Our series on Your Personal Journey to Financial Security is approaching the end, and we’ve already talked about why it is important to invest, especially if you are looking to retire comfortably, and offered investment solutions you can consider, such as Private Retirement Schemes (PRS).

Once you have determined your life goals and made the decision to invest, you should also take the extra step of protecting your investments. This is especially important, as the nation is still feeling the aftereffects of the global Covid-19 pandemic, and now – more than at any other time – we need the extra reassurance and peace of mind, especially when making plans for the future.

Have an Emergency Fund

For many people, the pandemic showed the importance of having an emergency fund to help cover basic expenses. This was especially true for those who found themselves encountering financial difficulties due to a job loss, or a sharp reduction in income. After all, the last thing you want is to find yourself facing a financial crisis, and have no ability to come up with money to cover your costs.

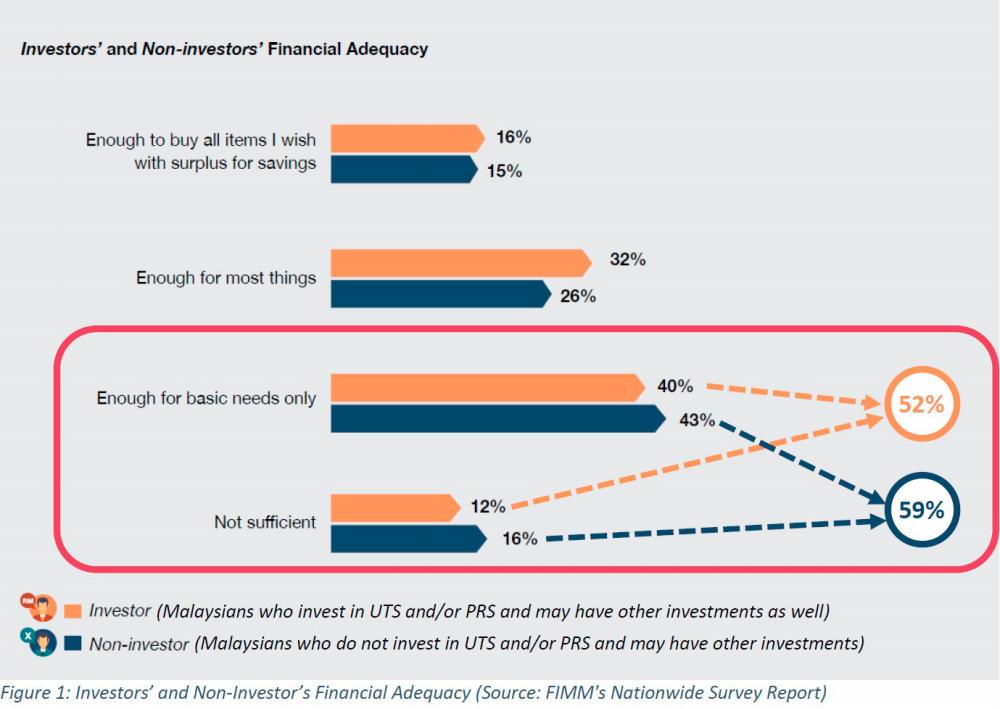

It is for this reason that many people begin investing in order to help build an emergency fund to provide a buffer for those unexpected expenses. According to the FIMM Nationwide Survey Report (NWS Report; published on June 24, 2020), a total of 52% of investors and 59% of non-investors (see Figure 1) were drawing in income that was either insufficient, or just enough to cover their basic needs.

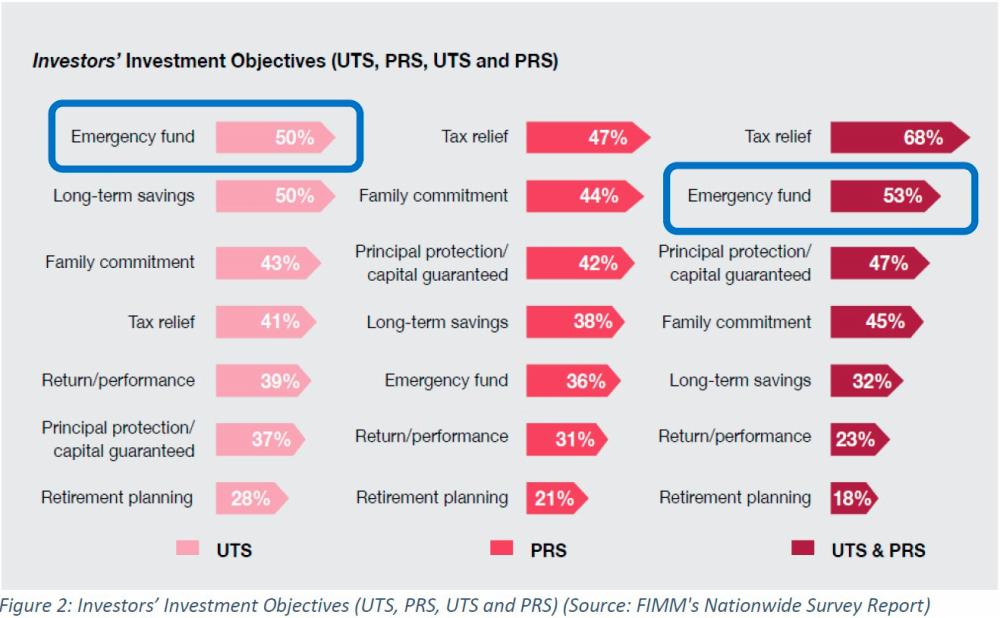

According to the NWS Report (see Figure 2), more than 50% of investors who invest in both Unit Trust Schemes (UTS) and Private Retirement Schemes (PRS) did so for the purposes of creating an emergency fund.

When investing, be it to establish an emergency fund or any other investment goal, it is important to ensure that your investment capital is well protected. As such, it is crucial for investors to implement “pre-investment controls” prior to starting the investment process to ensure that the initial investment capital is not lost due to an oversight or fraud. This includes making legitimate, secure investments that fit your risk appetite.

Consultants and Distributors

In the investing process, it is very common for an investment Consultant or an investment product Distributor to be involved. To purchase shares, one will have to go through a broker. For UTS and PRS, a UTS/PRS Consultant or Distributor is required.

Additionally, with the rise of financial technology, more commonly known as FinTech, Distributors have developed digital platforms from which investors can invest directly in the UTS and/or PRS of their choice (a sort of “DIY investing” method).

Despite the advancement of FinTech, the NWS Report also noted that 71% of respondents prefer to invest via Consultants (either belonging to a Unit Trust Management Company, PRS Provider, Institutional Unit Trust Adviser, Institutional PRS Adviser, or Financial Planning company).

These Consultants/Distributors play important roles in the investing process by connecting investors to the investment products/solutions.

Consequently, they are well equipped to explain to the investors the features and characteristics of the investment products and help investors make informed and suitable investment decisions. Thereafter, Consultants/Distributors will help to start the investment process for the investors.

One of the key roles of the Federation of Investment Managers Malaysia (FIMM) is to authorise/register and regulate the Consultants/Distributors for UTS and PRS. As of Dec 31, 2020, there were 59,975 UTS Consultants and 25,341 PRS Consultants registered with FIMM.

Consultants playing an advisory role can help investors make better financial decisions and face-to-face communication still has greater impact for a call to action.

It was acknowledged in the recent FIMM 2021 Investment Management Survey that Consultants need to understand investors’ behavioural biases that inhibit investors from making sound financial decisions such as managing emotions, negative peer influence, panic selling and investing for the long term.

Protecting your money

During the commencement of the investment process, investors will have to transfer their money to the relevant investment account in order to access the investment product/solution. It is at this point that investors should take precautions to ensure that their money will indeed be used for the intended investment – and not for other purposes.

Ensure that the investment product is authorised

Investment products/solutions that have been authorised by the relevant regulator, e.g. the Securities Commission Malaysia (SC), have gone through the necessary processes and due diligence prior to them being made available for investment. As such, the risk of investors being defrauded is relatively low compared to other unauthorised investments.

To discover whether an investment product is authorised or not, investors can visit the SC’s website, where, along with other investment products/solutions, the SC discloses a list of approved UTS and PRS.

Ensure that the Consultant is Authorised

Likewise, authorised Consultants/Distributors are expected to have undertaken all the necessary training and registration processes prior to them being allowed to connect investors with investment solutions. We have covered the reasons why this is crucial in our previous article here.

As registered Consultants, they are governed by the rules and regulations imposed by the relevant regulators. For example, UTS and PRS Consultants are registered with FIMM and hence, are subject to FIMM’s Rules. Should they commit any misconduct, FIMM can take action against them.

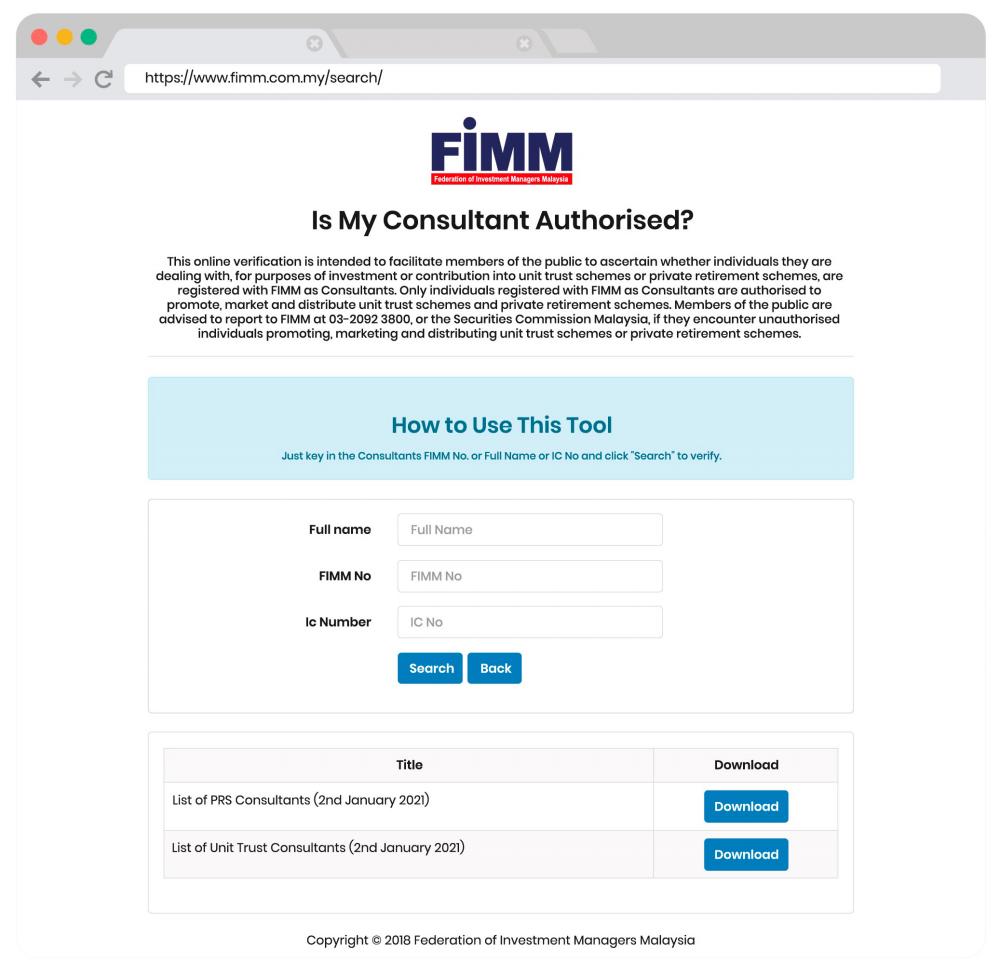

For UTS and PRS, investors can verify if the Consultant is authorised by visiting FIMM’s website and clicking on the “Is My Consultant Authorised” link.

Ensure that the Forms You Sign are Complete

To perform investment transactions, investors are required to sign the relevant forms. It is important for investors to complete the forms themselves before signing and submitting them.

A Consultant with bad intentions could fill in the pre-signed blank forms to perform unwanted/unauthorised transactions using investors’ money. On the flip side, the Consultant may not have bad intentions, but he/she could have completed the pre-signed blank forms incorrectly and inadvertently perform unwanted/unauthorised transactions. Both scenarios could lead to investors losing money.

Hence, if a Consultant insists that the investor signs a blank form, the investor should refuse and proceed to complete the form himself/herself. If the UTS /PRS Consultant is persistent in asking the investor to sign a blank form, the investor must lodge a complaint with the Distributor and/or FIMM at complaints@fimm.com.my.

Never give cash directly to Consultant

Be sure to exercise caution and common sense. Investors must never give cash directly to the Consultant or transfer money directly into the Consultant’s personal bank account for any investment. By doing this, the investor is putting his/her money at risk of theft or loss.

Always make payments in the method described in the relevant offering document. For UTS, the payment method is disclosed in the prospectus. For PRS, it is in the disclosure document.

If the consultant insists that the investor pays directly to him/her in cash, the investor must refuse and immediately lodge a complaint with the relevant regulator. For UTS/PRS Consultants, the investor can lodge a complaint with FIMM at complaints@fimm.com.my.

Take Necessary Precautions

The NWS Report also highlights that one of the top reasons people are reluctant to invest is that they are worried about the risks involved. However, in investing, risks will always be present. In addition to the investment-related risks (i.e. market risk, interest rate risk, etc) managed by the Fund Manager, investors should also mitigate other risks by implementing controls such as the ones shared above.

Additionally, it is essential for investors to read the offering documents and understand the features and costs involved prior to investing. This is part of the precautionary measures to ensure that we protect and do not lose our hard-earned money.

The final word

Establishing an emergency fund through an investment will not only help you prepare for the unexpected, it will also ensure that your emergency fund will grow steadily over time, giving it an advantage over starting it in a conventional savings account in a bank.

If such a prospect interests you, you should seek the advice of an authorised Consultant in order to see which investment solution will be an ideal fit for your financial needs.

To find out what other steps you can take to reach financial freedom, look out for the final article in our series on Your Personal Journey to Financial Security, only in theSun, brought to you by the Federation of Investment Managers Malaysia (FIMM).