KUALA LUMPUR: MGSB Bhd and its four directors pleaded guilty to the charges for accepting money from depositors without a valid licence under Section 10 of the Financial Services Act (FSA) and involvement in money laundering activities at the Kajang Session Court on Thursday.

Bank Negara Malaysia (BNM) said MBSB and the directors were charged under section 137(1) of the FSA Act 2013 and section 4(1) of the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA).

The central bank, in a statement, said MGSB was fined RM5 million for the charges under Section 137(1) of the FSA,

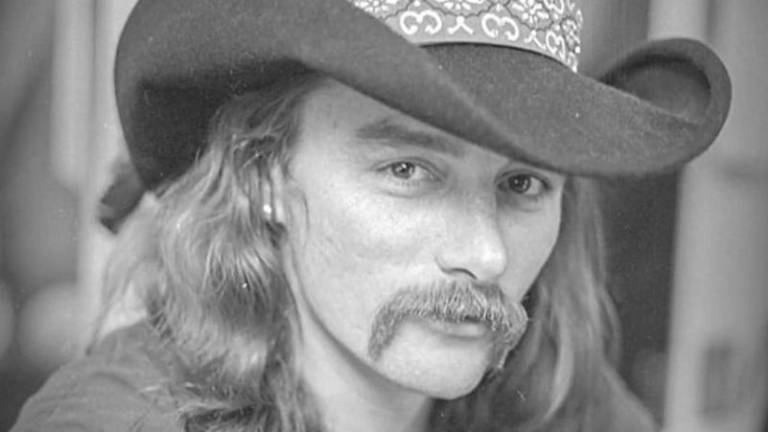

Meanwhile, directors, Hisyamuddin Che Ali and Ahmad Zalimi Mohd Ali were each sentenced to two years’ jail and fined RM1 million (in default six months imprisonment), Halimatun Saadiah Che Omar was sentenced to one-year jail and fined RM1 million (in default six months imprisonment).

MGSB was also fined RM288 million under for the charges under 4(1) AMLA.

Directors, Ahmad Zalimi, Halimatun and Nur Ain Aliana Mat Azmi were each sentenced to two years’ jail for each of three charges and fined a total of RM288 million (in default one-year imprisonment).

Hisyamuddin was sentenced to years’ jail for each of five charges and fined a total of RM288 million (in default one-year imprisonment).

Hence, BNM reminded the public to not place any monies or deposits with unlicensed institutions or be involved in any form of get-rich-quick schemes to avoid losing their money.

The list of institutions licensed under the laws administered by BNM to accept deposits is available on its website at www.bnm.gov.my.

The public can also access information relating to illegal financial schemes and enforcement actions taken by the central bank at the Financial Fraud Alert Site (http://fraudalert.bnm.gov.my). — Bernama