement. First introduced in 2012, it is meant to help encourage people to contribute to their retirement savings.

Investments in PRS are structured in the following manner: contributions are divided into two sub-accounts, and you can only make withdrawals once you reach retirement age, or in case of death or emigration. You are permitted to make partial withdrawals before then, but you will incur a penalty fee.

Contributions to PRS are entirely voluntary, and offer more diversification in terms of investment options. PRS seek to enhance choices available for all Malaysians, whether employed or self-employed, to supplement their retirement savings under a well-structured and regulated environment. Each PRS offers a wide range of retirement funds from which you may choose to invest in based on your retirement needs, goals and risk appetite.

Why invest in a PRS?

Contributing in PRS may be one of the best things you can do for your retirement. Here’s why:

Designed for retirement

As a scheme originally established to help investors accumulate more savings for their retirement, you can be assured that there is a selection of investment options to suit your specific goals and needs.

Easy investments

Anyone can invest in a PRS, regardless of experience. There is a wide choice of PRS Providers and self-selected funds, as well as default option funds that have been pre-selected based on investors’ age.

Affordable savings

The minimum contribution varies depending on your chosen PRS Provider. While the flexible nature of the investment scheme means that there is less pressure on you to commit to a certain amount, just remember that the more you ‘save’, the better your results. If you manage to contribute 10% of your salary into a PRS, you can grow your retirement savings at a faster rate.

Tax incentive

Besides being able to enjoy the additional retirement savings later in life, you can also enjoy a yearly personal tax relief of up to RM3,000 from your taxable income, for as long as you contribute to a PRS (the tax relief is available up to 2025). The earnings generated from a PRS will also be tax exempted, so that is even more reason to contribute!

Factors to consider

It takes time and effort to accumulate wealth and to maximise the benefits from compounded returns. This is more so given that most of us are saving for the long term, such as for our retirement years.

When making your PRS contribution, you need to consider various factors such as your age, personal and household income, risk tolerance, retirement objectives as well as the suitability of the different funds under the various schemes to meet your retirement needs.

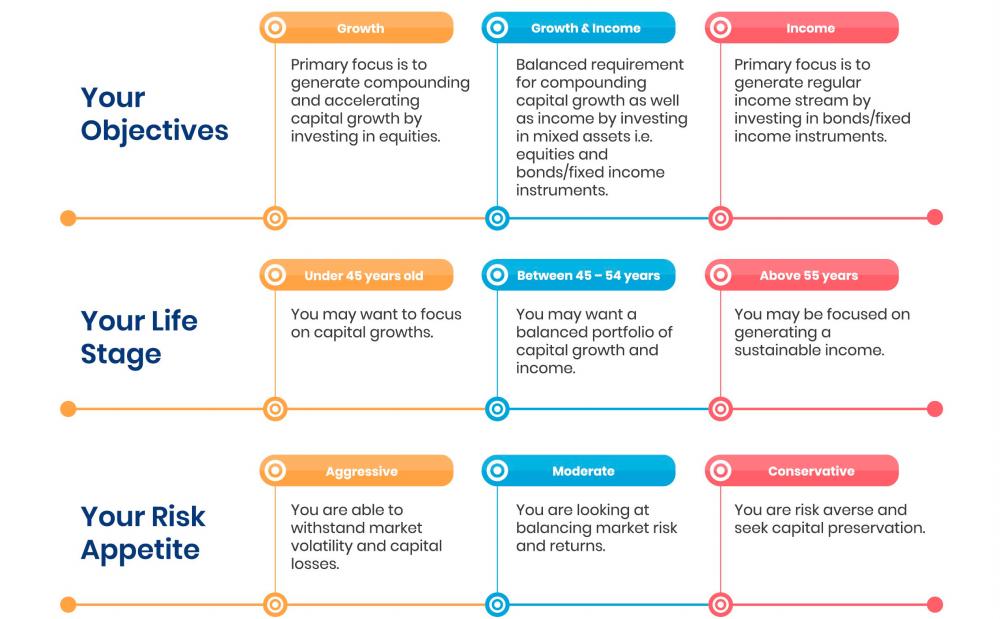

The following chart offers suggestions on what you should take into consideration prior to investing in PRS. While the rule of thumb is that your investment strategy should be based upon the time you have until retirement (i.e. long-term investment strategies should focus more on capital growth, while short-term investment strategies should focus on income generation), remember that everyone’s situation is different, and that you should always consult an expert should you have any questions.

Among the key items to note:

Objectives: Based on your intended goals, you can choose to invest with the intention of growing your capital, income generation, or a combination of both strategies. The goals for each person are different, and dependent upon a variety of factors, so it is important to decide which option you wish to take.

Your life stage: Those who are nearing retirement age should focus on investments that can provide them with a sustainable income, while those who are younger should be looking towards investments that have a higher potential for growth in order to reap bigger rewards once they are ready to retire.

Your risk appetite: Investors who are able to handle greater risks tend to be those with long-term goals, who have more time to weather any market volatility. Those who value stability tend to be those already nearing retirement age, and therefore would benefit more from investments that would allow them to preserve their initial capital.

It is important to bear in mind the cost of living and inflation in setting your retirement goals, as well as to think long-term. As our needs change through different stages of our lives, you should review your PRS portfolio regularly so that it matches your risk appetite and investment objectives.

Investment risks

When you invest in a PRS, there are investment risks involved. These are general risks which you will be exposed to when investing in any of the PRS funds as well as specific risks associated with the investment portfolio of each fund. Therefore, you should consider the different type of risks that may affect you and the fund. These risks are disclosed in the PRS’ Disclosure Document or Product Highlights Sheet (PHS).

For a list of the PRS fund’s general and specific risks with your respective PRS Provider, please refer to Funds & Providers section here. Alternatively, you may contact any of the PRS Providers and ask for a copy of their PRS Disclosure Document or PHS.

How do I invest in PRS?

Your journey to save more for your retirement with PRS begins by following these 4 simple steps:

1. Select your PRS provider. There are a number of accredited PRS providers in Malaysia, who are guided by the stringent rules set out by the Securities Commission Malaysia. For a list of PRS providers, visit here.

2. Choose a suitable fund. Once you have selected your PRS Provider, you should take the time to explore the funds they offer to find one that suits your current or long-term investment goals.

3. Open your PRS account. Your chosen PRS Provider should be able to help you with this, and you can choose to contribute directly to them through PRS Online, or by visiting any of their branches.

4. Top up your funds regularly. Once you have your account set up, you can make your contributions at your own convenience. The more you contribute, the closer you will get to reaching your retirement goals.

The final word

Remember that with a little careful planning, a PRS can be a useful tool to help you in your wealth-building journey. By staying focused, disciplined and investing wisely, you can be assured of a comfortable nest egg once you reach your golden years.

To find out what other steps you can take to reach financial freedom, look out for the next article in our series on Your Personal Journey to Financial Security, only in theSun, brought to you by the Federation of Investment Managers Malaysia (FIMM).

Visit FIMM’s website for more details on Unit Trust Management Companies (UTMC) and PRS Providers, information on Unit Trust Schemes and Private Retirement Scheme, as well as the lists of approved funds.