PETALING JAYA: In order for people to have enough living wages to meet their daily requirements, salaries have to be higher than the rate of inflation.

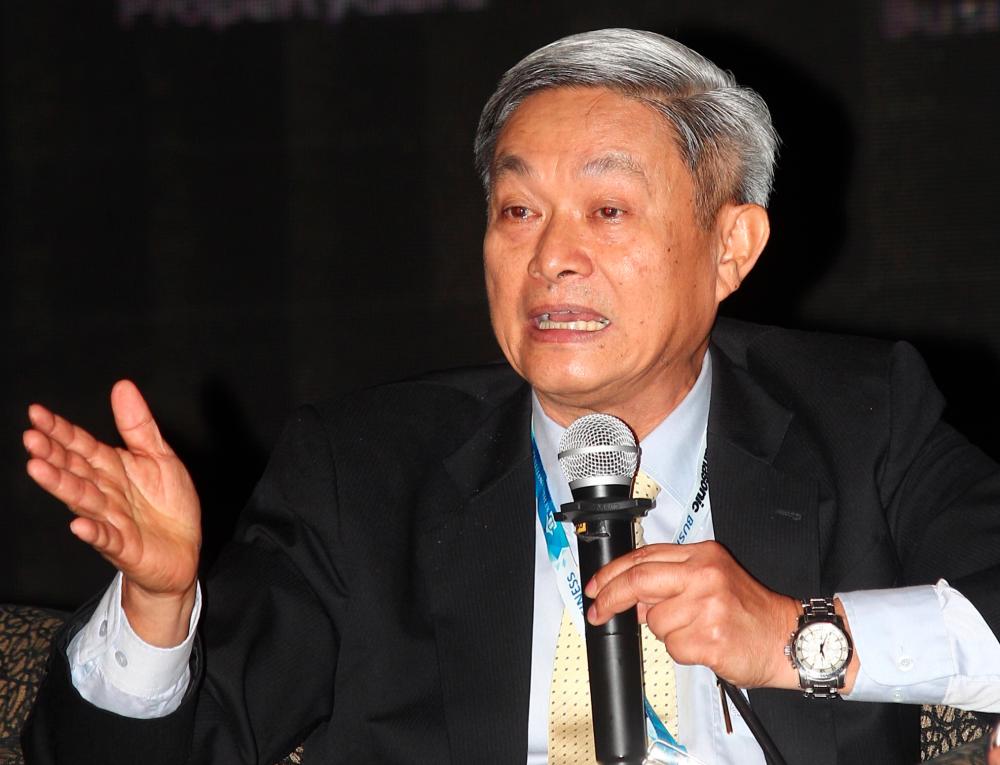

Sunway University Prof Dr Yeah Kim Leng (pix) said wages above inflation will allow people to meet their commitments.

He said what is concerning is those who are heavily in debt will suffer if their wages are not above inflation.

“The rising cost of living will make it harder for this group to service their debts and they might end up in financial distress.

“The loan moratorium ends in the middle of this year, and the B40 and M40 group might face difficulties in servicing their debts, and this may lead to non-performing loans (NPL).”

Yeah said one factor that needs to be considered is whether the group is still facing salary cuts or their salaries have returned to pre-pandemic levels.

He added that if their salaries have been reinstated it would provide them some breathing space, albeit not much.

He reiterated that wage levels need to be above inflation to enable this group to meet their loan obligations and the escalating cost of living.

“On the bright side, banks have made provisions to cater for NPL from this sector.”

Yeah also said the government needs to be proactive in helping people by accelerating mega infrastructure projects, which leads to job creation and economic development.

He said capital expenditure is one of the ways the government can improve economic growth.

“Rising domestic consumption will help businesses generate income, thus saving and creating jobs.

“Economic growth needs to be sustainable, the nation cannot survive another lockdown,” he said.

Yeah added that as businesses grow, people will be able to meet their loan obligations and thus drive the economy forward.

Universiti Tun Abdul Razak economist Dr Barjoyai Bardai said household debt will go up if the government fails to deal with inflation.

He said households affected by low income will face budget restraints thus making it difficult to service their debts.

“The cost of living is going up and wages need to move in tandem with this.

“Price of certain goods have gone up by 30% and the government needs to monitor this,” he said.

He added that the government will need to come up with measures to help those affected by such increases, and one way is by providing a form of subsidy.

Barjoyai said if salaries remain stagnant while the cost of living keeps going up, in time households will have less to spend, which in turn would lead to them defaulting on their loans.

He added that the prices of goods have been constantly going up, leaving people to fork out more funds on items they need.

Barjoyai said it is vital for salaries to be able to meet the higher cost of living.