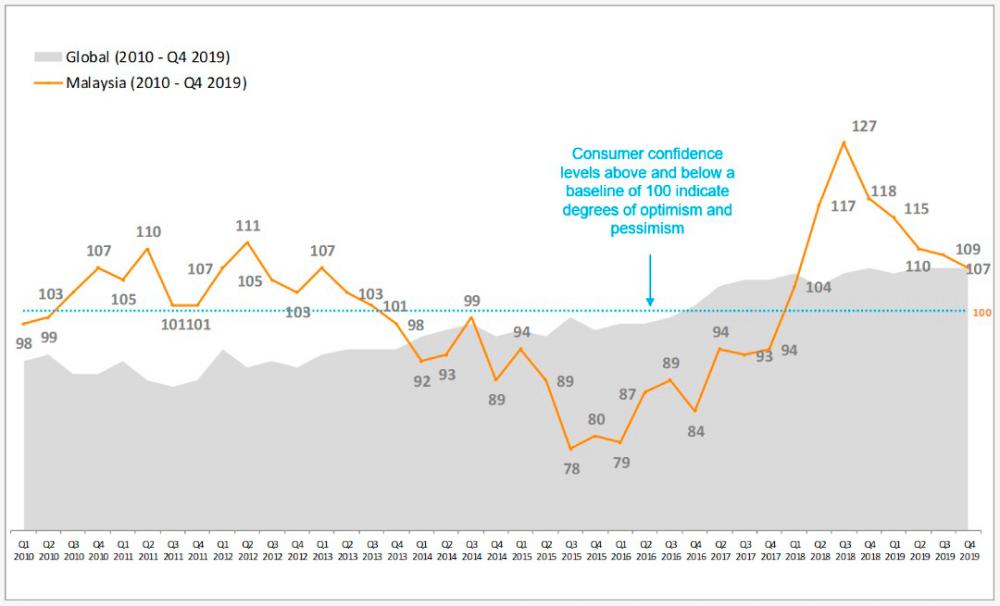

KUALA LUMPUR: Despite the fifth consecutive quarter of decline, Malaysian consumers remained largely optimistic in the fourth quarter last year (Q4 2019), based on an index score of 107 points on The Conference Board Global Consumer Confidence Index (CCI), produced in collaboration with Nielsen.

This is slightly down from the 109 points posted in Q3 2019, and a drop from 118 points in the same quarter of the previous year.

The CCI is driven by three indicators, which are consumers’ perception on local job prospects, personal finances and intentions/readiness to spend.

In Q4 2019, 61% of Malaysians believed the state of their personal finances in the next 12 months will be excellent or good (versus 62% in Q3 2019, 70% in Q4 2018). About 60% had a positive view on job prospects in the next 12 months (versus 68% in Q3 2019 and 71% in Q4 2018); while 46% said “now is the time to buy the things they want and need” (versus 44% in Q3 2019 and 53% in Q4 2018).

Nielsen Malaysia managing director Luca De Nard explained that this is the fifth consecutive quarter of decline since the all-time high index score in Q3 2018, which was recorded just after the 14th General Election.

“Since then, we have seen the score steadily decline to a level that is more realistic and sustainable in the long run. Barring any major economic or socio-political event that can adversely affect consumers’ outlook, confidence levels should remain in the positive in the coming months,” he said in a statement.

In Q4 2019, 70% of Malaysians believed that the country is currently in a recession – down slightly from 73% posted in the previous quarter. Of these, 37% were optimistic about an economic recovery in the next 12 months, which is higher than 34% in Q3 2019.

But while recessionary sentiment reduced, more Malaysians cited the economy as their top concern compared to the previous quarter (44% compared to 39% in Q3 2019). Other top concerns included job security (23%), work-life balance (19%), health (16%) and political stability (14%).

Reflecting their increased concerns on the economy, Malaysians continued to be cautious with their finances, with a majority of consumers saying that they have adjusted their spending habits to save on household expenses (85% in Q4 2019 versus 82% in Q3 2019).

When asked what actions they are taking to save on household expenses, 57% said they will spend less on new clothes (versus 49% in Q3 2019), 50% will cut down on out-of-home entertainment (versus 47% in Q3 2019), while 47% will switch to cheaper grocery brands (versus 44% in Q3 2019).

“Given that consumers are slightly apprehensive about spending, brands and retailers should strive to showcase value for money and appeal to Malaysians’ love for promotions. Those who do this successfully will be able to win over consumers in the current climate,” said De Nard.

At 107 points, Malaysia fell just outside the top 10 most optimistic countries, placing 11th on the index.

“Learning from this, the Malaysian government and private sector should be prepared to address extraordinary events such as the Covid-19 outbreak happening now, which will certainly impact consumer confidence and the overall economy if not contained.”