Our series on Your Personal Journey to Financial Security has come to an end, and we hope that you have gained some insight into the process through our articles on the importance of investing, especially when it comes to ensuring a comfortable retirement or building an emergency fund, how to find the right Consultants, and how a Private Retirement Scheme can benefit you.

For our final article, we would like to introduce the topic of Sustainable and Responsible Investments (SRI), an investing strategy that aims to generate both social change and financial returns for an investor. Some SRI practices use a framework of specific factors to guide their investing, which are also known as ESG (Environmental, Social and Governance) investments.

SRI/ESG investments have been on the rise and gaining more prominence over the last several years, especially with the younger generation of investors who want their money to be invested in something that makes positive impact to society and the environment, in addition to something that provides good financial returns.

What are SRI/ESG investments?

Unlike trends in the past, investors interested in SRI don’t just select investments by the typical metrics – such as performance or valuation – but also take into consideration the company’s revenue sources and business practices that are aligned with their own personal values.

Socially responsible investments may include companies making a positive sustainable or social impact, such as a solar energy company, and exclude those making a negative impact, such as those that produce dangerous chemicals or intoxicants, such as alcohol or cigarettes.

Some alternate names for this strategy include ethical investing, impact investing, socially responsible investing, and value-based investing.

ESG investment is a subset of SRI, and investment decisions tend to rely on measurable ESG factors. For example:

Environmental: Carbon emissions, water use and conservation, and clean technology.

Social: Workplace safety and benefits, community development, diversity and anti-bias issues.

Governance: Board diversity, corporate political contributions, and anti-corruption policies.

Why should you consider SRI/ESG investments?

Sustainable and responsible investments can mean different things to different people. But in general terms, socially-conscious investors would want to see their money go toward investments that are reflective of their social values. In return, this helps to foster a deeper emotional connection with their investment, making socially-conscious investors some of the most active and attuned investors in the market.

Some prefer to invest in companies that contribute to society, regardless of which industry they're in. They tend to look for businesses that treat their employees well, or that contribute to the environment, such as those creating clean energy through wind farms or solar panels.

SRI/ESG investments also provide investment opportunities that establish financial, intrinsic returns that can’t be made anywhere else. That emotional connection with the investment also ensures that an investor is not easily scared off by market shifts, as they are investing for a better future, allowing them to stay in the market for longer duration and to continue building their wealth for many years to come.

What sort of strategies can you look into?

Those looking into socially responsible investing tend to actively eliminate or select investments according to specific ethical guidelines. The underlying motive could be religion, personal values, or political beliefs.

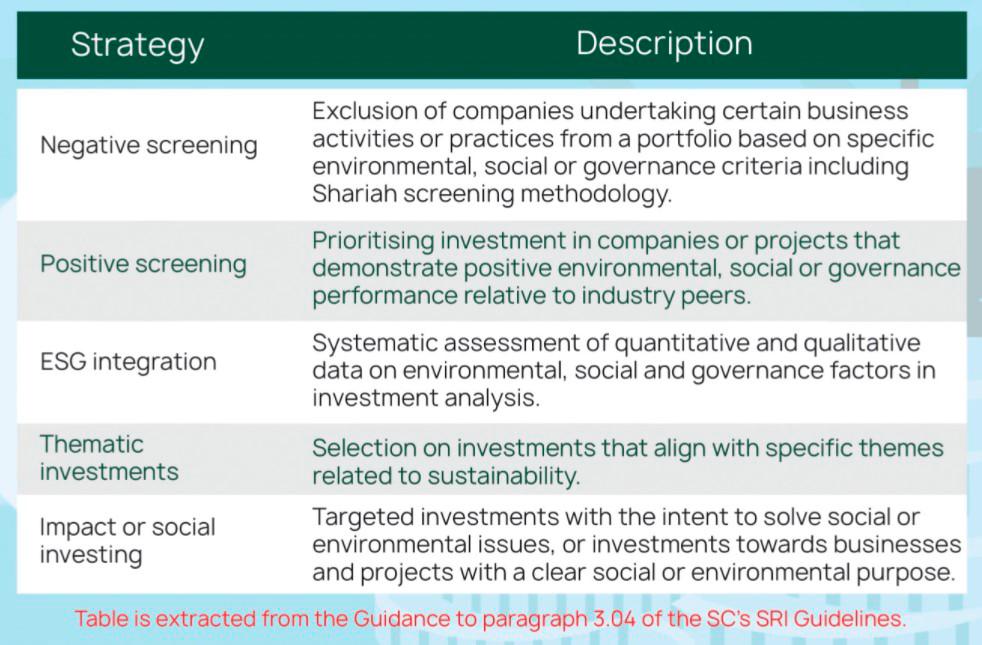

There are different ways to determine which funds to invest in, and the following table provides suggestions on which investment strategy that might work well with your own beliefs:

When a fund is submitted to the Securities Commission Malaysia (SC) for consideration of its SRI status, the SC will refer to the table and compare the fund’s policies to determine whether or not to grant it an SRI status.

How to check whether an investment is SRI/ESG-compliant or not

First, check the prospectus. As per the requirements of Guidelines on Sustainable and Responsible Investment Funds (SRI Guidelines), the prospectus should have a statement indicating that it is a qualified SRI fund on its cover, and display its SRI policy within the Fund Information chapter, as well as the Key Features section in its Product Highlight Sheet.

The investment’s Annual Report should also contain:

1. A statement that the Fund has complied with the SRI Guidelines;

2. Descriptions of sustainability considerations that have been adopted in the SRI strategies employed; and

3. A review on sustainability aspects of the fund’s portfolio, where applicable.

You can also refer to the Trustee’s Report section of the Annual Report for an independent verification that the fund is in compliance with all the laws, regulations and limitations, including with the SRI Guidelines and its SRI Policy, as disclosed within the Fund’s trust deed.

Additionally, you can also check the list of approved SRI funds on the SC’s website. As at Oct 21, 2021, there are 19 Unit Trust Schemes and 11 Wholesale Funds (available only to Sophisticated Investors) that have qualified as SRI funds.

The final word

The desire to invest ethically is especially pronounced among the younger generation of investors, especially those who are more socially conscious and wish to contribute positively to society as well as the environment. Implementing that desire, however, may be no easy task, given the growing complexity of investment concepts and products catering to this segment.

This is why it is important to work with a Consultant that can help guide an investor towards fund selections that are aligned with their investment goals and principles, thereby ensuring that an investor can make the right decisions with their money.

To find out the steps you can take to reach financial freedom, do explore the articles in our series on Your Personal Journey to Financial Security, only in theSun, brought to you by the Federation of Investment Managers Malaysia (FIMM).